Sitka Gold has never been stronger than today

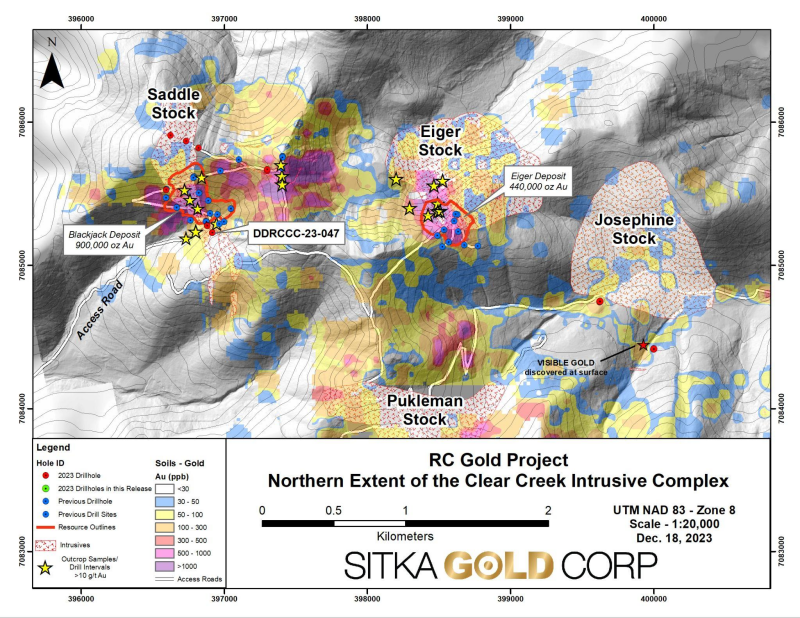

Sitka Gold (CSE SIG / FRA 1RF) announces a year-end summary of the pivotal 2023 exploration season at its year-round road-accessible RC Gold property in the prolific Tombstone Gold Belt, Yukon Territory, Canada. The Company has advanced RC Gold from an initial 1,500 meter scout diamond drill program in 2020 to the discovery of the Blackjack and Eiger deposits with an initial pit constrained resource estimate of 1.34 million ounces of gold released in 2023, creating tremendous value for Sitka shareholders!

Exploration work in 2023 focused on increasing this value by conducting drilling focused on expanding the resource at the Blackjack deposit, testing the potential for additional resources at the Saddle zone, located midway between the Blackjack and Eiger deposits, and conducting diamond drilling at the Josephine intrusion for the first time. In addition, the 2023 exploration program has identified several drill-ready intrusion-related gold deposit targets on the 386 square kilometer property. With approximately $8 million in the treasury and no debt, the Company is well positioned to significantly advance RC Gold by 2024.

2023 RC Gold Highlights:

● Announced an initial pit constrained inferred mineral resource estimate of 1.34 million ounces of gold comprising the Blackjack deposit (900,000 ounces of gold grading 0.83 g/t gold) and the Eiger deposit (440,000 ounces of gold grading 0.50 g/t gold) (see press release dated January 19, 2023).

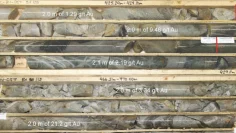

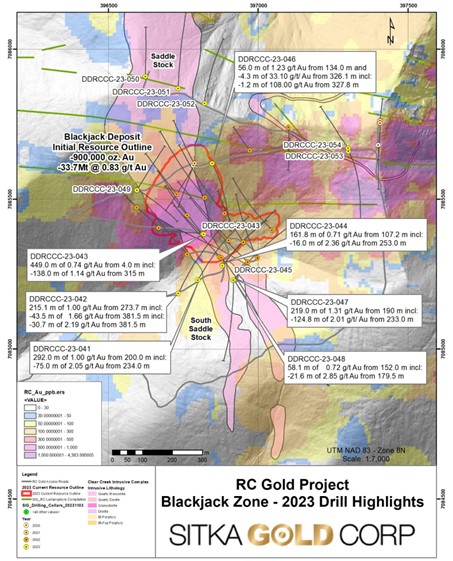

● Completed a 16-hole, 6,515 metre resource expansion drilling program that significantly expanded the known gold mineralization in the Blackjack deposit area, while the deposit remains open in all directions.

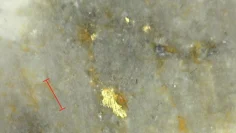

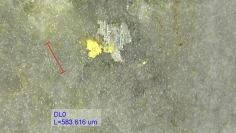

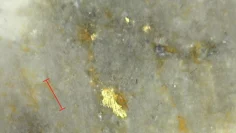

● Drilling of the best intercept to date on the property, which extends the known gold mineralization from the southern extent of the current Blackjack deposit and returned 219.0m of 1.34 g/t gold, including 124.8m of 2.01 g/t gold and 55.0m of 3.11 g/t gold in drill hole DDRCCC-23-047 (see press release dated September 26, 2023) and 4.3 m of 33.10 g/t gold, including 1.2 m of 108.00 g/t gold in drill hole DDRCCC-23-46 (see press release dated September 11, 2023), demonstrating the exceptional grades within this intrusion-related gold system.

● DDRCCC-23-54 at the Saddle Zone, 450 meters east of the Blackjack resource boundary, returned the best drill result to date with 84.0 m of 1.21 g/t gold from surface (see press release dated October 30, 2023). With only four holes completed, the Saddle Zone remains open in all directions and is underlain by the largest and highest grade gold-in-soil anomaly on the property, highlighting the potential for building additional resources on the project.

● Initial drilling confirmed significant gold-bearing mineralization within the Josephine intrusion.

● Field reconnaissance and compilation of data (historical and current) has identified five additional drill-ready, intrusion-related drill targets within the district-scale RC Gold property, as well as other prospective target areas that have the potential for undiscovered intrusions to be pursued.

● Completed all requirements to acquire 100% ownership of the Clear Creek Property, which comprises the northern portion of the Clear Creek Intrusive Complex including the Blackjack and Eiger deposits.

Cor Coe, P.Geo., Director and CEO of Sitka, commented, “2023 was a very exciting year for Sitka Gold in the exploration of the RC Gold property. Our team achieved several milestones, starting with the release of the maiden Mineral Resource estimate for the Blackjack and Eiger deposits. Drilling in the Blackjack area continued to encounter exceptional grades in many of the 2023 drill holes, highlighted by the 55.0m of 3.11 g/t gold in hole 47. The potential for high grades within the Reduced Intrusion Related Gold Systems in the Yukon’s Tombstone Gold Belt has been recognized with the discovery of the Valley Target by Snowline Gold and the grades intersected in our Blackjack deposit. The RC Gold project includes the Blackjack and Eiger deposits and seven other under-explored intrusive bodies with known gold mineralization. The exceptional grades intersected in many of the drill holes in the Blackjack Zone, both within and outside the current resource area, highlight the significant potential of the property. The size, grade and continuity of the gold system here continues to impress us and demonstrates the potential of this area to host a multi-million ounce economic gold resource. The Company has focused drilling efforts on the current resource discoveries while compiling information on the numerous additional highly prospective targets within the district-scale property using current and historical data in 2023. With approximately $8 million in treasury and no debt, Sitka is well positioned to both advance current drill-ready targets elsewhere on the property and to further expand and define the highly prolific, gold-bearing area of the Clear Creek Intrusive Complex, which currently hosts the Blackjack and Eiger deposits).”

The 2023 drill campaign focused on expanding the recently reported resource at the Blackjack deposit. All 12 holes completed at the Blackjack Zone intersected further significant gold mineralization, with the exception of the northeastern-most hole on the project, which deviated from the drill target and only encountered anomalous gold values. The highlight of the drilling was the highest-grade intercept to date on the project in the current southern extent of the Blackjack Zone, which returned 219.0 meters of 1.34 g/t gold, including 124.8 meters of 2.01 g/t gold and 55.0 meters of 3.11 g/t gold in hole DDRCCC-23-047.

The Company continued to evaluate the potential of the northern portion of the Clear Creek Intrusive Complex, which includes both the Blackjack and Eiger deposits as well as the Saddle Zone and numerous other high priority exploration targets identified by soil geochemical surveys, geologic mapping and geophysical surveys. Several of these areas are highlighted in Figure 7 and are described in more detail in the press release dated August 2, 2023, including the discovery of visible gold in metasedimentary rocks along the southern margin of the Josephine intrusion.

Two holes were drilled near the southern edge of the Josephine intrusion. Drill hole DDRCCC-23-055 intersected the Josephine intrusion, which consists of equigranular and feldspathic megacrystic granodiorite phases. Numerous narrow, 1 to 2 cm thick quartz-arsenopyrite veins were encountered throughout the hole. Drill hole highlights include 6.0 meters of 0.85 g/t gold within 18.0 meters of 0.41 g/t gold. A second hole DDRCCC-23-056 was drilled south of the Josephine intrusion and encountered variably altered metasedimentary rocks intersected by occasional narrow, fine-grained feldspar porphyry dikes, but did not reach the southern contact of the Josephine intrusion. Quartz, quartz-arsenopyrite and quartz-arsenopyrite-tourmaline veins and anomalous gold values were noted throughout the hole. Sitka is very pleased with these first diamond drill holes ever drilled near the Josephine intrusion as they demonstrate the potential of the gold-bearing intrusion to host potentially economic gold grades. Future work will utilize these initial results to target further drilling in the Josephine zone.

“The accomplishments at RC Gold over the past year reflect the hard work and dedication of Sitka Gold’s outstanding team, and I want to thank everyone who helped us achieve our goals in 2023, including our supportive shareholders, investors and contractors,” said Cor Coe, CEO and Director of Sitka. “We look forward to building on the success of 2023 by continuing to grow the resource at RC Gold and testing additional drill-ready targets in 2024. Initial drill testing completed this year at Josephine also returned significant results, including 6.0m of 0.85 g/t gold within 18.0m of 0.41 g/t gold, confirming that the Josephine intrusion has the ability to host significant gold mineralization and we look forward to further drilling in this area next year. We continue to look forward to the potential for additional new discoveries on the property, not only in the northern portion of the Clear Creek intrusive complex, but also on the many known and potentially undiscovered intrusions in the remainder of the property. With a healthy treasury and a proven exploration approach, Sitka is well positioned to create significant value for our shareholders as we continue to develop this exciting asset through 2024 and beyond.”

Conclusion: Sitka Gold has never been stronger than it is today. For a long time, Sitka (market capitalization CAD 50 million) was overshadowed by the high-flyer Snowline Gold (market capitalization CAD 720 million), which rightly claims the attention of the market with its groundbreaking discoveries and spectacular gram-meter gold grades in the Yukon. In the meantime, however, more and more investors, including Crescat Capital in the latest financing, seem to be recognizing parallels between the two companies. Both are active in the Tombstone Gold Belt in the Yukon; both are exploring instrusion-related gold systems and both have multi-million ounce potential. Not only Snowline, but also Sitka has exceptional gold grades to offer, especially in the Blackjack area. Hole 47 intersected 55.0 meters of 3.11 g/t gold this year. Snowline and Sitka both benefit from the continuity of mineralization, which often starts at or near surface. In addition, both have favorable topography that could favor future open pit mining. Both projects have a district format: Snowline covers 3,300 km², Sitka 386 km². The biggest difference lies in how the projects are connected to infrastructure. Sitka’s Clear Creek Intrusive Complex is accessible by road all year round. Snowline’s projects do not have this advantage. Sitka ends the year with a reassuring financial cushion of CAD 8 million. This bodes well for 2024. We wish Sitka continued success in the coming year: may the size, content and continuity of the gold system continue to impress us!

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, however, any liability for financial loss or the content guarantee for timeliness, accuracy, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

Pursuant to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.