Great potential for further discoveries

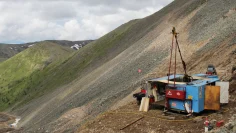

Canadian exploration company Sitka Gold (TSXV SIG / WKN A2JG70) has already made great progress in exploring its RC Gold property in the Yukon, where it recently demonstrated an initial resource of more than 1.3 million ounces of gold. However, the potential of the property is still immense, as demonstrated, among other things, by the consistently strong drill results presented since the resource estimate was published. The Sitka team around CEO Cor Coe is now ensuring that this potential belongs entirely to the company and is now also acquiring 100% of the last two areas, which together make up the 386 square kilometer RC Gold property.

As has just been announced, the corresponding option agreements for the RC and BeeBop areas have been amended, as was recently done with the Barney Ridge and Clear Creek properties. RC and BeeBop adjoin Clear Creek to the east, where Sitka has defined the Blackjack and Eiger gold deposits.

Sitka has now completed all exploration work and payments required to date in respect of RC and BeeBop. Further exploration activities agreed for the future will not be required under the option agreement and the Company will only make final payments of $60,000 and $20,000 for RC and BeeBop, respectively, and issue 375,000 and 125,000 common shares, respectively, to earn 100% interest in the properties.

RC and BeeBop

RC and BeeBop form a contiguous claim block of 2,760 hectares, which includes the Big Creek Stock in particular. This is a 2 kilometer by 3 kilometer dioritic intrusive body that is part of the Clear Creek Intrusive Complex, where Sitka has already proven the aforementioned resource of 1.34 million ounces of gold in and around the Saddle and Eiger intrusives. The Saddle and Eiger Stocks are in turn associated with the Blackjack and Eiger intrusive-related gold deposits, which not only comprise the resource but remain open in all directions.

In comparison, the intrusion-related gold deposit targets at RC and BeeBop have seen only limited exploration work. This much is clear, however, they have gold mineralization analogous to that of the nearby Blackjack and Eiger gold deposits. Both RC and BeeBop are therefore promising targets for Sitka. The company will probably concentrate its future work on the western and southern parts of the claim group first, as these are accessible by road.

Great potential for further discoveries

And Sitka CEO Cor Coe points out that Big Creek is only one of nine (!) known intrusions associated with gold mineralization that occur on the RC Gold Project. Coe adds that Sika has already generated numerous intrusive-related gold deposit targets at RC and BeeBop that have similar characteristics to the Blackjack and Eiger gold deposits, which continue to grow. While Sitka will continue to focus primarily on expanding the existing resource in the Blackjack and Eiger area, it also looks forward to pursuing promising targets in other parts of the project area, he added.

Conclusion: Sitka Gold now has its Yukon project RC Gold completely under control and can benefit to 100% from future successes and developments. The results of the winter phase of the drilling planned for this year on the property should arrive in the near future and provide further information on the potential of RC Gold. A further 15,000 meters of additional diamond core drilling is also planned for this year. The chances are therefore good that the company will be able to significantly expand its existing resource in 2024. In addition, the hunt for new discoveries at the RC Gold project should provide further excitement.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.