IP survey scheduled for late April/early May

Nicola Mining Inc. (TSXV: NIM; FRA: HLIA) plans to test two previously identified targets with targeted 3D IP surveys at its New Craigmont copper project near Merritt, B.C., in the upcoming exploration season to determine if the MARB-CAS zone could be a re-solution of the high-grade historic Craigmont mine with skarn mineralization; in the second case, geologists suspect a potential new porphyry deposit in the so-called West Craigmont zone. Both target areas together cover 4.5 square kilometers (see Figure 1). They are part of Nicola’s 10,913 hectare (>100 km²) license, which is adjacent to Teck Resources’ Highland Valley Copper, Canada’s largest copper mine. The IP survey is scheduled for late April/early May.

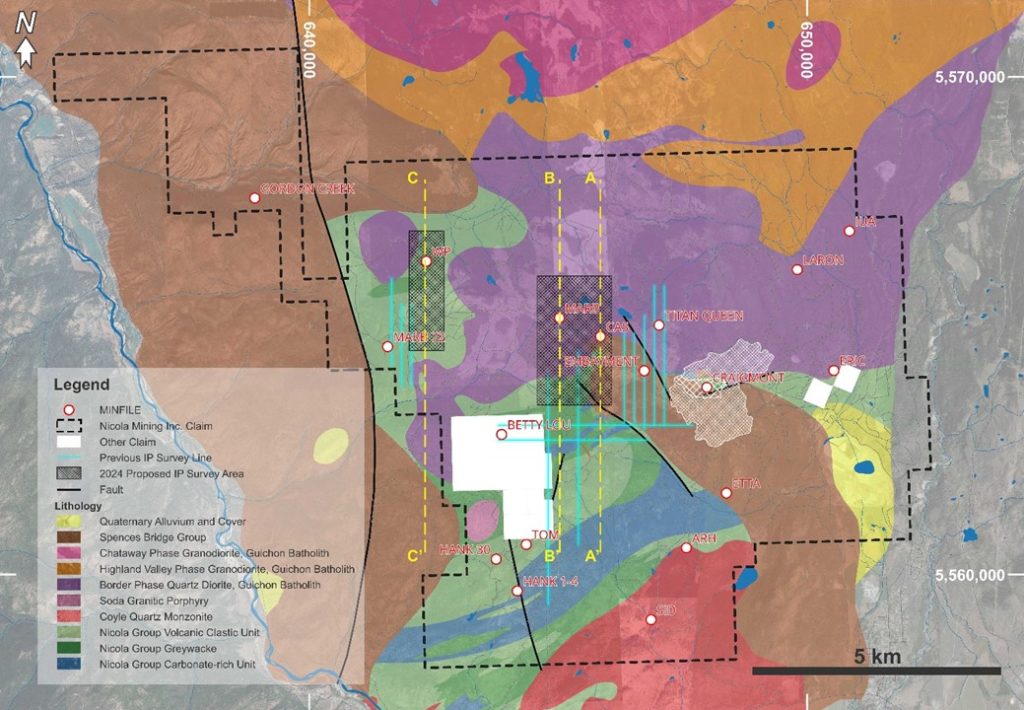

Figure 1: Map of the New Craigmont project. The two areas to be explored are shaded: The first zone is the MARB-CAS Zone, located immediately west of the Embayment Zone, while the second zone is the West Craigmont Zone, which hosts the WP MINFILE deposit in the western part of New Craigmont.

Peter Espig, CEO of Nicola Mining Inc. commented, “Over the past two years, various modern exploration techniques have shown significant correlation with older IP surveys and drilling. With the recently mapped mineralized outcrops correlating significantly with the observed anomalies, we are confident that the upcoming IP survey at the MARB-CAS and West Craigmont zones will yield solid drill targets.”

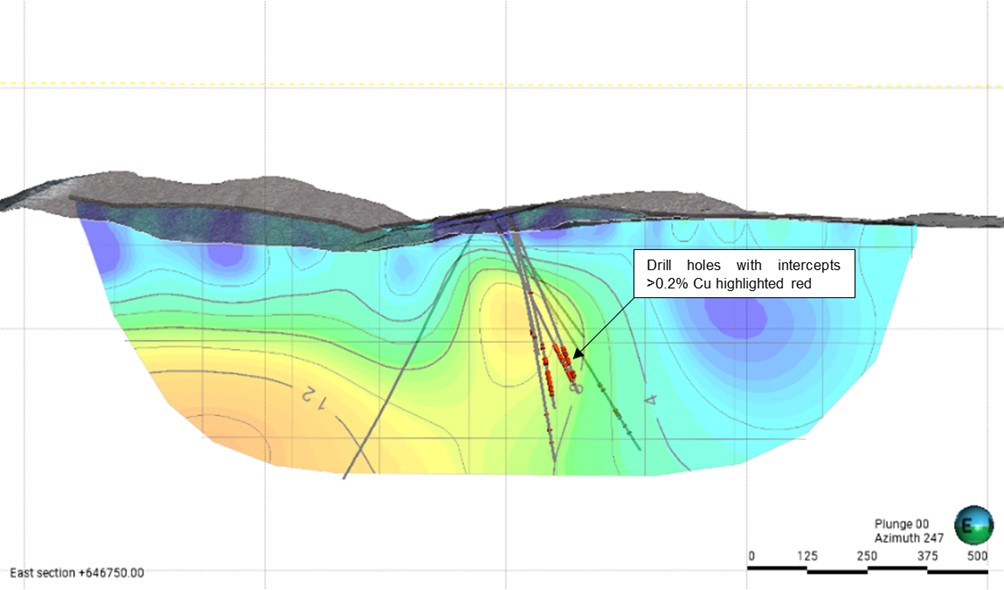

In 2017 and 2018, Nicola had 32.45 line kilometers of IP survey flown (highlighted in yellow in Figure 1). The survey results and subsequent exploration drilling showed a significant correlation between the IP data and the high-grade copper intercepts in the Embayment zone (Figure 2).

Figure 2: IP chargeability cross-section (200m thick) through the Embayment Zone showing a higher chargeability anomaly corresponding with high-grade copper intercepts.

The objective of the IP survey is to find drill targets west of the historic Craigmont Mine and Embayment Zones (Figure 1). Nicola’s geological team believes that the mineralized body has been offset by local faulting and continues to extend to the west. The potential mineralization at the MARB-CAS anomaly is interpreted to be analogous to the ore bodies at the historic Craigmont mine and exploration results at the Embayment Zone. The expected IP results are supported by the copper mineralization observed and mapped in outcrop at MARB-CAS, both hosted in the Guichon quartz diorite.

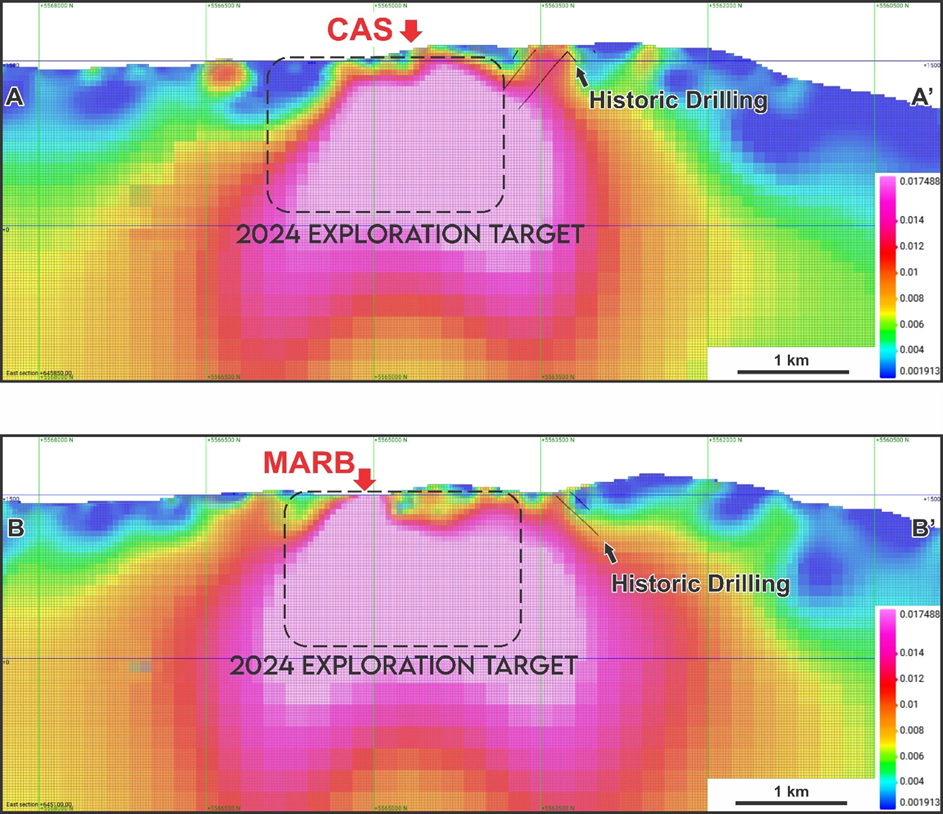

Mineralization at CAS consists of magnetite breccia and magnetite-chalcopyrite mineralization associated with garnet-epidote-actinolite skarn. The MARB-CAS zone has similar magnetite-associated geophysical characteristics to the historic Craigmont Mine and Embayment Zone (Figure 3).

Figure 3. cross sections through the CAS and MARB magnetic anomalies showing the target areas for IP and follow-up drilling in 2024.

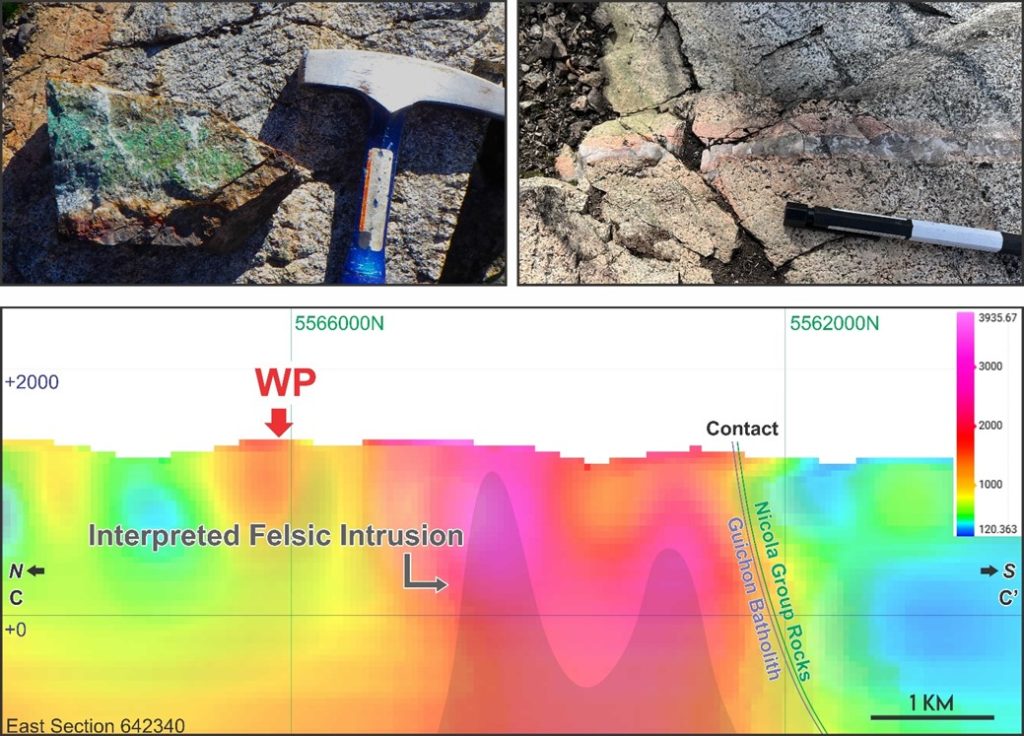

The objective of the IP survey is to find a porphyry drill target near the WP deposit at West Craigmont. The 2022 ZTEM survey discovered a high resistivity feature coincident with a high magnetism anomaly in the West Craigmont zone. The 2017 IP survey detected a chargeability anomaly to the southwest beneath the MARB 72 deposit. The 2024 IP survey will determine if the ZTEM resistivity anomaly coincides with a chargeability anomaly, which would indicate a porphyry.

Figure 4. cross section through WP showing the ZTEM resistivity anomaly possibly representing a felsic intrusion. The photos above the cross-section show malachite (copper-bearing green mineral) on the left and a quartz vein with a halo of potassium feldspar (K) on the right.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, however, any liability for financial loss or the content guarantee for timeliness, accuracy, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

Pursuant to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH may hold shares of Nicola Mining Inc. and therefore a conflict of interest may exist. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Under certain circumstances this can influence the respective share price of the company. GOLDINVEST Consulting GmbH currently has a commissioned relationship with the company or would like to enter into a commissioned relationship with the company, which is reported on in the context of the internet offer of GOLDINVEST Consulting GmbH as well as in the social media, on partner pages or in email messages, which also represents a conflict of interest. The above references to existing conflicts of interest apply to all types and forms of publication used by GOLDINVEST Consulting GmbH for publications on Nicola Mining Inc. We also cannot exclude that other stock letters, media or research firms discuss the stocks we discuss during the same period. Therefore, symmetrical information and opinion generation may occur during this period. No guarantee can be given for the correctness of the prices mentioned in the publication.