Formation Metals (WKN A3D492 / TSXV FOMO) has hit the mark with the first results from the ongoing drilling program at its N2 gold project! The figures paint a picture of a broad, continuous system with strong gold mineralization near the surface.

Formation is conducting a fully funded drilling program at its flagship project—located approximately 25 kilometers south of the mining town of Matagami in Quebec—which is initially designed for 14,000 meters in the first phase.

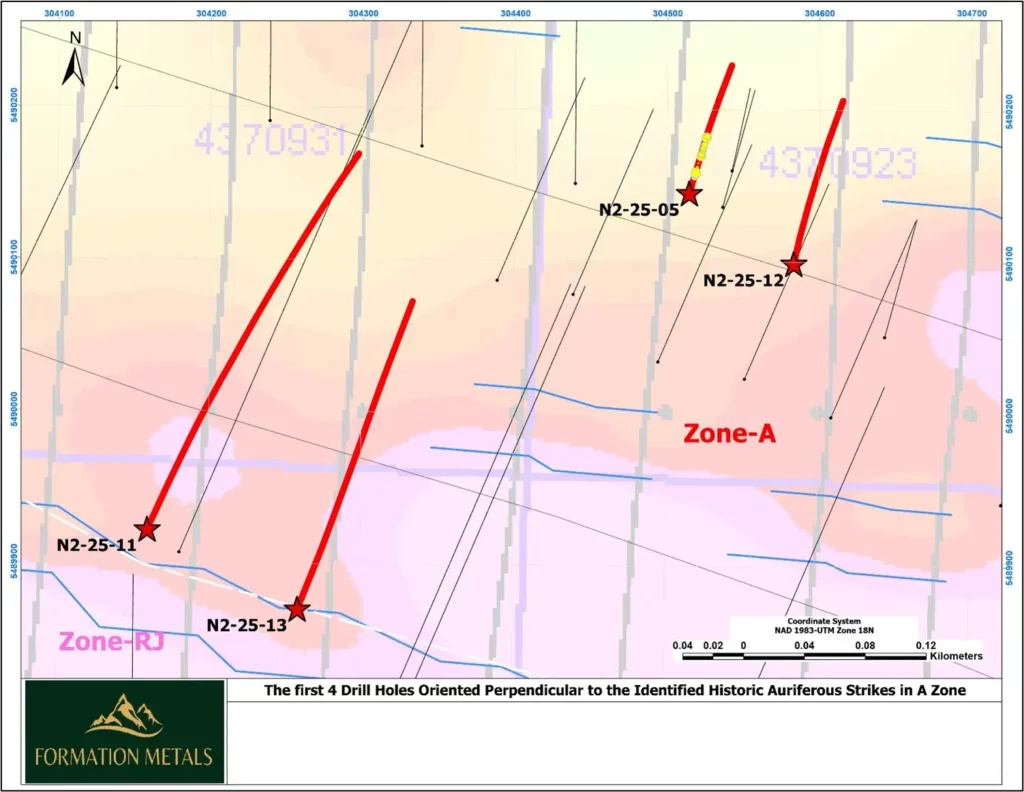

As reported by the company under CEO Deepak Varshney, all drill holes show strong gold grades and/or widths—particularly holes N2-25-005 and N2-25-012. They encountered broad intervals with gold grades that, according to Formation, not only confirm the historical data base but also support the geological modeling for the next steps. This is relevant for an advanced project because the planning of future resource work—and later potential development studies—relies heavily on whether grades and widths occur repeatably over a distance.

Formation Metals: Broad Gold Intercepts in Two Drill Holes Nearly 100 Meters Apart

The most significant new drilling results come from two holes that Formation Metals drilled as part of the Phase 1 program in the A-Zone area. N2-25-005 yielded 0.91 g/t gold over 42.3 meters, starting at a downhole depth of 14.0 meters (equivalent to 12 meters vertical). Within this overall interval, Formation Metals highlights two sub-sections: 2.04 g/t gold over 8.1 meters and 1.31 g/t gold over 11.4 meters.

The second key hit is even more significant: N2-25-012 yielded 1.75 g/t gold over 30.4 meters, starting from a downhole depth of 64.1 meters (55 meters vertical). This section contains several higher-grade sub-intervals, including 3.51 g/t gold over 10.5 meters and a short high-grade inclusion of 19.2 g/t gold over 0.51 meters. Additionally, Formation Metals reports another interval further down in N2-25-012 of 2.07 g/t gold over 4.5 meters, including 3.32 g/t gold over 1.5 meters.

Two further holes are also mentioned: N2-25-011 intersected 0.69 g/t gold over 7.5 meters (including 1.78 g/t over 4.13 meters). N2-25-013 yielded 4.16 g/t gold over 0.5 meters.

A crucial point: Formation views the intercepts from N2-25-005 and N2-25-012 as part of a continuous mineralized zone that can be traced over approximately 100 meters between the two drill collars. Such continuity is particularly important for the objective of a later open-pit oriented resource, as it supports the geometry of the system and the predictability of the mineralization.

Drilling Program at N2: 14,000 Meters Phase 1, 30,000 Meters Total Plan—and Many Results Still Pending

As mentioned, Formation Metals is currently working on Phase 1 (14,000 meters) of a fully funded drilling program. To date, 23 drill holes totaling 7,968 meters have already been completed. Assays are still pending for nine drill holes, so further updates can be expected in the coming weeks.

The objectives of Phase 1 are clearly defined: First, infill drilling is intended to close gaps in the near-surface mineralization to increase the reliability of the database. Second, the company plans step-outs and tests in the down-dip direction as well as along strike, particularly west of the boundaries of the historical resource. Third, core material is being collected for metallurgical confirmation work to place future recovery rate assumptions on a more solid foundation.

Formation is utilizing two drill rigs, primarily to systematically test the “A” and “RJ” zones over more than eight kilometers of strike. The company also speaks of the overarching goal of presenting its first own resource estimate after the completion of Phase 1 in the third quarter, which is expected to incorporate a total of nearly 70,000 meters of drilling data.

Historical Resource, Zones, and Expansion Potential at the N2 Gold Project

According to Formation, the project area comprises 87 claims covering approximately 4,400 hectares in the Abitibi sub-province of northwestern Quebec. N2 has a global historical resource of approximately 871,000 ounces of gold. This consists of approximately 18 million tonnes at 1.4 g/t gold (equivalent to about 810,000 ounces) across four zones (A, East, RJ-East, and Central), plus an additional 243,000 tonnes at 7.82 g/t gold (about 61,000 ounces) in the RJ zone.

Formation Metals highlights two areas in particular: The A-Zone is described as shallow and very continuous, historically containing approximately 522,900 ounces at 1.52 g/t gold. Historically, around 15,000 meters were drilled there over 1.65 kilometers of strike; 84% of the historical drill holes intersected gold-bearing sections, with examples up to 1.7 g/t over 35 meters. The RJ-Zone is cited as a high-grade area with approximately 61,100 ounces at 7.82 g/t gold; according to the announcement, historical intercepts reach up to 51 g/t over 0.8 meters and 16.5 g/t over 3.5 meters. At the same time, Formation Metals emphasizes that only about 900 meters have been drilled along RJ and more than 4.75 kilometers of strike remain open.

From the company’s perspective, this results in a clear focus: broad, continuous intercepts near the surface—as seen in N2-25-005 and N2-25-012—can create the foundation for further developing the project toward a future, open-pit oriented resource. This is exactly where Phase 1 comes in: proving continuity, expanding boundaries, and simultaneously generating data required for the next technical steps.