Results expected in the next few weeks

Abitibi Metals (CSE: AMQ / WKN A3EWQ3) originally only planned to drill a total of 2,750 meters on its polymetallic B26 project as a first step. However, due to the continued success of the drilling and the strong (financial) support from shareholders, the first phase of drilling has been extended to over 13,500 meters. This is more than was originally planned for 2024 in total!

Abitibi has now completed all 44 drill holes and has already presented the results from ten holes. CEO Jonathon Deluce is already enthusiastic about these and the company is now awaiting the results of the remaining 34 holes, which it hopes to receive in the coming weeks.

CEO Deluce emphasizes the importance of the drilling program as a whole, with which Abitibi intends to evaluate the potential open pit component that it hopes to add to the historic underground resource.

The strategy of the initial drill program at B26 is to focus primarily on high-priority targets within the main deposit to a depth of 300 metres, and Deluce believes the results of holes #293, #294, #300 and #301, which identified significant near-surface high metal factor zones, support the plan to proceed with the evaluation of the open pit potential of B26.

The aforementioned drill hols yielded:

#1274-24-293: 2.6% CuEq over 37.0 meters from a depth of 106 meters, including 6.3% CuEq over 10.6 meters

#1274-24-294: 2.5% CuEq over 61.3 meters, starting at 128.6 meters depth, including 11.4% CuEq over 10.6 meters

#1274-24-300: 5.35% CuEq over 8.1 meters, starting at 251.5 meters depth

#1274-24-301: 1.47% CuEq over 97.5 meters, starting at 30.5 meters depth, including 3.9% CuEq over 21.9 meters

Phase 1 drilling spread over three target areas

Abitibi has spread the first phase drilling on the project over three target areas. At the B26 Main Deposit, 36 drill holes totaling 10,469.5 metres were completed to evaluate the open pit potential and potential near surface extensions of the Main Deposit to the north and to fill gaps in the model.

In addition, five holes totalling 1,716 meters were drilled at Satellite West to test the geometric continuity of a potential satellite zone 500 meters west of the main deposit.

Finally, three holes totalling 1,317 meters were drilled to test the extent of the main deposit to the east. There, historical drilling had encountered 2.45% CuEq over 26.7 meters, including 4.74% CuEq over 11.7 meters.

According to Abitibi, the next drilling phase will then continue at the beginning of June, as soon as the winter break is over and the target generation for phase 2 has been completed.

The strategy for 2024

This second drill phase is expected to cover more than 16,500 meters in 2024. In total, the drill program, which is scheduled to run until 2025 and is fully financed, is designed for 50,000 meters of drilling.

However, other important activities are planned in addition to drilling:

– Updated Internal Resource and 3D Model: The Company recently announced its first 3D model of the project, which integrates the data from the initial program with the over 115,000 metres drilled by SOQUEM. The new 3D geological model represents a fundamental advancement in the understanding of the geological controls on mineralization within the B26 deposit and is expected to improve confidence in an updated internal mineral resource estimate currently underway.

– Gravity Survey: The Company is planning a gravity survey grid to cover the extensions of the VMS contact and model the geology, particularly the mafic-felsic contacts and sulphide-rich environment, to target new mineralized extensions and satellites near surface and at moderate depth (300 to 600 metres). This is in line with our first year objective to improve our understanding of the project. Ultimately, an integrated geophysical approach could lead to further discoveries on the property.

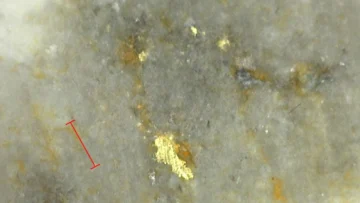

– Assessment of assay preparation: In the 2018 resource estimate, SGS recommended QAQC protocols to explain replicability for the four metals (Au-Cu-Ag-Zn). The company has established a series of assay protocols with the aim of controlling QAQC issues from the start of the project. As a result, the samples are crushed finer, with 95% of the particles being 1.7 mm in diameter, and a large split of 1 kg is pulverized down to 106 µm (150 mesh). The Company believes these adjustments will help to better evaluate the higher grade areas of the deposit as demonstrated by the results from drill hole 1274-24-293, which represents a potential opportunity to increase grade in areas of the deposit. The Company is reviewing the historical intercepts to determine the areas that will be re-assayed to better define the higher grade lenses within the deposit.

– Additional sampling of historical core: During the 2018 resource estimate, SGS identified 8,300 metres of historical, untested drill core within the mineralized corridor. The company plans to begin testing these identified areas to complete the model and better define the limits of the deposit.

Conclusion: Abitibi Metals is moving ahead at full speed, so that shareholders can already look forward to the next drill results within a few weeks. The company’s tactics (drilling) and strategy (drilling and further development steps) are clear and should be able to continue to be implemented quickly given the more than well-filled coffers. If Abitibi continues to deliver positive drill results from B26, we believe this should give the share price new momentum. Especially, as the Beschefer gold project is another iron in the fire for Abitibi.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Abitibi Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Abitibi Metals for reporting on the company. This is another clear conflict of interest.