There are few polymetallic deposits of this grade and size in Canada

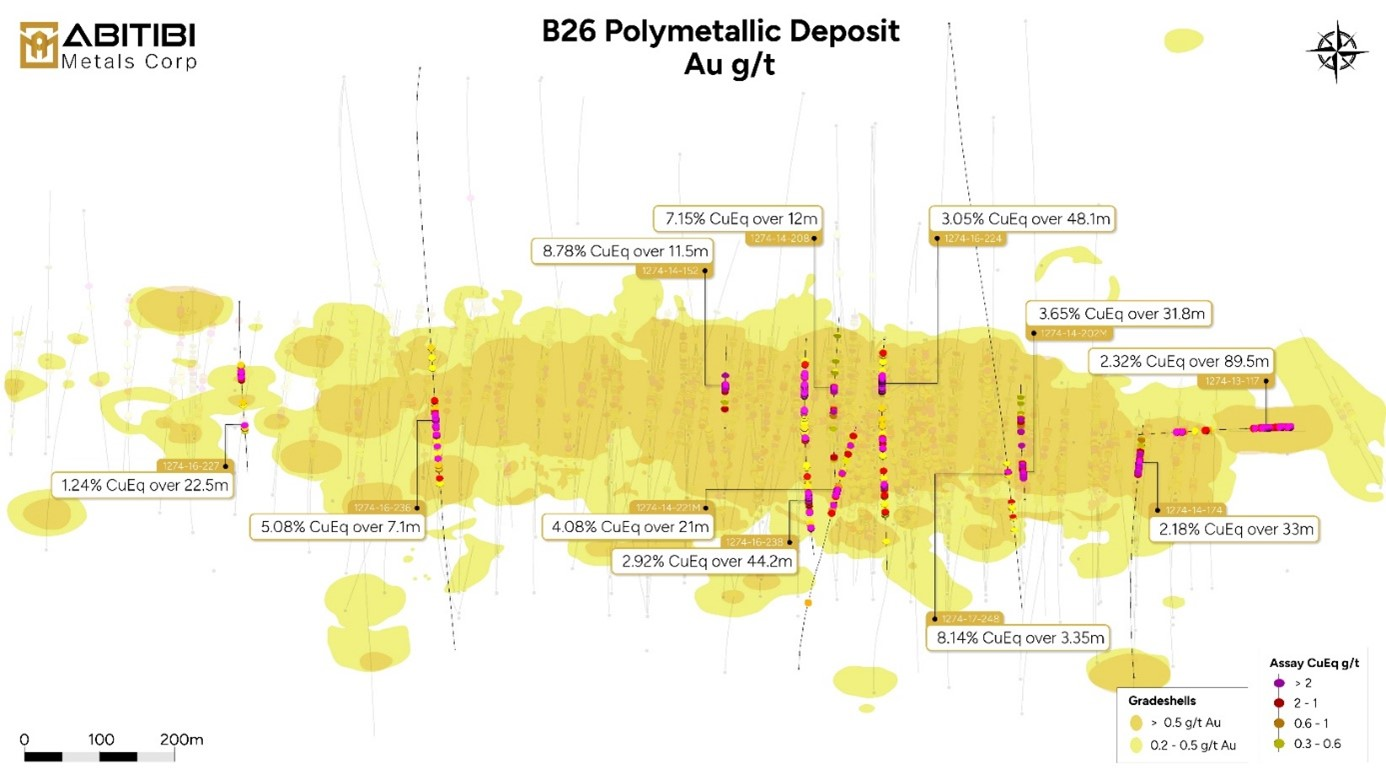

Abitibi Metals Corp. (CSE:AMQ; OTCQB:AMQFF; FSE:FW0) has unveiled a 3D geologic model of its high-grade B26 polymetallic deposit at the Abitibi mining camp in Quebec. The new model breaks down the distribution of the individual elements Cu, Au, Ag, Zn and provides a much finer understanding of the geological controls on mineralization within the B26 deposit. The model’s findings increase confidence in the assessment of mineralization potential and inform ongoing drill planning initiatives. Through the interpretation of individual intercepts and observations from Phase 1 drilling, the Company has already identified priority expansion targets and trends within and outside the main deposit area to be drilled in Q2 and Q3. To further enhance the property-wide target model, a mag inversion along the B26 corridor and a property-wide gravity survey will commence shortly. Results from 33 drill holes are pending.

Jonathon Deluce, CEO of Abitibi Metals, commented: “We are pleased to present our new 3D model of the B26 deposit, which highlights the size, scale and growth potential of the deposit. There are few polymetallic deposits of this grade and size in Canada and we believe these deposits will be highly sought after as the commodity and precious metals market continues to erupt. We will continue to refine the model as we receive the results and provide updated information to the market. We are still awaiting results from over 30 drill holes from our Phase 1 drill program, which we will announce in the coming weeks.”

Figure 1: Gold plan view. Similarly, the 3D model shows the distribution of copper and silver.

Figure 2: Gold – longitudinal section. Similarly, the 3D model shows the distribution of copper and silver.

The footprint of the deposit extends over a strike length of 1.6 km and 0.8 km in depth and occupies a corridor of approximately 150 meters in width, whereby three historical zones can be distinguished: In the Main Deposit, Abitibi has completed 36 drill holes totaling 10,469.5 metres to evaluate the open pit potential and possible up-dip, near-surface extensions of the Main Deposit to the north and to fill in gaps in the model. In the West Satellite, 5 drill holes totaling 1,716 meters were completed to explore the geometric continuity of a potential satellite zone 500 meters west of the main deposit. In the Eastern Extension: Abitibi has completed 3 drill holes totaling 1,317 meters. This drilling is targeting the eastward extension of the main deposit where historical drilling has intersected 2.45% Cu Eq over 26.7 meters, including 4.74% CuEq over 11.7 meters (1274-14-167).

The latest drill results support the Company’s thesis that B26 has near-surface potential: #293 returned 2.6% CuEq over 37.0 meters starting at 106 meters depth, including 6.3% CuEq over 10.6 meters, and #294 returned 2.5% CuEq over 61.3 meters starting at 128.6 meters depth, including 11.4% CuEq over 10.6 meters. #Hole 301 intersected 1.47% CuEq over 97.5 meters starting below the bedrock contact from 30.5 to 128 meters below the hole, representing an estimated true width. At #300, a shorter high-grade intercept of 5.35% CuEq over 8.1 meters from 251.45 to 259.6 meters was intersected, which also contained 1.1 g/t Au.

Figure 3: Abitibi regional greenstone map

Just last November, Abitibi received an option from SOQEM to acquire 80% of the high-grade B26 polymetallic deposit, which hosts a historical resource estimate of 7.0 million tons at 2.94% Cu Eq (Ind) and 4.4 million tons at 2.97% Cu Eq (Inf). In addition, the Company is currently active with drilling at the Beschefer Gold Project where historic drilling has identified four historic intercepts with metal grades in excess of 100 g/t gold. Among others, 55.63 g/t gold over 5.57 meters and 13.07 g/t gold over 8.75 meters were measured in four modeled zones. Abitibi has raised more than CAD 20 million in fresh capital since the end of last year and with these funds will be able to complete and most likely significantly accelerate the seven-year negotiated earn-in process.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Abitibi Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Abitibi Metals for reporting on the company. This is another clear conflict of interest.