Known mineralization to be extended

After three successful, consecutive financings totaling C$21.8 million, Abitibi Metals Corp. (CSE: AMQ; OTCQB: AMQFF; FSE: 4KG) is now putting the money to work. In parallel with ongoing drilling at its B26 polymetallic deposit in the Abitibi mining camp, Quebec, the Company has now also commenced drilling at its Beschefer gold project. Beschefer is located approximately 7 kilometers to the east along trend with the B26 deposit. In addition, the polymetallic, formerly producing Selbaie mine is located only 14 kilometers from Beschefer. And the Casa Berardi mine, operated by Hecla Mining, is just 45 kilometers away.

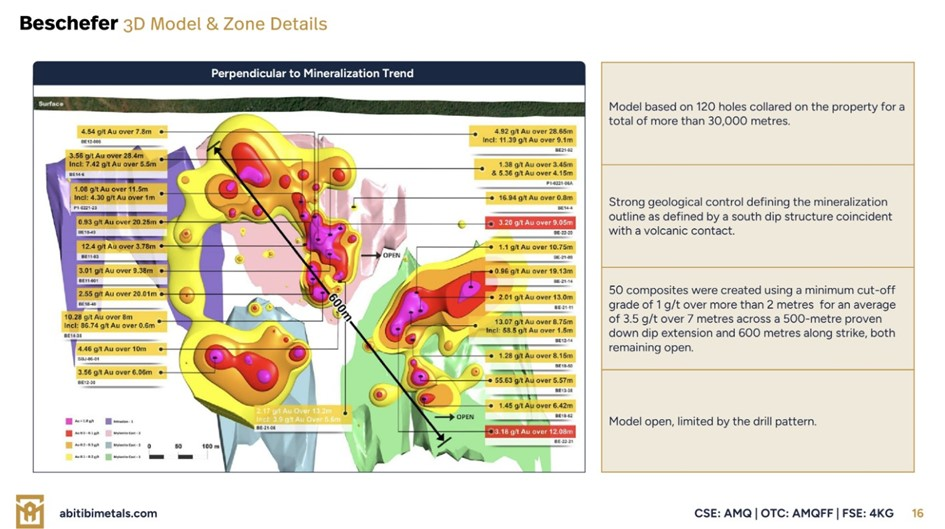

Abitibi is initially planning 10 drill holes with a total length of 2,975 meters. The objective of the drilling is to extend the known mineralized zone to the northeast and increase the high metal content lenses, including the Central Shallow and East zones. Highlights from previous intercepts include 4.92 g/t gold over 28.65 meters in hole BE-21-02 (including 11.39 g/t over 9.23 meters). 65 meters in hole BE-21-02 (including 11.39 g/t over 9.1 m), 55.63 g/t gold over 5.57 meters in hole BE13-038 (including 224 g/t over 1.23 m; 13.95 g/t over 0.68 m and 13.70 g/t over 0.73 m), 13.07 g/t gold over 8. 75 m in hole B12-014 (including 58.5 g/t over 1.5 m), 3.56 g/t gold over 28.4 m in hole B14-006 (including 7.42 g/t over 5.5 m) and 10.28 g/t gold over 8.00 m in hole B14-35 (including 86.74 g/t over 0.60 m). True widths in these intercepts vary between 89% and 99% of intersected widths.

Beschefer is also located 30 kilometers southwest of Wallbridge Mining Company Fenelon Gold Project. Abitibi has optioned the Beschefer project from Wallbridge and can earn 100% over a four-year period. As of December 31, 2023, the Company has incurred approximately $2 million in work expenditures on the project. The Company must reach its final option milestone and incur $3.0 million in work expenditures by February 2025 to acquire 100% of the project.

Jonathan Deluce, CEO of Abitibi, commented: “We are pleased to resume drilling at the Beschefer high-grade gold project. It is an advanced gold exploration project with significant near-term resource potential. The first 2,975 meters of drilling in 2024 will build on the four historic intercepts with metal grades in excess of 100 g/t gold, highlighted by 55.63 g/t gold over 5.57 meters and 13.07 g/t gold over 8.75 meters. We have 26 holes planned, 10 of which have been selected to test the potential of the system to extend the strike length and test the high metal content zones. With our two ongoing drill programs, we have a catalyst-rich spring ahead of us with continued drill results from both B26 and Beschefer.”

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.