Pictures are worth a thousand words, they say. Group Ten Metals Inc. (TSX.V: PGE; FRA: 5D32) just released, for the first time, an image from its Stillwater-West polymetallic project in Montana that provides a kind of X-ray view of the massive dimensions of the suspected PGE-Ni-Cu-Co + Au mineralization that lies just beneath the surface.

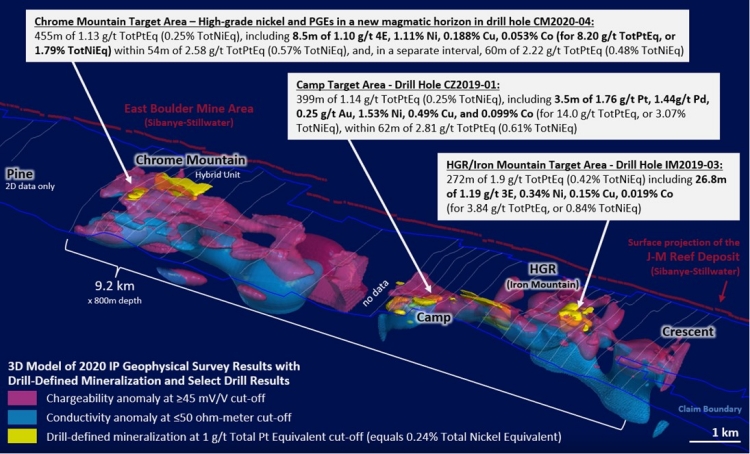

Technically speaking, it is a three-dimensional projection of the Induced Polarization (“IP”) geophysical data collected over the past year. What is impressive is the sheer length, breadth and depth of the suspected structures and that means the potential volume of Group Ten’s polymetallic mineralization is staggering. Never before has a company presented the overall context of mineralization at Stillwater in this way. The three areas, prominently marked in yellow are Group Ten’s three most advanced target areas and the ones which will form the basis of its initial mineral resource estimate expected this summer. It is clearly visible that only the very smallest parts of this highly prospective area has been explored by drilling and that means we should expect to see dramatic expansion of tonnage as drilling continues.

Figure 1 – High-grade conductivity (blue) and chargeability (pink) anomalies from 3D modeling of 2020 IP geophysical survey results with drill-defined mineralized zones (yellow) and selected drill results in the most advanced target areas at Stillwater West. Strong correlations are demonstrated over 9.2 kilometers highlighting world-class potential for battery metals, platinum group elements and gold in the lower Stillwater Complex adjacent to the producing Sibanye-Stillwater mines.

Group Ten’s neighbour, Sibanye-Stillwater, is currently mining its world-class palladium-platinum deposit along the JM Reef, with around 80 million ounces of ultra high-grade resources & reserves. That company’s entire resource at Stillwater comes from a reef structure averaging just 2 meters wide but across 40km in length and over two kilometers deep, which extends like a curtain along Stillwater. Similarly, in the Bushveld District of South Africa, such is the nature of the bulk of the world’s platinum production, which is extracted from narrow high-grade structures like the well-known Merensky and UG2 reefs.

Group Ten, however, is successfully transferring Ivanhoe’s model from the Platreef district in the northern Bushveld complex to its similar geology in the Stillwater District. Like Bushveld, Stillwater is a layered magmatic system with these narrow, very high-grade PGE-rich seams known as reefs in the upper portion. Below these structures are massive, disseminated polymetallic occurrences like those found at Anglo American’s Mogalakwena, Ivanhoe’s Platreef and Platinum Group Metals’ Waterberg projects. These South African “Platreef-type” PGE Ni-Cu feature some of those most favourable production economics[CA1] of any mines in the world, providing valuable nickel for the burgeoning battery industry, palladium, platinum and rhodium for the automotive market, including fuel cells, and copper, which is essential for the growing transition to electrification and economic growth in general. It is noteworthy, that the US federal government has listed nickel, cobalt, and PGEs as critical metals, meaning it has a mandate to support domestic supply. That puts Group Ten in good stead vs its global peers.

2021 will be a pivotal year for Group Ten

Group Ten’s President & CEO, Michael Rowley, put things in perspective “The 3D inversion models developed from our 2020 IP survey have far exceeded our expectations. The results highlight the remarkable extent of the mineralized system at Stillwater and demonstrate the potential to continue to discover new Platreef-style mineralized horizons as was the case in the 2020 drilling campaign.”

Of particular value is the recognition that the 2020 IP surveys have proven to be an effective tool in identifying high-grade sulphide mineralization and already resulted in the discovery of several new high-grade horizons at Chrome Mountain within broad zones of continuous mineralization in the past 2020 drilling campaign, including 8.5 m of 1.10 g/t 4E, 1.11% Ni, 0.188% Cu and 0.053% Co for 8.20 g/t total platinum equivalent (“TotPtEq”) or 1. 79% total nickel equivalent (“TotNiEq”), in hole CM2020-04, within 54m at 2.58 g/t TotPtEq (0.57% TotNiEq) and, in a separate intercept, 60m at 2.22 g/t TotPtEq (0.48% TotNiEq). The entire hole was mineralized and returned 455m at 1.13 g/t TotPtEq (0.25% TotNiEq), starting from surface (see news of March 3, 2021).

Rowley believes 2021 will be a pivotal year for the company, saying “Group Ten is planning its largest exploration program to date with multiple drill rigs and an expanded IP survey to build on the successes of 2020.” Rowley announced plans to release more details of the plans in the coming weeks. He has confirmed the first resource for Stillwater West will be released as planned in mid-2021. With multiple drill rigs operating at the three key target areas this year, it will be exciting to see the aforementioned yellow highlighted areas in the IP survey expand and grow.

About Stillwater West

The Stillwater West PGE-Ni-Cu-Co + Au project makes Group Ten the second largest landholder in the Stillwater Complex, which is adjacent to Sibanye-Stillwater’s Stillwater, East Boulder and Blitz PGE mines in south-central Montana, USA. The Stillwater Complex is considered one of the top regions in the world for PGE Ni-Cu-Co mineralization, along with the Bushveld Complex and the Great Dyke in southern Africa. The J-M reef and other PGE-enriched sulfide horizons in the Stillwater Complex share many similarities with the highly productive Merensky and UG2 reefs in the Bushveld Complex. Group Ten’s work in the lower Stillwater Complex has demonstrated the presence of large-scale disseminated and sulfidic battery metal and PGE mineralization, similar to the Platreef in the Bushveld Complex.

Conclusion: it is no coincidence that Group Ten has entered into several confidentiality agreements with major mining companies. The 3D models now presented make it clear for the first time, even to laymen, what the major companies are interested in: They want a long-lived project that will provide them with large-tonnage polymetallic mineralization for large-scale industrial extraction and finding that in a productive, famous district in the United States makes it almost irresistible. This is exactly the potential that Group Ten could have. The maiden resource estimate, anticipated mid-year, will provide a first indication in terms of tonnage. But really, systematic exploration at Stillwater West is just getting started. The project is likely to grow for years to come. It is probably only a matter of time before Group Ten’s value proposition is finally recognized in the USA.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. This content exclusively serves to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly is it to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities carries high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Group Ten Metals and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between a third party that is in the camp of Group Ten Metals and GOLDINVEST Consulting GmbH, which means that there is a conflict of interest, especially since this third party remunerates GOLDINVEST Consulting GmbH for reporting on Group Ten Metals. This third party may also hold, sell or buy shares of the issuer and would thus benefit from an increase in the price of the shares of Group Ten Metals. This is another clear conflict of interest.

[CA1]Changed this up because 2 of 3 aren’t actually mines yet, so this way we can rely on their engineering study econmics and get the same point across