Investment Highlights

- Two advanced exploration projects in North America with gold, silver, copper, and zinc potential

- Cervantes Project (Sonora, Mexico): emerging gold-copper porphyry discovery with excellent infrastructure and extensive drill base

- Tombstone Project (Arizona, USA): historically significant silver-gold district with promising CRD mineralization (Carbonate Replacement Deposit)

- Over 17,000 drill meters of exploration results with numerous high-grade intercepts

- Experienced management team with a proven track record in the discovery and development of deposits in North and South America

- Solid financial foundation: Recently increased financing of over 8.7 million CAD (September 2025) for further exploration and project development

Company & Strategy

Aztec Minerals Corp. is a Canadian exploration company listed on the TSX Venture Exchange (Symbol: AZT) and OTCQB (Symbol: AZZTF), focused on the discovery and development of precious and base metal deposits in North America. The company’s focus is on two promising projects: the Cervantes Gold-Copper Project in Sonora (Mexico) and the Tombstone Gold-Silver Project in Arizona (USA).

The company’s strategic direction is to identify economically attractive deposits in established mining areas, verify their potential through targeted exploration, and thus increase shareholder value. Both projects benefit from excellent infrastructure, geological continuity with existing mines, and low political risk.

With a combination of technical expertise, conservative financial planning, and an experienced management team, Aztec Minerals pursues a systematic growth strategy: from exploration and resource definition to potential joint ventures or acquisitions by larger mining companies.

Market Environment

Gold and Copper Potential in the Laramide Belt

The Cervantes Project is located in the prolific Laramide Porphyry Belt, one of the world’s most productive copper-gold belts, hosting significant deposits such as Cananea (Grupo México). The Sonora region is considered mining-friendly, with existing infrastructure, power supply, and water resources.

The gold market continues to benefit from macroeconomic uncertainty, inflationary pressure, and geopolitical instability, while copper, driven by ongoing electrification, energy transition, and infrastructure investments worldwide, is increasingly becoming a strategic metal.

Silver and Zinc in the US Southwest

The Tombstone Project is located in a historically significant silver district, which produced over 32 million ounces of silver in the 19th century. With new exploration results at depth, Aztec Minerals aims to identify modern CRD systems (Carbonate Replacement Deposits) – a geological type that has already yielded high-grade discoveries in the region, such as the Hermosa-Taylor deposit (South32).

Project Portfolio

Cervantes Project (Sonora, Mexico)

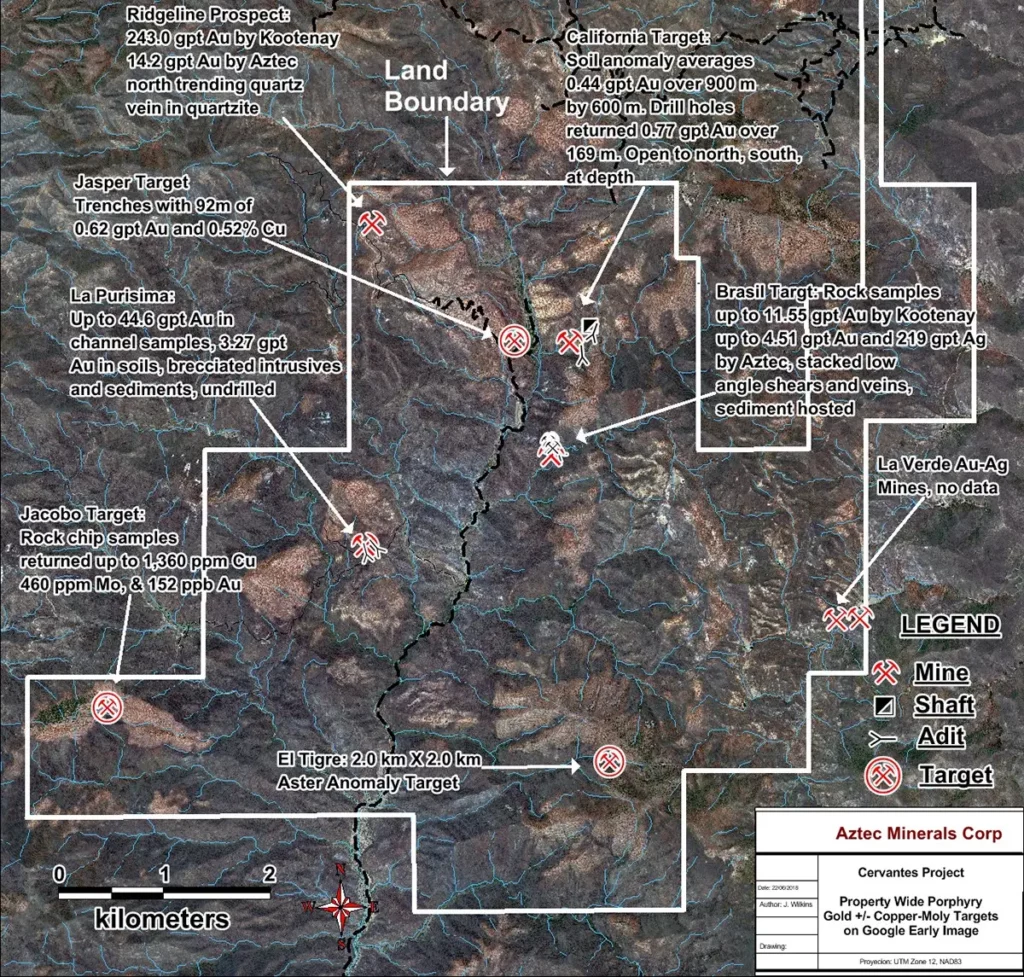

The Cervantes Project, 100% owned by Aztec Minerals, covers over 3,649 hectares in southeastern Sonora, Mexico. It is a promising gold-copper porphyry system with multiple target zones along a 7-kilometer mineralized corridor.

Figure 1: Location of the Cervantes Project in Sonora, Mexico

Geology and Mineralization

The project comprises seven identified zones, including California, California Norte, Purisima East, Purisima West, Estrella, Jasper, and Jacobo.

Drilling has so far focused on the California zone, where an extensive oxidized gold-copper system was confirmed. Significant drill results were achieved here, including:

- 137 m with 1.49 g/t gold incl. 51.7 m with 3.42 g/t gold

- 165 m with 1.00 g/t gold incl. 24.4 m with 4.25 g/t gold

- 152 m with 0.87 g/t gold incl. 33.5 m with 2.05 g/t gold

In total, more than 10,500 meters across 54 drill holes were completed, with nearly all drill holes intersecting significant gold mineralization. The system remains open in all directions.

Infrastructure and Location Advantages

The project boasts optimal development conditions: paved roads, nearby power supply, water sources on site, and private land rights. Its proximity to existing mines such as Mulatos (Alamos Gold) and La India (Agnico Eagle) underscores the region’s potential.

Metallurgical Results

Initial metallurgical tests yielded high gold recoveries between 74% and 87% in simple bottle roll tests. Finer ground samples achieved up to 94% gold recovery – a clear indication of suitability for cost-effective heap leaching.

Additional Target Zones

In addition to the core zone “California”, other areas such as Purisima East and Estrella show promising results with high gold and copper values. Notably, Purisima East yielded rock samples with up to 44.6 g/t gold, while Jasper showed copper values of over 0.5% Cu over 90 meters.

With the most recent 2023 drill road mapping, the extent of the mineralized system was expanded to over 1,000 x 1,200 meters – the structure remains open and offers significant exploration potential for future drill programs.

Tombstone Project (Arizona, USA)

The Tombstone Project is located in southern Arizona, approximately 100 km southeast of Tucson, and covers over 1,600 acres (approx. 663 hectares) of patented and unpatented mining claims. Aztec Minerals holds an 85% interest in it.

Figure 2: Overview of Tombstone Properties and Historic Mining Areas

Historical Background

Between 1878 and 1939, Tombstone produced over 32 million ounces of silver and 240,000 ounces of gold – predominantly from near-surface oxide ores. Mining at the time ceased when the water table was reached at approximately 190 meters depth, leaving deeper deposits undeveloped.

Current Exploration

Since 2020, 51 drill holes totaling 6,579 meters have been completed. The results confirm extensive, oxidized gold-silver mineralization around the historic Contention Pit, which remains open in all directions. Highlights include:

- 65.5 m with 3.39 g/t AuEq

- 96.0 m with 2.20 g/t AuEq

- 32.0 m with 6.28 g/t AuEq

- 125 m with 1.63 g/t AuEq

- 36 m with 5.02 g/t AuEq

These drill results confirm the economic viability of a potential open-pit mining operation with heap leaching in the oxide ore zone.

Deeper CRD Potential

Below the oxidized zones, geophysical and geochemical data indicate deeper carbonate replacement deposits (CRD) – a high-grade deposit type comparable to the Hermosa-Taylor deposit (South32, 65 km southwest). Several strong AMT anomalies suggest mineralized zones between 400 and over 1,000 meters depth.

The current exploration strategy focuses on the correlation of historical structures with modern data to identify new high-grade silver, lead, and zinc mineralizations in the deeper limestone formations.

Figure 3: View of the Tombstone Property

Outlook

With a solid capital base of recently 8.7 million CAD (September 2025, bought-deal financing by Stifel Canada), Aztec Minerals is well-positioned to implement the next exploration phases in both core projects.

- At the Cervantes Project, an expanded RC drilling program is planned to further delineate the gold-copper zones and prepare an initial resource estimate.

- For the Tombstone Project, the focus is on expanding the high-grade gold-silver zones and systematically exploring the deep CRD potential.

Both projects are located in mining-friendly regions with established infrastructure and low development costs, which minimizes risk and increases development opportunities.

Management

Aztec Minerals’ leadership team possesses extensive experience in the discovery, financing, and development of deposits in North and South America.

- Simon Dyakowski, CFA, MBA – President & CEO

Over 12 years of experience in capital markets and corporate development. Previously with RBC, Bank of Tokyo-Mitsubishi, and as a consultant for TSXV companies. - Allen David Heyl, B.Sc., CPG – VP Exploration

Over 38 years of experience in global exploration and deposit development. Involved in discoveries totaling over 30 million ounces of gold and 25 million tonnes of copper. Previous roles include Barrick, Southern Peru Copper, and OroPeru. - Blaine Bailey, CPA, CGA – CFO

Many years of experience in finance and reporting for listed companies (TSX, TSXV, NYSE). - Priscilla Ikani, B.Com – Controller

Over ten years of experience in financial management for mining companies.

The Board of Directors is complemented by experienced professionals such as Patricio Varas (Geologist, Far West Mining) and Stewart Lockwood (Lawyer, McCullough O’Connor Irwin LLP), adding expertise in geology, law, and capital markets to the leadership team.

Conclusion

Aztec Minerals positions itself with two advanced exploration projects in established mining areas of North America as a high-growth exploration company in the precious and base metals sector. The Cervantes Project offers scalable gold-copper potential in Mexico, while Tombstone, with its historical production and deeper CRD zones, opens up a significant exploration and development window. The recent capital increase and consistently positive drill results lay the foundation for building significant resource value in the coming years. For investors, Aztec Minerals therefore offers substantial leverage from exploration success in geopolitically stable regions – backed by an experienced management team and a clear strategic direction.