Canadian gold explorer Formation Metals (CSE: FOMO | WKN A3D492) has expanded its Phase 1 drilling program at the N2 Gold Project (“N2”) in Québec. According to a company update on the ongoing campaign, Phase 1 is now expected to encompass approximately 14,000 meters. The decision is based on observations from the drilling already completed, which revealed long sections of the target mineralization across multiple drill holes! Concurrently, Formation Metals is working on the final compilation and interpretation of the data; analysis results are expected to be published “shortly,” according to the company.

The N2 project is located approximately 25 kilometers south of Matagami, Québec. Formation Metals is pursuing a large-scale, fully funded drilling program there, totaling 30,000 meters. The goal is to better define the project’s known zones with systematic drilling and to examine potential extensions. The starting point includes a historical global resource of approximately 871,000 ounces of gold: approximately 18 million tonnes at 1.4 g/t gold (approximately 810,000 ounces) are distributed across four zones (A, East, RJ-East, and Central). Additionally, 243,000 tonnes at 7.82 g/t gold (approximately 61,000 ounces) are cited for the RJ zone.

Formation Metals: Why Phase 1 is Being Expanded at the N2 Gold Project

To date, Formation Metals has completed 13 drill holes totaling 3,879 meters. According to the company, it is notable that the target mineralization often begins very close to the surface: in four boreholes, it began within the first ten meters, and in another six, within the first 25 meters. Furthermore, long mineralized sections were also observed in all other boreholes; several holes cumulatively yielded more than 80 meters of target mineralization.

As examples, Formation Metals cites several drill holes in which more than 100 meters of target mineralization were identified along the borehole length. These include N2-25-003 (152.9 meters from 23.1 meters drilling depth), N2-25-008 (208.8 meters from 28.6 meters), and N2-25-011 (166.8 meters from 60.0 meters). In N2-25-013, a mineralized section up to 121.7 meters long was also described from 51.6 meters, in which a partial interval of up to 30.8 meters with visible gold was documented. According to the company, assays for these new drill holes are not yet available; publication is scheduled to take place after the evaluation is completed.

According to Formation Metals, the described visual characteristics – intense quartz-carbonate alteration and sulfide mineralization (pyrite/arsenopyrite) in sheared and brecciated zones – are comparable to the rock that has yielded long gold sections in historical drill holes. A historical drill hole that intersected 1.7 g/t gold over 35 meters is cited as a reference. For the ongoing campaign, the company emphasizes that the initial focus is on confirming continuity over strike lengths and thicknesses; the grades are to be verified with the upcoming lab data.

Focus on A- and RJ-Zone: Drilling Strategy and Next Steps

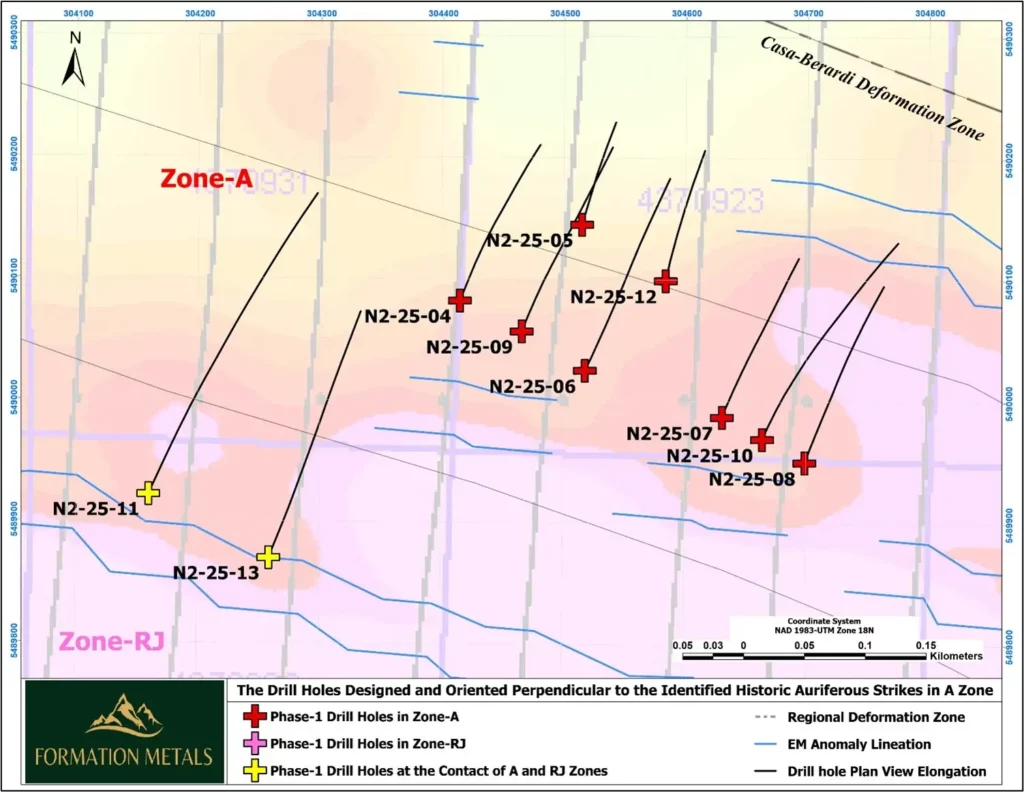

The previous phase of initial drilling focused on near-surface targets in the “A” and “RJ” zones. Formation Metals describes that the campaign has primarily addressed the first 300 meters in the vertical. The target definition is based on historical drilling data, which is said to contain gold-bearing intervals of up to 35 meters with 1.7 g/t gold in these areas. According to the company, the drill holes were designed to intersect the historically derived strike directions as perpendicularly as possible. The controlling elements cited are main deformation zones and electromagnetic conductivity anomalies that correlate with the targeted structures.

Particularly in the A-zone, Formation Metals highlights a recognizable correlation between the new drill holes and the surrounding historical boreholes – both in terms of lithological sequences and alteration and type of mineralization. The now expanded Phase 1 is intended to test further areas along the strike as well as larger gaps in the historical block model of the A-zone. The goal is to better delineate the spatial continuity of the mineralized zones and to create the basis for the next steps within the overall drilling campaign.

Formation Metals: Drilling Campaign Fully Funded

According to the company itself, Formation Metals has approximately CAD 12.3 million in working capital and no debt. The exploration budget for 2025/2026 is estimated at approximately CAD 8.1 million, which also includes provincial tax credits from Québec. Which means the drilling is fully funded.

With the expansion of Phase 1, Formation Metals is thus shifting the focus initially to a denser and further-reaching assessment of the described mineralized sections. Now we eagerly await to see to what extent the announced assays confirm the observed structures in terms of grade and continuity.