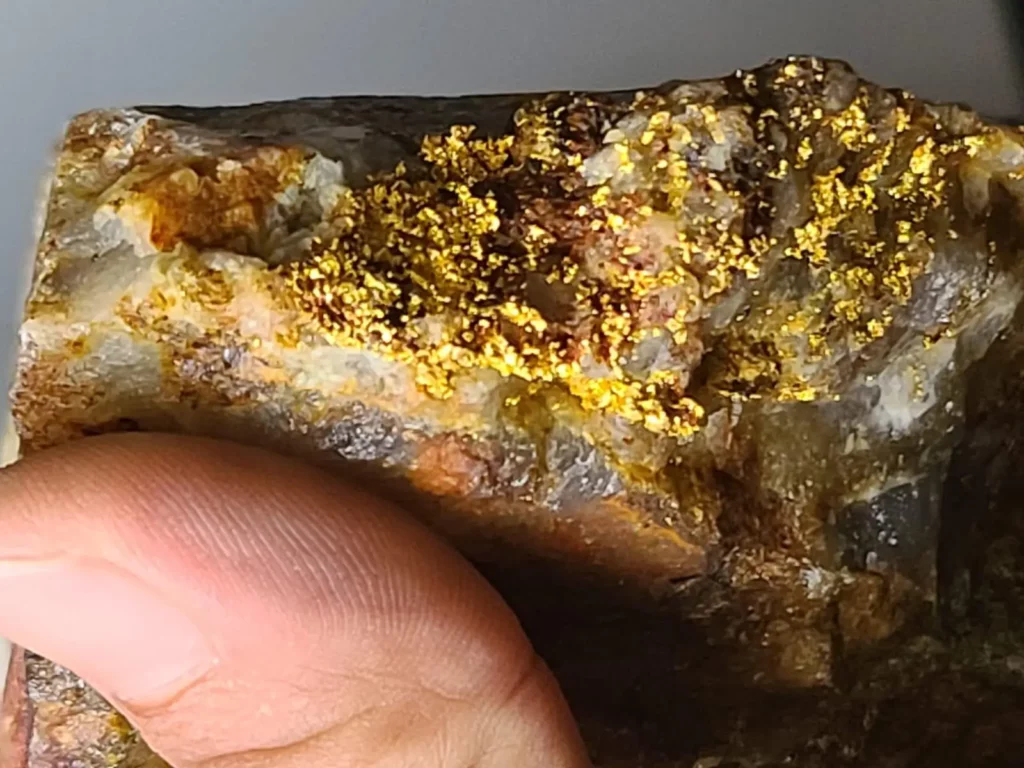

The gold price rose slightly on Tuesday morning, after gaining more than 2% in the previous session.

The precious metal continues to be supported by increasingly cautious expectations of the US Federal Reserve, following the release of weak US Purchasing Managers’ Index data for the manufacturing sector, which has heightened fears of an economic slowdown in the world’s largest economy and fueled expectations of an interest rate cut.

US intervention in Venezuela increases demand for safe-haven assets

Demand for safe-haven assets has also increased following the weekend’s events in Venezuela and subsequent comments from President Trump, which appeared to raise the prospect of similar military action in other countries in the region.

Against this backdrop, it is not surprising that gold prices are rising and have further upside potential. Nevertheless, traders are likely to remain cautious about building large long positions ahead of Friday’s US jobs data, which is likely to be crucial for expectations regarding the Fed’s future course.

Ricardo Evangelista – Senior Analyst, ActivTrades

About ActivTrades:

Founded in 2001, ActivTrades is an independent broker for Forex and Contracts for Difference (CFDs). From its headquarters in Luxembourg, ActivTrades serves a broad European client base, which has benefited for years from a comprehensive product offering, competitive spreads, continuous innovation, excellent technical infrastructure, and effective risk management. A negative balance protection for ActivTrades’ clients was already abolished in July 2013. ActivTrades places particular emphasis on intensive customer support and is available around the clock for this purpose.

Disclaimer:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. ActivTrades Europe SA, Public Limited Company, is authorized and regulated by the Commission de Surveillance du Secteur Financier (CSSF). ActivTrades Europe SA is registered in Luxembourg under number B232167.