As of: 2026-02-05 by Florian Grummes

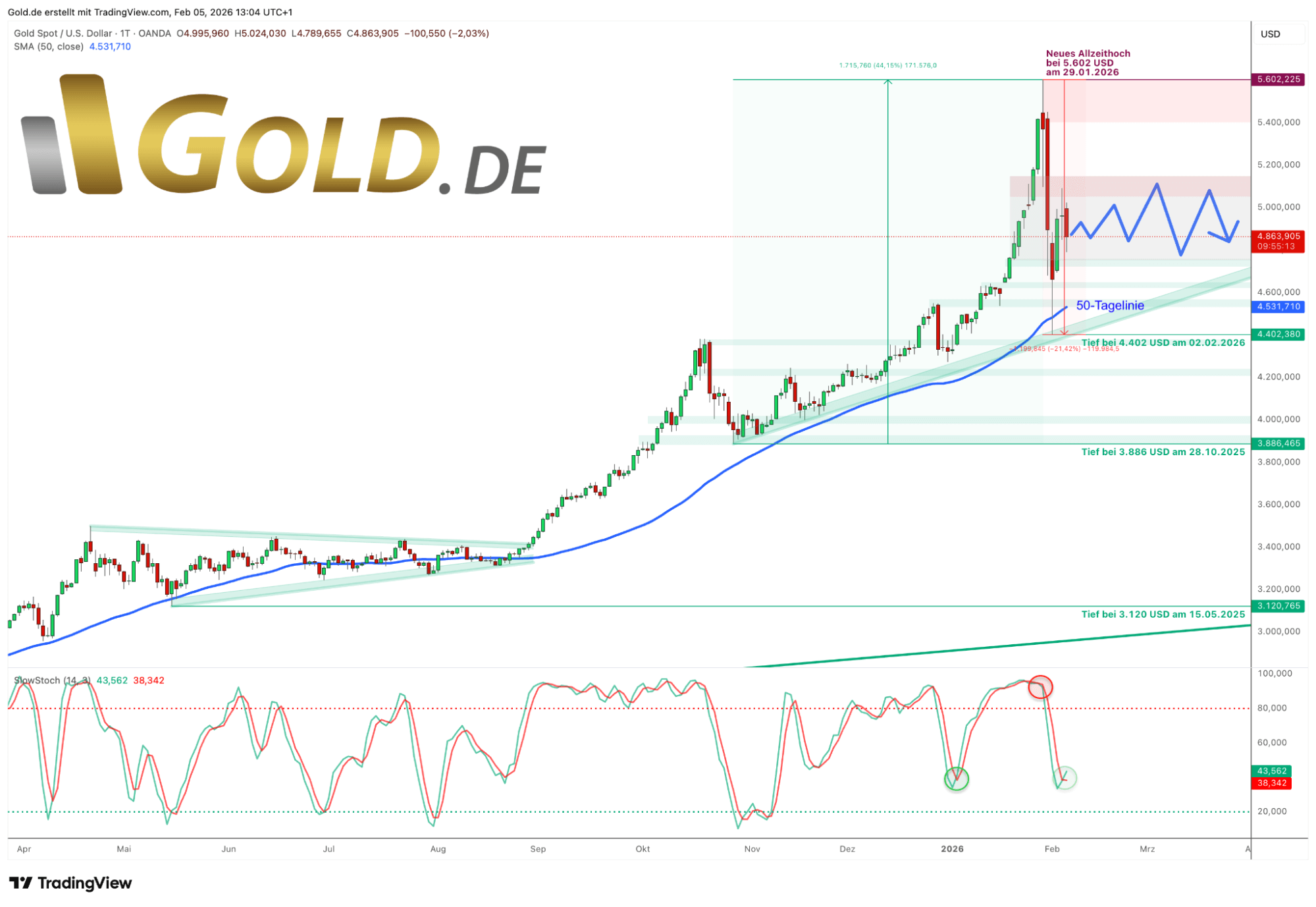

While precious metal prices surged in a euphoric mood until the middle of last week, a sharp correction surprisingly began on Thursday. Gold plummeted from $5,602 to $4,402, and silver even crashed by 41% from $121.47 to $71.35. Platinum lost approximately 35.5% over just under a week, falling from $2,882 to $1,858.

Correction Phase Without Structural Trend Change

After the strong price increases of recent weeks, such a sharp correction and sentiment cleansing (= ice-cold shower) was long overdue.

Even in a pronounced bull market, prices never move exclusively in a straight line upwards. In this case, completely exaggerated euphoria and a heavily overbought market situation met with profit-taking, increased margin requirements from COMEX and the Shanghai Gold Exchange, the expiration of the January contract, as well as obvious interventions by major Wall Street players.

Every major gold bull market experienced such painful interim corrections during its development, each time feeling like the end.

The 1974 correction – with a 47% decline – is an impressive example: almost half of the value was wiped out back then. Gold was declared dead. But in the following six years, the price rose by an incredible 790% from around $100 to $890 in January 1980. Against this backdrop, the current pullback of around 21% seems rather moderate and would not even be among the five largest corrections in the 1970s.

Crucially, however, nothing has changed regarding the fundamental drivers of this secular bull market. The economic and monetary policy frameworks will continue to force almost all governments and central banks worldwide to further expand or devalue their fiat money supplies. Global debt will continue to increase unchecked. Accordingly, Asian central banks, in particular, will continue to increase their gold holdings, as will Tether Holding.

After the sharp slump, gold and silver prices initially recovered significantly from their lows since Monday morning, before the bears went on the offensive again yesterday. While the silver price fell back almost to Monday’s low at $73.50, the gold price has so far proven significantly more resilient, currently trading at around $4,865, still somewhat within sight of the psychological mark of $5,000.

Gold – Wild Rollercoaster Ride Around the $5,000 Mark

From the last significant low of $3,886 on October 28, 2025, the gold price spectacularly climbed by 44% to a new all-time high of $5,594 in just under three months.

The sharp price drop to $4,400 since last Thursday allowed the bears to provisionally reclaim 70% of the previously lost ground. However, the overarching uptrend remains intact and would only begin to falter below $3,900.

As indicated two weeks ago, the pullback in the gold market has now closed two of the three open price gaps. Another gap lurks at $4,350, which could still be closed in the coming weeks if weakness persists.

However, the daily stochastic has already been cleared and has turned upwards again above the oversold zone, while the 50-day line (currently $4,531) has withstood the first stress test.

We therefore initially expect a wild consolidation (rollercoaster ride) around the psychological $5,000 mark to digest the strong price increases of recent weeks and the sharp pullback. Given the massacre in the silver market, such a consolidation could take several weeks or even months.

Conclusion: Gold – Healthy Correction within the Bull Market

The sharp correction in precious metal prices was overdue after the euphoria of recent weeks and serves as a necessary sentiment cleansing.

Historically, the decline in the gold price has so far been moderate. The silver market, however, has been hit much harder. Accordingly, the trend in the gold/silver ratio has turned, and gold should outperform silver for now.

At the same time, the gold price is holding up reasonably well. As long as visual contact with the $5,000 mark is not lost, everything points to a volatile sideways consolidation around this round mark in the coming weeks. Even closing the open price gap around $4,350 would not be a disaster. Danger would only be imminent below $3,900.

In summary, this brutal pullback does not mean the end. Rather, it likely simply ushered in a healthy and necessary pause in the largest gold cycle in decades. Stay invested and take advantage of buying opportunities on weak days.

As of: 2026-02-05

written by:

Florian Grummes

Technical Analyst, Precious Metals Expert