Exceptional pipeline of drill targets for 2024

After just a single season of targeted resource drilling (10,000 metres) at its Storm project on Somerset Island near the Northwest Passage in Nunavut, Canada, American West (ASX: AW1; FRA: R84) is already presenting its first near-surface resource, which management believes “lays the foundation for a globally significant new copper camp”.

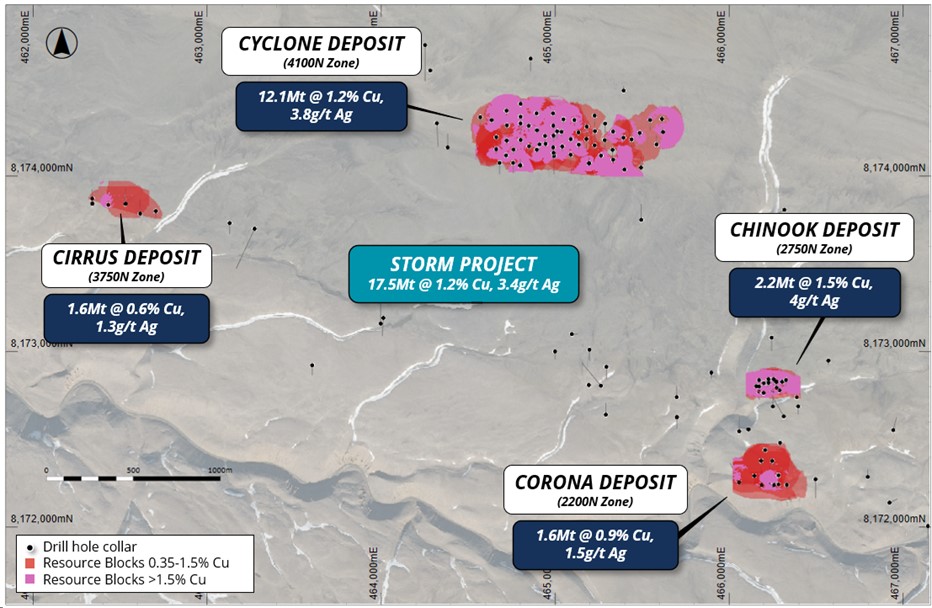

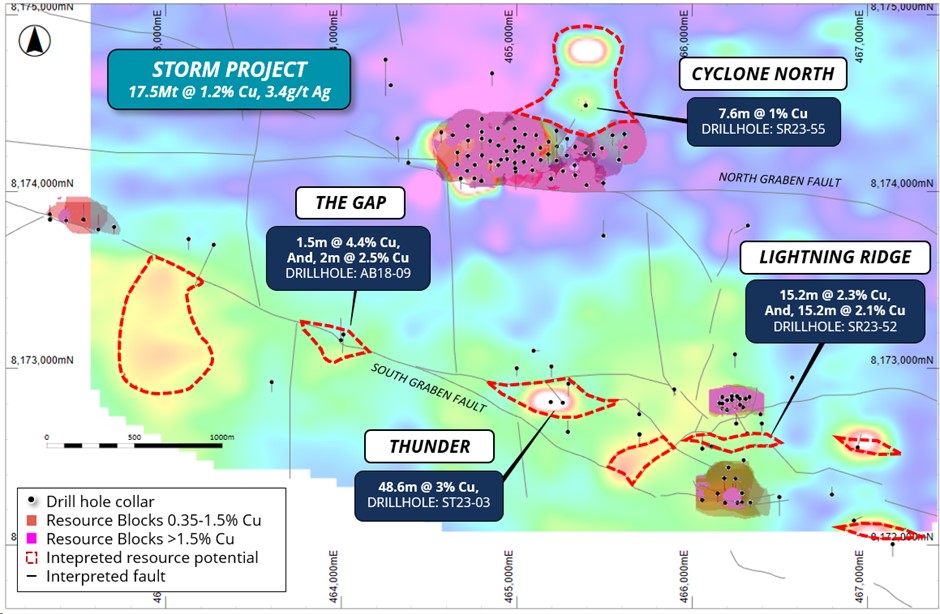

The first independent JORC 2012 estimate of Indicated and Inferred Mineral Resources (MRE) defines 17.5Mt at 1.2% Cu and 3.4g/t Ag (0.35% Cu cut-off) with a total metal content of 205Kt copper and 1.9Moz silver. Mineralisation starts at or very near surface and may be developed by open pit mining. 100% of the MRE is classified as fresh sulphide consisting predominantly of the copper mineral chalcocite. Preliminary studies indicate that low-cost processing, including direct shipping ore sorting, is possible.

The company sees exceptional growth potential at the Strom project, which is 80 per cent owned by American West. 20 per cent of the project and a 2 per cent royalty are owned by Aston Bay (TSXV: BAY; FRA: 6AY) of Canada. American West and Aston Bay are working together on a NI 43-101 compliant MRE for the Canadian market, which is also expected to be released shortly. The Storm resource is open in all directions, providing the potential for significant and rapid growth in 2024 and beyond.

Not included in the MRE are several high-grade copper discoveries made in 2023 at Thunder (48.6m @ 3% Cu in ST23-03), Lightning Ridge (15.2m @ 2.3% Cu and 15.2m @ 2.1% Cu in ST23-52) and Cyclone North (7.6m @ 1% Cu in ST23-55).

Storm is the size of a future world-class copper camp. Less than 5% of the 100km long prospective copper-bearing horizon within the project area has been drill tested to date, including the Tempest prospect where a 4km long copper-zinc gossan was identified at surface.

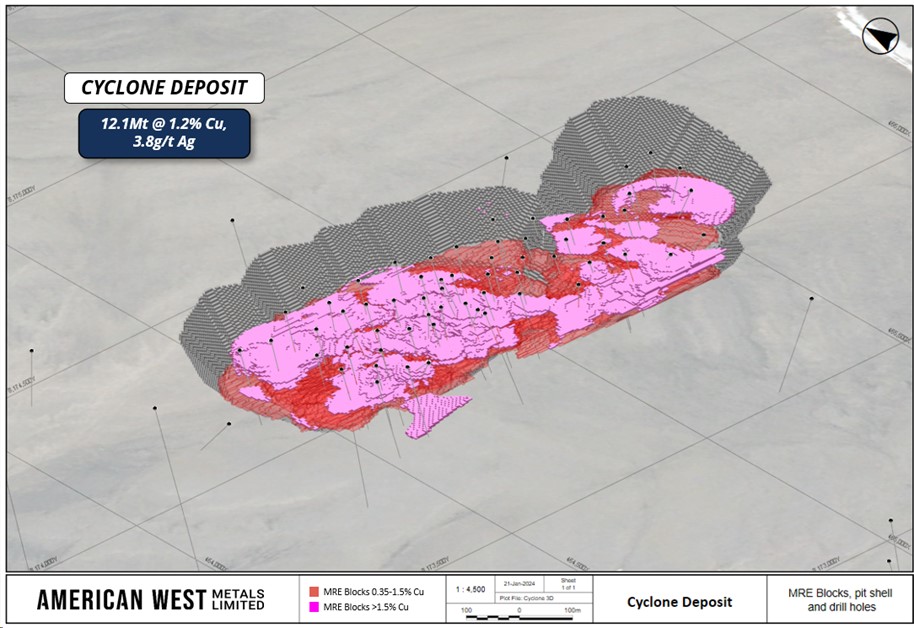

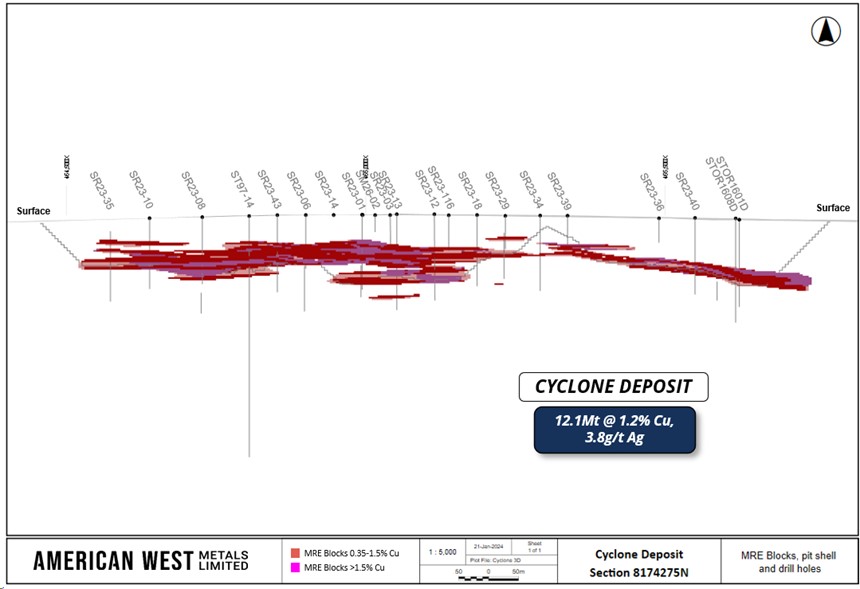

Mineral Resource Estimate (MRE) for the Storm project has exceeded our expectations and laid the foundation for what we believe is a globally significant copper district. We have rapidly defined four robust copper deposits at or very close to surface: Cyclone, Chinook, Corona and Cirrus. The location and size of the mineralisation gives us the opportunity to potentially mine 100% of the resource in open pit, using cut-off grades that are much lower than underground deposits. The result is more copper metal. The first resource has excellent and immediate growth potential. The known copper deposits remain open and the high-grade Thunder, Lightning Ridge and Cyclone North discoveries from 2023 are not yet included in the MRE.”

Possible open pit with potential for low-cost mechanical ore sorting

The Company has commenced mining and processing studies, which are a critical step in preparing future mine licence applications. The initial studies indicate that the deposits may be minable using conventional open pit mining methods due to the near-surface nature and favourable geometry of the Storm copper mineralisation. American West’s ongoing metallurgical studies have confirmed that the ores are amenable to a range of low-cost ore sorting and beneficiation methods with excellent copper recoveries.

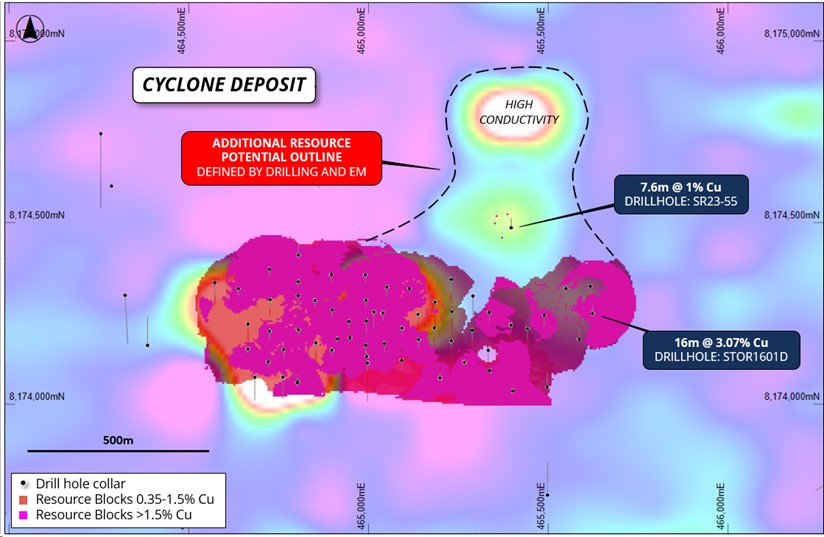

Cyclone North potential

Exploration drilling to the north of the Cyclone deposit (4100N zone) in 2023 intersected a thick interval of copper sulphide. Drill hole SR23-55 intersected a 24.4m thick interval of breccia and copper sulphide vein mineralisation, which is thought to occur in the same prospective horizon as the copper mineralisation at Cyclone. The mineralised zone contains a stronger sulphide breccia intercept of 7.6m of 1% Cu containing 1.5m of 2% Cu. The >2% copper mineralisation is interpreted to be the source of the EM anomalies.

Significantly, the untested FLEM anomaly, located over 300m north of drill hole SR23-55, has higher conductivity and may represent larger amounts of >2% copper mineralisation. These two anomalies cover an area of approximately 16 hectares and have the potential to host significant amounts of additional resources given the current size of the Cyclone deposit (12.1M tonnes at 1.2% Cu and 3.8M tonnes Ag).

American West believes there is significant potential to expand the MRE through further exploration in the Storm and regional areas. Four immediate opportunities have been defined for the expansion and addition of further resources at Storm, specifically the recently discovered high-grade Thunder and Lightning Ridge zones, Cyclone North and The Gap Prospect.

Exceptional pipeline of drill targets for 2024

Six significant, fault-related copper deposits and prospects (Chinook, Corona, Cirrus, Thunder, Lightning Ridge and The Gap) have been identified in the South Graben area alone. (Figure 6). All of these discoveries are at or near surface and have only been tested to a depth of approximately 100 vertical metres. In addition, a number of EM anomalies in the South Graben area have not yet been tested and have exceptional potential for the discovery of further high-grade copper mineralisation.

Exploration drilling in 2024 will aim to expand the search area deeper and along strike within the extensive fault zone of the South Rift area as well as test the existing high priority EM targets in the area.

Conclusion: The term "world class" should be used sparingly. But the term simply suggests itself in the case of American West's Storm project. The speed with which the company has drilled its first resource shows how well the underlying exploration model works. There is therefore much to suggest that American West could add further resources at the same pace in the coming drilling season. The near-surface nature, simple geometry and high copper grades of the Storm deposits favour an open pit mining scenario, particularly in the higher grade core of the MRE, which has 11.2 million tonnes at 1.5% Cu and 4.3 g/t Ag (cut-off grade of 0.7% Cu) with 173,000 tonnes of copper and 1.5 million ounces of silver. Such ore grades are exceptionally high for open-cast mines. Added to this is the favourable mineralogy which, according to initial tests, enables simple mechanical ore sorting without water, without chemicals and therefore without sulphide tailings. Such factors could make Storm's direct shipping copper concentrate a sought-after ESG raw ore in the future. At Storm, American West and Aston Bay have the unique opportunity to realise a low-threshold entry into copper mining with a particularly small (environmental) footprint. The capital required to start production with open pit mining and ore sorting is likely to be a fraction of what would be required to develop a high tonnage, low copper grade, chemical processing copper porphyry project, for example. At the same time, Storm still has the potential to become a globally significant mining camp. American West has only tested 5 per cent of its licence. The Storm project was owned by Teck's predecessor Cominco until 2007. In 2017, BHP ended an earn-in with Aston Bay after 2,000 metres of drilling. You can be sure that the aforementioned (and other large) companies are keeping a very close eye on developments near the North West Passage. American West is only at the beginning. The company could become the new star in the copper sky.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially with shares in the penny stock area, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

Pursuant to §34b WpHG (Securities Trading Act) and according to paragraph 48f (5) BörseG (Austrian Stock Exchange Act) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of American West Metals and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss American West Metals during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between American West Metals and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists.