Some spectacular results already in

Copper and gold explorer Abitibi Metals (CSE:AMQ; OTCQB:AMQFF; FSE:4KG) provides a prime example of the sudden resurgence of interest from resource investors, particularly in high-grade, open pit amenable copper deposits. The company has recently successfully completed its third consecutive placement since the end of last year. According to Abitibi, a further CAD 7.1 million in fresh capital will flow into the company’s coffers following the latest capital round. In line with the overwhelming demand from investors, the placement volume had to be gradually increased from CAD 3 million to CAD 5 million and finally to CAD 7.1 million.

Most of the money was raised in the form of so-called charity flow-through shares at $0.86 CAD. Just last December, Abitibi started to raise $4.37 million CAD at $0.30 CAD and brought prominent investor Frank Giustra on board, among others. This was followed at the end of December last year by a further capital round of CAD 10 million (at $ 0.70 CAD flow through). In total, the company has raised around CAD 21.8 million in the past 4 months. The company is therefore fully financed until 2025. With the exception of a few finders’ warrants, no warrants were issued in any round! We haven’t seen anything like this with Resource Juniors for a long time.

Pivotal Moment for Abitibi Metals

Jonathon Deluce, Chief Executive Officer of Abitibi Metals, stated, “The successful completion of this offering represents a pivotal moment for Abitibi as we are now in a position to fully finalise the option agreements at our B26 and Beschefer projects. With a cash balance of C$19 million, Abitibi is now in a position to embark on the most aggressive drilling programme in its history. The start of 2024 marks the beginning of a bull market for gold and copper, allowing high-grade projects like ours to flourish.”

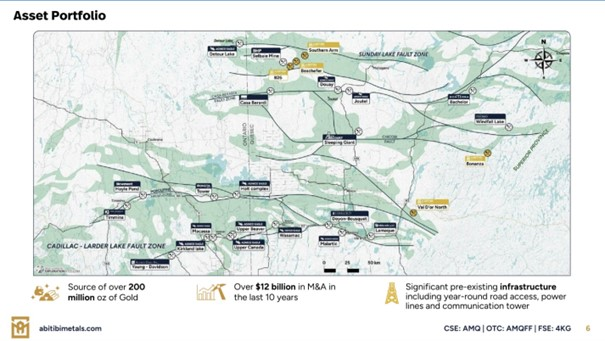

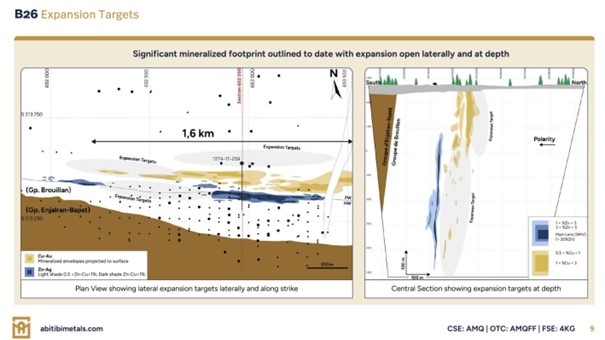

Abitibi Metals is planning 40,000 metres of drilling on both the B26 and Beschefer projects in the world-renowned Abitibi mining camp in Quebec by the end of 2024. The company can draw on the wealth of data from 115,311 metres of historical drilling that was drilled to delineate the open pit potential of the B26 deposit. At the same time, the company intends to further develop and expand the existing underground resource to ultimately deliver a robust economic, high-grade copper resource. Drilling has been underway since January and has already delivered some spectacular results. In February, Abitibi reported a 10.6 metre drill intercept of 11.4% CuEq within a 34 metre interval of 4.1% CuEq near the surface of the B26 deposit. This was followed at the end of March by a 61.3 metre 2.5% CuEq drill interval, also near the surface of B26.

Conclusion: With the high-grade near-surface results reported to date, Abitibi Metals’ B26 project is one of a small elite of high-grade polymetallic deposits, that are at least partially amenable to open pit mining. Abitibi Metals’ vision is to establish a diversified metals company in Quebec. The historical resource estimate from 2018 indicated 6.97 Mt at 2.94% Cu Eq (1.32% Cu, 1.80% Zn, 0.60 g/t Au and 43 g/t Ag) in the Indicated category and a further 4.41 Mt at 2.97% Cu Eq (2.03% Cu, 0.22% Zn, 1.07 g/t Au and 9 g/t Ag) in the Inferred category after 115,000 metres of drilling. The Company is therefore starting with a significant head start resource comprising 400 million pounds of copper, 286,000 ounces of gold and a significant zinc and silver deposit in all categories. Abitibi is targeting an economic PEA with a defined high-grade copper resource of at least 20 to 30 million tonnes. This would represent a doubling or tripling of the historical resource. A high-grade polymetallic project of this size is likely to be a highly sought-after asset in the Abitibi Camp. In the past 10 years alone, the M&A volume there totalled $12 billion CAD. This may also explain current investor’s interest.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Abitibi Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Abitibi Metals for reporting on the company. This is another clear conflict of interest.