{kanada_flagge}It’s a pretty good start when your neighbor is Barrick Gold (TSE: ABX; NYSE: GOLD) and, on top of that, is a nearly five percent shareholder. Tembo Gold Corp. (TSX-V: TEM; FSE: T23), the only remaining gold junior in Tanzania, benefits not only from its proximity to Barrick’s 20 million ounce Bulyanhulu mine, but more specifically from the work of Barrick’s “Buly Team” in advancing the exploration of those licenses that Barrick finally acquired from Tembo Gold in April of this year for $6 million.

{kanada_flagge}It’s a pretty good start when your neighbor is Barrick Gold (TSE: ABX; NYSE: GOLD) and, on top of that, is a nearly five percent shareholder. Tembo Gold Corp. (TSX-V: TEM; FSE: T23), the only remaining gold junior in Tanzania, benefits not only from its proximity to Barrick’s 20 million ounce Bulyanhulu mine, but more specifically from the work of Barrick’s “Buly Team” in advancing the exploration of those licenses that Barrick finally acquired from Tembo Gold in April of this year for $6 million.

At the time of purchase, Barrick had also committed to invest $9 million over four years in exploration of the freshly acquired licenses, which fully enclose the Tembo project. Tembo would benefit massively from an exploration success by Barrick: for the first five million ounces Barrick finds, Tembo would receive staged payments of up to USD 45 million. For now, Tembo not only has the right to be informed of Barrick’s progress, but in turn is allowed to publish Barrick’s quarterly reports. The first of these Barrick quarterly reports is now available.

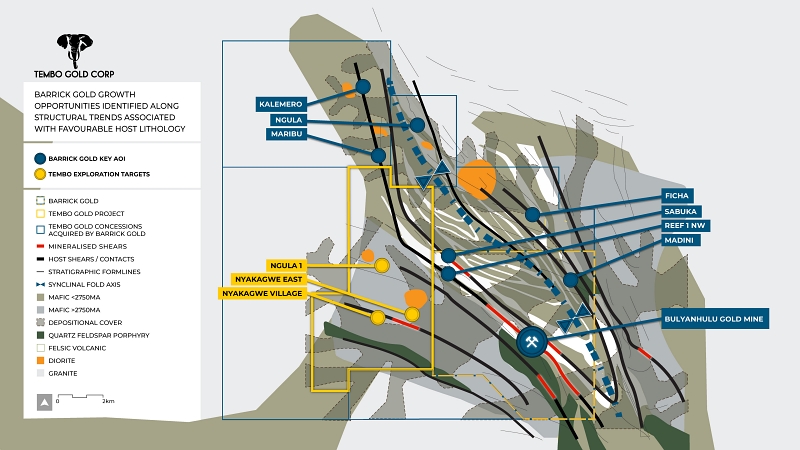

Barrick’s exploration team (“the Buly team”) has completed preliminary reconnaissance mapping and produced a remarkable geological model showing the suspected path of major structures (see Figure 1). The work has confirmed the high-grade potential of the tenements. Samples from quartz veins as well as from artisanal dumps returned gold grades of 39.5 g/t Au and 38.7 g/t Au, as well as numerous variable and low-grade grades up to 1.5 g/t.

Figure 1: A map says more than a thousand words. Starting from the Bulyanhulu Mine, the new map by Barrick geologists shows in black the major geological structures along the so-called Buly Trend. These major structures run in a northwesterly direction partly through the middle of Tembo Gold’s property (license boundary marked in yellow). Barrick geologists have marked each of the best targets with an orange star. Such stars are found on the southeast boundary of the Tembo license as well as immediately to the north of the property boundary.

According to Barrick geologists, the extensive alluvium in particular offers “near-surface discovery potential.” The team next plans to conduct geophysical and geochemical drilling to test the locations that could not be covered by satellite. The Buly team has also visited Tembo’s camp and drill core storage facility and self-reviewed some of the recent core drilling conducted by Tembo. In addition, the Buly team has inspected artisanal activities within the Tembo license that may assist in locating targets within Buly’s license area.

Hendrik Meiring, Exploration Manager at Tembo, commented, “It’s great to see exploration activity on Barrick’s adjacent licenses and Tembo’s activity on our PL, and we look forward to a good working relationship with the Buly team.”

David Scott, President & CEO of Tembo, stated, “We are pleased to see exploration moving forward on Tembo’s properties acquired from Barrick and eagerly await the commencement of drilling. The increased local mining activity on all concessions is an encouragement to our exploration efforts and supports Tembo’s commitment to advancing the project through ongoing targeted diamond drilling. Our goal is to rapidly delineate one or more gold resources.”

Tembo Gold holds a 100% interest in the eponymous Tembo Gold Project and has already drilled over 40,000 meters of holes at the project between 2012 and 2014. The 2022 season saw the first drilling of an additional 7,000 meters after an eight-year hiatus. About half of the results are still pending. Both Tembo CEO David Scott and exploration manager Hendrig Meiring have many years of personal experience at Bulyanhulu itself. David Scott has been following the Tembo project for more than a decade.

Bottom line: the new geological map from Barrick Gold’s Buly team already tells the whole story. Some of the most promising large-scale geological structures extend northwest from the Bulyanhulu Mine directly across the Tembo license. Both to the north and to the southeast boundary of the Tembo license, Barrick geologists have identified high priority targets. It speaks to the open partnership that Barrick is openly sharing these findings, as it would be easy to imagine its large neighbor keeping its findings to itself. Barrick CEO Mark makes no secret of his enthusiasm for Tembo. With its strategic stake in Tembo, Barrick has created a “beachhead,” he let it be known in a recent interview. The block of shares guarantees that Barrick will at least be first in line if Tembo makes a major discovery. Excerpts of the interview with Mark Bristow can be found at the following link: https://goldinvest.de/videos/video/1078-barrick-gold-nyse-gold-ceo-mark-bristow-on-tembo-gold-cve-tem-partnership-in-tanzania

Furthermore, just last weekend, at the precious metals conference in Munich, Goldinvest.de conducted an interview with Tembo CEO David Scott, in which he in detail explained the cooperation with industry giant Barrick:

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH may hold shares of Tembo Gold and therefore a conflict of interest may exist. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time, which could affect the price of Tembo Gold Corp. shares. In addition, a consulting or other service contract exists between Tembo Gold Corp. and GOLDINVEST Consulting GmbH, with which a further conflict of interest exists, since Tembo Gold Corp. remunerates GOLDINVEST Consulting GmbH for reporting on Tembo Gold Corp.