Potential for short-term value add

While the gold price is once again rushing from record high to record high, Canada’s Brixton Metals (TSXV BBB / WKN A114WV) keeps presenting strong drill results from its Trapper gold target time and again. Trapper is part of the huge Thorn project in the northwest of the Canadian province of British Columbia.

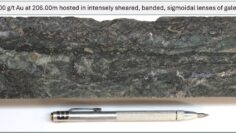

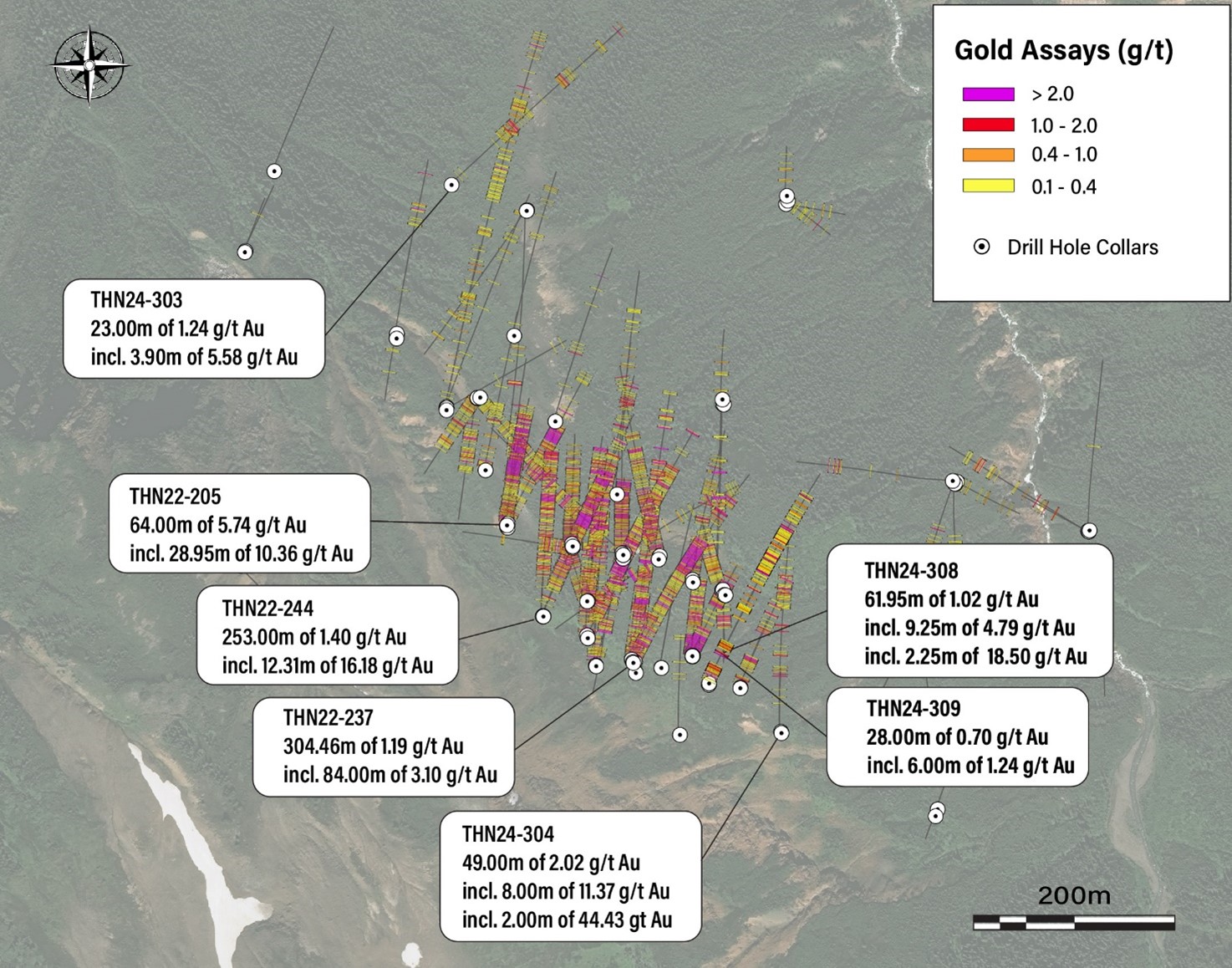

And the results of the two drill holes now presented are impressive! Drill hole THN24-308 returned a massive 61.95 meters of 1.02 g/t gold from only 184.75 meters depth within 77.25 meters of 0.9 g/t gold. Brixton also announced that this included high-grade intercepts of 9.25 meters of 4.79 g/t gold and 2.25 meters of 18.50 g/t gold!

In addition, drill hole THN24-309 intersected 28 meters of 0.70 g/t gold, including 6 meters of 1.24 g/t gold. Furthermore the company stated that the precious metal occurs as native gold, and is associated with base metals such as galena, sphalerite, chalcopyrite, quartz carbonate and pyrite.

Christina Anstey, responsible for exploration at Brixton, is delighted with the latest results from Trapper as they not only show encouraging gold grades, but also fit well with the company’s exploration model for the gold target. These results further expand the company’s understanding of the mineralization in the area, and in turn supports the company’s strategy to leverage Trapper’s potential with further drilling.

On the trail of the Lawless fault zone

Brixton has completed a total of 2,745.6 meters of drilling across eleven diamond core holes (762 meters of which are discussed in today’s announcement) to determine the extent and continuity of the main mineralized corridor along the Lawless mineralized zone with both definition and extension drilling. In addition, extension drilling has been undertaken to the north of the main mineralized zone where the Company is testing mineralized zones discovered in 2023 that are covered by overburden. Not all results from the program are yet available, and Brixton will of course present further results as soon as they become available.

Both holes hit thick gold mineralization intercepts near surface

As reported today, Brixton drilled THN24-308 and THN24-309 from the same location, primarily to confirm grade continuity between previously reported holes THN22-251 and THN22-239 from 2022. And both holes succeeded in detecting wide intercepts of gold mineralization near surface as shown above.

In addition, Brixton drilled hole THN24-306 from the same location as previously drilled THN24-304 – 227.50 meters of 0.50 g/t gold, including 27 meters of 3.49 g/t gold – but chose a steeper dip to test the extent of mineralization to the southeast along the Lawless Fault. However, hole 306, which was drilled 65m into the footwall of the Lawless Fault, did not return any significant intersections of mineralization. However, given the thick intercept from hole 304, the potential for a later extension along the hanging wall of the main mineralized structure to the east is still seen.

Plenty of potential to uncover new zone of gold-bearing mineralization

To date, Brixton’s geologists understand that the gold mineralization at Trapper is structurally controlled along the Lawless Fault, trending northwest to southeast and dipping gently to the north in the area where most of the drilling has occurred. In addition, numerous CVG features occur that may represent similar, parallel structures to the Lawless Fault and could still be tested for new gold potential. Brixton intends to use a combination of oriented core drilling, surface mapping, geochemistry and geophysics to achieve predictability of the gold bearing zones.

Trapper appears on surface as a 4 kilometer long, northwest trending gold and zinc geochemical anomaly in soil that is part of the larger, 11 kilometers long gold geochemical anomaly that runs from the Camp Creek copper porphyry target to the Trapper gold target. Future drilling will focus on identifying new zones of gold-bearing mineralization under cover along this major gold geochemical anomaly.

This prolific, district-scale Thorn project offers no shortage of targets, and Brixton’s CEO, Gary Thompson recognizes that the Trapper gold target, in a buoyant gold market, could offer a short-term value add for shareholders and investors. The recent drilling success at Trapper warrants more work to be done at this prolific target.

Newsletter Anmeldung

Risikohinweis: Die GOLDINVEST Consulting GmbH bietet Redakteuren, Agenturen und Unternehmen die Möglichkeit, Kommentare, Analysen und Nachrichten auf https://www.goldinvest.de zu veröffentlichen. Diese Inhalte dienen ausschließlich der Information der Leser und stellen keine wie immer geartete Handlungsaufforderung dar, weder explizit noch implizit sind sie als Zusicherung etwaiger Kursentwicklungen zu verstehen. Des Weiteren ersetzten sie in keinster Weise eine individuelle fachkundige Anlageberatung, es handelt sich vielmehr um werbliche / journalistische Veröffentlichungen. Leser, die aufgrund der hier angebotenen Informationen Anlageentscheidungen treffen bzw. Transaktionen durchführen, handeln vollständig auf eigene Gefahr. Der Erwerb von Wertpapieren birgt, gerade bei Aktien im Penny Stock-Bereich, hohe Risiken, die bis zum Totalverlust des eingesetzten Kapitals führen können. Die GOLDINVEST Consulting GmbH und ihre Autoren schließen jedwede Haftung für Vermögensschäden oder die inhaltliche Garantie für Aktualität, Richtigkeit, Angemessenheit und Vollständigkeit der hier angebotenen Artikel ausdrücklich aus. Bitte beachten Sie auch unsere Nutzungshinweise.

Gemäß §34b WpHG i (Deutschland) und gemäß Paragraph 48f Absatz 5 BörseG (Österreich) möchten wir darauf hinweisen, dass Auftraggeber, Partner, Autoren und Mitarbeiter der GOLDINVEST Consulting GmbH Aktien von Brixton Metals halten oder halten können und somit ein möglicher Interessenskonflikt besteht. Wir können außerdem nicht ausschließen, dass andere Börsenbriefe, Medien oder Research-Firmen die von uns empfohlenen Werte im gleichen Zeitraum besprechen. Daher kann es in diesem Zeitraum zur symmetrischen Informations- und Meinungsgenerierung kommen. Ferner besteht ein Beratungs- oder sonstiger Dienstleistungsvertrag zwischen Brixton Metals und der GOLDINVEST Consulting GmbH, womit ein Interessenkonflikt gegeben ist.