Initial exploration success has already been achieved

Portofino Resources (TSX.V: POR, FSE: POTA, WKN: A2PBJT) and Lithium Chile will form a 50:50 joint venture in the form of a net equity partnership for the 8,445-hectare Arizaro salar in Argentina after winning the tender. Within this joint venture, the Salar, located in the province of Salta, will subsequently be jointly developed.

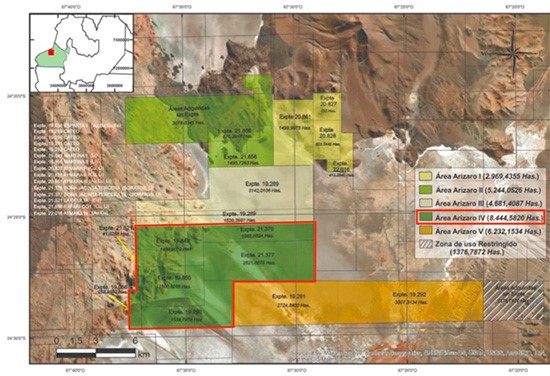

Previously, Portofino Resources and Lithium Chile had submitted separate bids for a total of five concession areas in the province of Salta. Within the five concessions, Arizaro IV is the largest property. A final joint venture agreement, yet to be finalised, will include an offer of US$16.7 million, with the first payment of US$5,739,915 already made by Lithium Chile and the balance due within twelve months.

Portofino has committed to a 50 per cent payment once short term financing is finalised. The company has received strong expressions of interest for financing from several Canadian institutions, so this can be considered largely unproblematic.

The partnership agreement includes a 50/50 allocation of net equity to Portofino Resources and Lithium Chile, including pro-rata responsibility for acquisition costs and future exploration expenditures. The agreement will include a credit to Portofino in respect of certain exploration expenditures incurred during due diligence.

Map of the Arizaro Salar, Source: Portofino Resources

Initial exploration successes have already been achieved

In cooperation with REMSa, the state mining company of the province of Salta, Portofino Resources had carried out a comprehensive geological due diligence on Arizaro Area IV prior to the tender. The exploration work on the surface uncovered a thick overburden. Notwithstanding this lithium-shielding crust, surface samples returned lithium grades of up to 100 milligrams per litre, consistent with surface results from other groups exploring this mature salar.

Portofino Resources’ exploration activities included over 40 surface brine samples collected and analysed, 35 trenches using trenching equipment to reach the water table and a 69,000 metre geophysical survey using Vertical Electric Soundings technology. It uncovered aquifers down to a depth of 1,000 metres. Low resistivity horizons were also identified and interpreted as targets that may contain large lithium-bearing aquifers.

Further work to follow shortly

The companies now intend to submit the necessary environmental and drilling applications to commence the recommended 4-hole, 2,000 metre drill programme as soon as possible.

David Tafel, President and CEO of Portofino Resources was pleased with the new partnership and commented: “The exploration knowledge Portofino has gained through initial concession identification and foresight coupled with geological due diligence by our expert-led geological team has given us insight into what appears to be a very deep aquifer. Coupled with Lithium Chile’s exploration successes and infrastructure immediately to the south, the partnership can move forward quickly. This is a win-win for both companies, a partnership that is strongly supported by the Argentine authorities, and we look forward to commencing drilling as soon as possible.”

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on http://www.goldinvest.de. This content is intended solely for the information of readers and does not represent any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company mentioned and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested, particularly in the case of small-cap companies with a narrow market, which are frequently reported on Goldinvest.de. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee of the topicality, correctness, appropriateness and completeness of the content of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares of Silver Storm Mining and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time, which may influence the company’s share price. In addition, there is a contractual relationship between Silver Storm Mining and GOLDINVEST Consulting GmbH, which involves GOLDINVEST Consulting GmbH reporting on Silver Storm Mining. This is another clear conflict of interest.