Better surveying equipment will allow looking deeper into the ground

Portofino Resources (TSX.V: POR, FSE: POTA, WKN: A2PBJT) has received confirmation from the Ministry of Mines of the Argentine province of Catamarca that it has been registered as 100% owner of the lithium concessions at the Yergo project as of 31 October 2023. Meanwhile, preparations for the new drill programme are in full swing.

Prior to receiving confirmation of full transfer of ownership from the Ministry of Mines, the Ministry had already sent Portofino Resources a request for information as part of the amended permit application. The technical response to this request is being prepared by the company’s geological team, already.

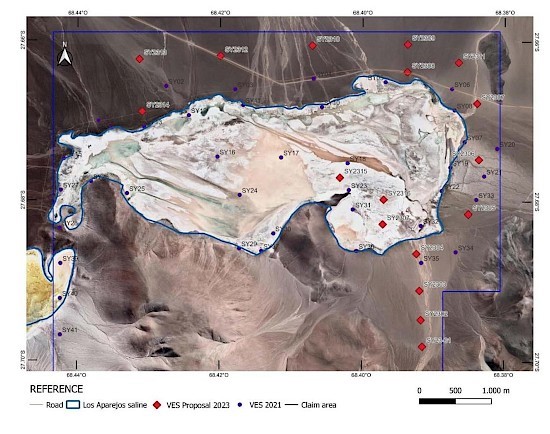

In addition, the Portofino Resources team has identified opportunities to expand the previously identified geological targets at surface and underground. To this end, a pre-drilling programme has been developed. It is designed to expand both the previous surface sampling and geophysical survey programmes.

Better surveying equipment will allow Portofino to look into greater depths

Geophysical survey equipment capable of identifying potentially lithium-bearing aquifers to depths of 500 to 600 metres will soon be in use. This is a considerable improvement, because the equipment used so far could only carry out the surveys to a depth of about 100 metres. Both exploration programmes in preparation for drilling are scheduled to begin in November.

Portofino Resources CEO David Tafel commented, “Although our previous surface sampling in 2021 was very successful, the programme was conducted during an unusually wet period, potentially diluting the brine samples. Our technical team believes that sampling during the current dry period should be more representative of actual (higher) surface grades. In addition, our team believes that the use of the improved VES geophysical survey equipment could significantly expand the size of the underlying brine aquifers.”

Source: Portofino Resources

Portofino Resources stock to become more liquid

Portofino Resources has appointed Integral Wealth Securities Limited as market maker for three months with effect from 1 November 2023. Thereafter, the contract may be renewed on a monthly basis. This is expected to further improve the tradability of Portofino’s shares through the liquidity provided by the broker. In return for the services provided by Integral, a monthly cash fee of 10,000 Canadian dollars (CAD) will be payable.

Portofino Resources has also applied to the TSX Venture Exchange for a one-year extension of 6,305,000 warrants to purchase common shares. Normally, the warrants would have expired on 09 November 2023. The warrants entitle the holder to acquire common shares of the company at a price of CAD 0.15 per share and were issued in November 2020 in a private placement consisting of 6,305,000 common share units at a price of CAD 0.10 per unit.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Portofino Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Under certain circumstances this can influence the respective share price of the company. GOLDINVEST Consulting GmbH currently has a contractual relationship with the company, which is reported on the website of GOLDINVEST Consulting GmbH as well as in the social media, on partner sites or in email messages, which also represents a conflict of interest. The above references to existing conflicts of interest apply to all types and forms of publication used by GOLDINVEST Consulting GmbH for publications on Portofino Resources. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. No guarantee can be given for the correctness of the prices mentioned in the publication.