Can the Barkerville success be repeated with GCC?

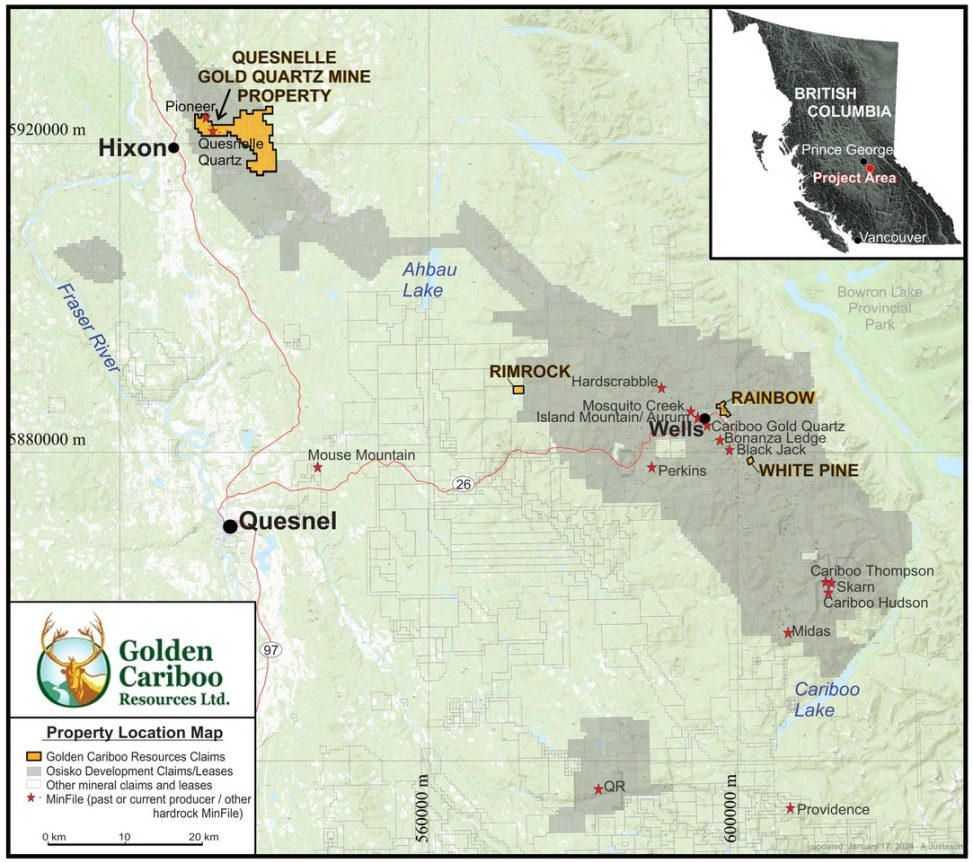

Play it again, Frank. James Francis Gerard Callaghan, “Frank”, one of the best-known serial entrepreneurs in the North American exploration industry, wants to do it again. Around five years ago his successful gold company Barkerville Gold Mines was taken over by Osisko Royalties for $330 million. At that time, the price of gold was around USD 1,500 per ounce. With the tailwind of now more than USD 2,300 per ounce of gold, Callaghan is now starting up again with his new vehicle Golden Cariboo Resources (CSE: GCC, OTC: GCCFF), again in British Columbia and even in the geological neighborhood of Barkerville. In fact, the Brownfileld-Quesnelle gold-quartz mine project (“QGQ”) near Hixon, BC, is almost completely surrounded by Osisko Development Corp.!

Golden Cariboo not only wants to build on the success of Barkerville, but is also taking a big step back in history with its exploration thesis. The company name “Golden Cariboo” is a reminder of the Cariboo gold rush of the 1860s. From today’s perspective, the exciting thing about the QGQ project is not just the historically proven gold production, but the hypothesis that the root of the gold deposits presumably lies in a greenstone contact that has never been explored using modern exploration methods. In the past, over 101 gold placer creeks have been mined along the 90 km trend from the Cariboo Hudson mine north to the Quesnelle gold quartz mine and successful placer mining continues to this day.

Figure 1: The Quesnelle Gold Quartz Mine property is almost completely encircled by Osisko Development

Golden Cariboo has recently commenced drilling at its Quesnelle gold-quartz mine project near Hixon, BC. The first diamond drill hole (QGQ24-05) of the 2024 drill program has just been completed. The Company has a 5-year exploration permit with authorization to drill 270 surface diamond drill holes on 54 drill pads.

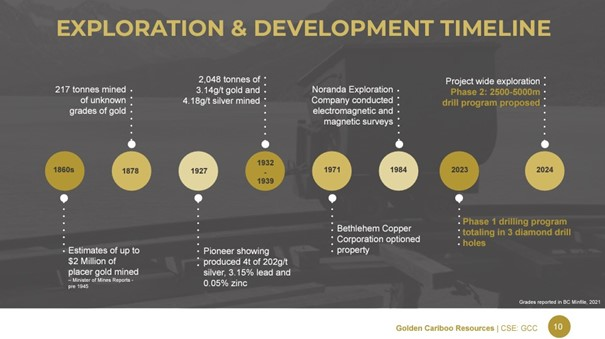

The property covers the Quesnelle quartz-gold-silver deposit, which was discovered in 1865 in association with placer mining activities. Hixon Creek, which intersects the Quesnelle Gold-Quartz Mine property, is a placer creek where small-scale placer production was conducted. The property includes the Quesnel quartz-gold-silver deposit, which was discovered in 1865 in association with placer mining activities and produced 2,048 tons grading 3.14 g/t Au and 4.18 g/t Ag in 1932 and 1939, with an additional 217 tons of unknown grade reported in 1878. Hixon Creek, which intersects the Hixon Gold Claims, is a placer creek that has seen limited placer production since the mid-1860s. Annual reports from the Minister of Mines prior to 1945 indicate that up to $2,000,000 worth of gold was mined from Hixon Creek.

Figure 2: The QGQ project has a long history. There has been no exploration for more than 40 years. Since then, the technologies and the underlying geological understanding have developed enormously. Golden Cariboo is the first company to utilize these capabilities.

Golden Cariboo operates in two shifts and drills approximately 100 meters per day under optimal conditions. Hole QGQ24-05 was drilled over 321 metres from the same drill pad as QGQ23-04 to target the greenstone-pyllite contact northwest of QGQ23-04 and possible mineralization on the west side of the contact. Logging and sampling of QGQ24-05 is underway with more than half completed to date. Samples are regularly sent to the lab for analysis. The drill rig is currently being mobilized again to begin drilling QGQ24-06. 122 samples have been sent to ALS Geochemistry in North Vancouver, BC for analysis. Results are pending.

The Company’s President and CEO, Frank Callaghan, commented: “We are pleased to have commenced our 2024 drilling campaign. I anticipate that we have an exciting time ahead as our exploration and management teams strive to bring our third mine in British Columbia into production. Our Cariboo gold project was acquired by Osisko Royalties for $330 million. The now producing mine is now owned by Osisko Development. We believe the QGQ project offers the opportunity to repeat our success with Barkerville.”

Conclusion: Barkerville Gold has made its shareholders rich because Frank Callaghan resisted the temptation to sell early. Today, five years after the sale and after several hundred million dollars of investment by the buyer Osisko, the Cariboo gold project is at an advanced stage. The Cariboo Gold Project Feasibility Study, released in early 2023, outlined a robust and scalable underground operation expected to produce approximately 1.87 million ounces of gold over a 12-year mine life. At the time, a discounted net present value (NPV) after tax of C$502 million was calculated, based on a gold price of US$1,700 per ounce. The higher gold price is likely to have made the project considerably more valuable for Osisko Development in the meantime. The reference to the current Osisko project is only intended to give an indication of the “size of the price” that Frank Callaghan is chasing after at Golden Cariboo Resources. An important factor for future success is likely to be whether the company succeeds in structurally linking the high-grade mineralization with the presumed greenstone contact. This would allow for efficient exploration along a several kilometer long trend. We look forward to following Golden Cariboo here at Goldinvest and would like to encourage Frank: “Play it again!”

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on https://www.goldinvest.de. This content is intended solely for the information of readers and does not represent any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, they are in no way a substitute for individual expert investment advice; rather, they are advertising/journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially in the case of penny stocks, involves high risks that can lead to the total loss of the capital invested. GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete. Please also note our terms of use.

In accordance with §34b WpHG (Securities Trading Act) and Section 48f (5) BörseG (Austrian Stock Exchange Act), we would like to point out that clients, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares in Golden Carbiboo Resources and therefore a possible conflict of interest exists. Furthermore, we cannot rule out the possibility that other market letters, media or research companies may discuss the stocks we recommend during the same period. This may result in the symmetrical generation of information and opinions during this period. Furthermore, there is a consulting or other service agreement between Golden Carbiboo Resources and GOLDINVEST Consulting GmbH, which constitutes a conflict of interest.