{kanada_flagge} Largely unnoticed by the general public, rhodium has been beating gold’s performance for a long time and by a wide margin: in the past five years, rhodium, considered the “most precious of the platinum metals,” has increased in price by a staggering 4,000 percent. The economic effect for platinum producers is now immense, although rhodium is still a pure by-product in terms of volume, often mined at grades of less than 0.1 g/t. Among the market-leading platinum producers in South Africa, it is estimated that rhodium already accounts for 40 percent of sales, with just 8 percent of output. That was the reason for Group Ten Metals Inc. (TSX.V: PGE; FRA: 5D32) to thoroughly investigate the rhodium grades at its PGE Ni-Cu-Co + Au Stillwater West project in Montana, USA. In total, Group Ten plans to re-assay 4,000 drill cores from various parts of the deposit. Today, the company presented a first interim report of its analyses.

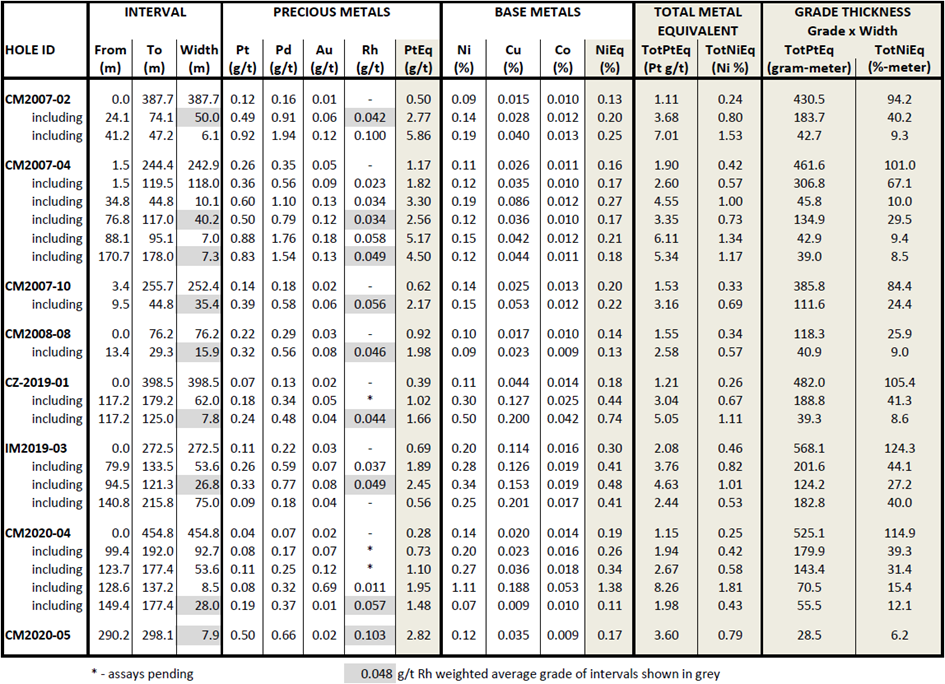

The results give hope that rhodium could also become a significant economic factor for Group Ten’s Stillwater project. This is not entirely unexpected, as Sibanye-Stillwater’s mine, which is directly adjacent to Group Ten’s Stillwater West project, has been the most important US producer of rhodium to date. Group Ten’s work to date has confirmed widespread rhodium with potentially significant co-product grades of 0.03 to 0.1 g/t Rh in all three advanced areas, Chrome Mountain, Camp and Iron Mountain, with shorter intercepts as high as 0.5 g/t Rh. At current spot price of $27,000USD, 0.1 g/t Rh is equivalent to 2.17 g/t platinum equivalent and even at its three-year trailing average price around $8500USD, it equates to 0.71 g/t pt. The weighted average grade of 0.048 g/t Rh from the intercepts highlighted in Table 1 is equivalent to over 1 g/t platinum equivalent, which would definitely have a meaningful impact on the overall resource picture.

Table 1: Selected rhodium drill results from the Chrome Mountain, Camp and Iron Mountain advanced targets, Stillwater West PGE-Ni-Cu-Co + Au project, Montana USA.

Previous work previously reported by Group Ten returned surface sample results of up to 5.78 g/t Rh on the HGR target in the Iron Mountain area and 1.07 g/t Rh on Chrome Mountain in rock samples. Additional results from historical assays also indicate the potential for iridium, osmium and rubidium, which commonly co-occur with platinum, palladium and rhodium at Stillwater West.

Michael Rowley, President and CEO, stated, “We are very pleased with these results from the first phase of our rhodium surveys. We were able to detect potential co-product grades of rhodium over a seven kilometer strike length in the lower Stillwater Complex.”

Rowley emphasized that Group Ten is rapidly approaching completion of its maiden resource estimate. He also promised further updates in the near future on the multi-rig drilling campaign planned for 2021 and the expanded IP survey at Stillwater West.

Strategic importance of rhodium to the U.S.

Rhodium is a rare platinum group element (PGE) used primarily as a specialty catalyst alongside platinum and palladium in automotive catalytic converters. Supply shortages of rhodium have caused prices to rise steadily since 2017. Currently, rhodium is trading at over $27,000 per ounce on a spot price basis, more than 20 times more expensive than platinum. Rhodium, along with palladium, platinum, nickel and cobalt, is one of the five target commodities deemed critical by the U.S. government.

{letter}

Conclusion: There is growing evidence that with Stillwater-West, Group Ten has a deposit that need not fear comparison with the geologically closely related platinum projects in South Africa. Considering that so far mainly historical results have been evaluated and that Group Ten has completed only ten of its own drillings, this year’s drill program is of outstanding importance. For the first time, Group Ten will be able to drill test new targets identified by modern IP surveys. In fact, Group Ten is the first company to consistently interpret the Stillwater project as a polymetallic deposit analogous to the Platreef deposits in South Africa. Some major mining companies have long understood the value of this reinterpretation and have signed confidentiality agreements. For shareholders, answering two questions in particular could act as a catalyst. The first question is how will Group Ten fund the upcoming drilling program and the second, when will the maiden resource come and how big is it? We look forward to hearing the answers that Group Ten will provide and note that we also expect this initial resource will be updated on the heels of this season’s mult-rig drill program. Catalysts galore.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. This content exclusively serves to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly is it to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities carries high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34b WpHG and according to paragraph 48f paragraph 5 BörseG (Austria) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Group Ten Metals and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between a third party that is in the camp of Group Ten Metals and GOLDINVEST Consulting GmbH, which means that there is a conflict of interest, especially since this third party remunerates GOLDINVEST Consulting GmbH for reporting on Group Ten Metals. This third party may also hold, sell or buy shares of the issuer and would thus benefit from an increase in the price of the shares of Group Ten Metals. This is another clear conflict of interest.