23% of resource now in indicated category

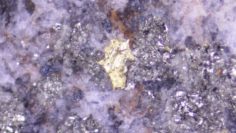

Goldshore Resources (TSXV GSHR / WKN A3CRU9) is pleased to announce an updated resource estimate for the Moss and East Coldstream deposits, which are part of the 100%-owned Moss Gold Project in Ontario, Canada. According to CEO Brett Richards, the company has succeeded in significantly improving both the quality of the resource and the average grade.

This is helped by the fact that 23% of the resource can now be assigned to the higher “indicated” category in the new calculation. As a result, Goldshore now reports 1.535 million ounces of gold in this category at an average of 1.23 g/t gold contained in 38.96 million tons.

And the inferred resource now stands at 5.198 million ounces of gold at an average of 1.11 g/t gold in 146.24 million tons. The total volume of the resource has thus “only” increased by just under 1% compared to last year’s estimate, but Goldshore was able to increase the total grade by around 11% compared to 2023.

Another point that underscores the quality of the new resource, according to the company, is that the shears that host the gold mineralization have been extensively remodeled as constraining domains, which has significantly improved the reliability of the current MRE. At estimated gold prices (US$1,850 per ounce) consistent with those of the 2023 resource estimate, 94% of the tons and gold ounces of the 2024 calculation are now included in these shear models. This is a clear increase compared to the previous year, when only 35% of the tons and 65% of the gold ounces were included in a shear model.

Goldshore also stated that the depth of the potential pit is limited by the model in numerous places, so there is potential for a larger pit if the model is extended to depth.

Starting point for further growth

This is not the only reason why Goldshore sees the 2024 resource estimate as the starting point for further growth of the Moss project towards world-class status. The new calculation should ultimately also lead to an initial, preliminary economic assessment, it said. The assessment that there is still considerable growth potential for Moss is supported by the fact that all zones identified within the project are still open for potential expansion. And the Moss project includes 36 satellite targets – including several mapped and sampled gold trends in the vicinity of the Moss gold deposit – which hold the opportunity for further discoveries and additional gold mineralization.

Goldshore CEO Brett Richards stated, “The above MRE results are extremely encouraging and validate the strategic exploration and drilling campaign we commenced nearly three years ago. We have consistently delivered exciting drill results in relation to the Moss Gold Project and this MRE demonstrates a significant and material increase in the quality, quantity and grade of the deposit. Conducting this MRE update was the logical next step in defining our strategy to understand and define the potential of the Moss Gold Project to maximize value for our shareholders. We continue to believe that the Moss Gold Project is an anomaly in the sector as it is in the upper quartile of grades and size compared to other comparable projects and is well on its way to becoming a Tier 1 project.”

Conclusion: Based on a thorough and objective review of the geology of the Moss and East Coldstream deposits and the underlying drill database by the experts at APEX, Goldshore says, implicit modeling of the core and rim shears was carried out. This has led to a more accurate model of the distribution of the gold, which in turn has resulted in a significant improvement in the resource estimate. The new resource can now form the basis for planning further definition and expansion drilling as well as a PEA (Preliminary Economic Assessment). The potential for direct expansion of the resource within and outside the possible pits has also become clear. We are looking forward to hearing more on the company’s plans for 2024.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on http://www.goldinvest.de. This content is intended solely for the information of readers and does not represent any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Portofino Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. Under certain circumstances, this may influence the respective share price of the company. GOLDINVEST Consulting GmbH currently has a contractual relationship with the company about which reports are published on the GOLDINVEST Consulting GmbH website, in the social media, on partner sites or in emails, which also constitutes a conflict of interest. The above information on existing conflicts of interest applies to all types and forms of publication used by GOLDINVEST Consulting GmbH for publications on Portofino Resources. Furthermore, we cannot rule out the possibility that other market letters, media or research companies may discuss the stocks we recommend during the same period. Therefore, there may be a symmetrical generation of information and opinions during this period. No guarantee can be given for the accuracy of the prices quoted in the publication.

Latest News

Latest Videos

MD INTERVIEW: Parkway Corporate (ASX:PWN) MD Speaks with GoldInvest about recent corporate developments (30 Sep 2021).

Group managing director, Bahay Ozcakmak sat down with Sven Olsson of to discuss all things $ESG & $water.

$pwn

https://www.youtube.com/watch?v=h3DtJKjGNs4

Parkway Corporate - Die Zukunft der Wasseraufbereitung

Parkway Corporate (WKN A1JH27 / ASX PWN) hat sich unter der Führung des jungen MD Bahay Oczakmak in weniger als...

Goldinvest.de

Earlier this month, Parkway Corporate (ASX:PWN), released a new corporate presentation.

$PWN #ESG #investing #sustainability #water #innovation #technology

The corporate presentation can be viewed here:

https://cdn.shopify.com/s/files/1/0529/9529/3345/files/2021_09_03_PWN_Presentation_82.pdf?v=1630891279

June 2020 Quarterly Report can be found here: https://www.asx.com.au/asxpdf/20200709/pdf/44kcy4sy0mpryd.pdf

$PWN - JUNE 2020 QUARTERLY REPORT

The quarter was marked by significant progress on both the Technology and Projects front, as Parkway Minerals continues to undergo an exciting transformation into a leading brine processing technology company.

June 2020 Quarterly Report can be found here: https://www.asx.com.au/asxpdf/20200709/pdf/44kcy4sy0mpryd.pdf

🌿 June 2020 Quarterly Report | Parkway Minerals (ASX:PWN) | Strong progress during quarter 🌿 - https://mailchi.mp/parkwayminerals.com.au/parkway-minerals-asx-pwn-updated-investor-presentation-outlining-business-model-3909134

PWN - March 2019 Quarterly Report - https://mailchi.mp/parkwayminerals.com.au/pwnupdate-1567837

PWN - Exploration Target for Dambadgee Prospect, Dandaragan Trough - https://mailchi.mp/parkwayminerals.com.au/pwnupdate-1536229

Significant Resource Upgrade for Davenport Resources - https://mailchi.mp/parkwayminerals.com.au/pwnupdate-1510121