{kanada_flagge}A.I.S. Resources Limited (TSXV: AIS; FRA: 5YHA; OTCQB: AISSF) and its joint venture partner Spey Resources Corp. (CSE: SPEY; FRA: 2JS) have jointly acquired the prospective Candela II lithium brine project in Incahuasi-Salar, Argentina. AIS paid USD 1 million to the Argentine seller for a 100% interest in the project and passed the project on to SPEY at the same moment. SPEY Resources has exercised its option to acquire an 80% interest in the Candela II project by paying in turn USD 1 million to AIS. AIS retains a 20% interest in the Candela II project, which SPEY may also redeem by March 18, 2023, upon payment of $6 million.

The Candela II project has been successfully explored recently. Highlights of the work to date include 25 surface samples and 3 bulk samples. In addition, 5 holes were drilled, with hole 5 going down to 209 meters. A NI43-101 report is currently being prepared by Montgomery & Associates.

Successful Direct Extraction of Lithium from Brine Samples

In addition, Ekosolve, an Australian tech start-up with a novel direct lithium extraction process, has already successfully extracted high-purity lithium from several brine samples. Sample 002 contained 160 ppm lithium. Using a multiple wash program, more than 90% of the lithium contained in the brine was extracted. This is the highest known recovery ever recorded and published with a direct lithium extraction system using the Ekosolve™ DLE process.

Fig. 1 – Work continues to progress on the Candela II project.

Production Drilling Program

Next, production wells will be drilled to measure brine flow and determine aquifer porosity and permeability. Concurrently, Ekosolve is designing a larger pilot plant to complete process verification for the Ekosolve™ solvent exchange DLE lithium process.

AIS Resources and SPEY hold lithium assets in Argentina.

Back in June 2021, AIS sold its Pocitos 1 and 2 licenses on the Pocitos Salar to SPEY Resources for an option fee of US$100,000 per exploration license and 2,500,000 common shares of Spey.

Spey can exercise the option and earn a 100% interest in the property from AIS by paying a total of US$1,732,000 prior to June 23, 2022. In addition, Spey must complete a $500,000 exploration program on the property prior to June 23, 2022. Upon exercise of the option and Spey’s acquisition of a 100% interest in the property, AIS will retain a royalty of 7.5% on sales proceeds of lithium carbonate or other lithium compounds from the Pocitos 1 and 2 properties, net of export taxes.

In 2018, AIS completed two drill holes at Pocitos 1. Assay results conducted by Alex Stewart show that lithium values of up to 125ppm Li were contained in brines flowing at intervals of 350m to 400m at more than 50,000L per minute. The project was abandoned in 2018 due to high magnesium content. However, as the Ekosolve™ process is capable of treating brines with high magnesium content, the project could still become profitable.

AIS continues to actively seek lithium JV partners

AIS also has options on the Pocitos 7 and 9 and Yareta III properties and is actively seeking joint venture partners to develop these lithium projects. Pocitos 7 and 9 are located at the southern end of the Pocitos Salar. A geophysical survey and deep trench sampling were completed in 2018. Results showed low resistivity on the east side of the salar, suggesting sandy units with brine may be present.

Yareta III Exploration License

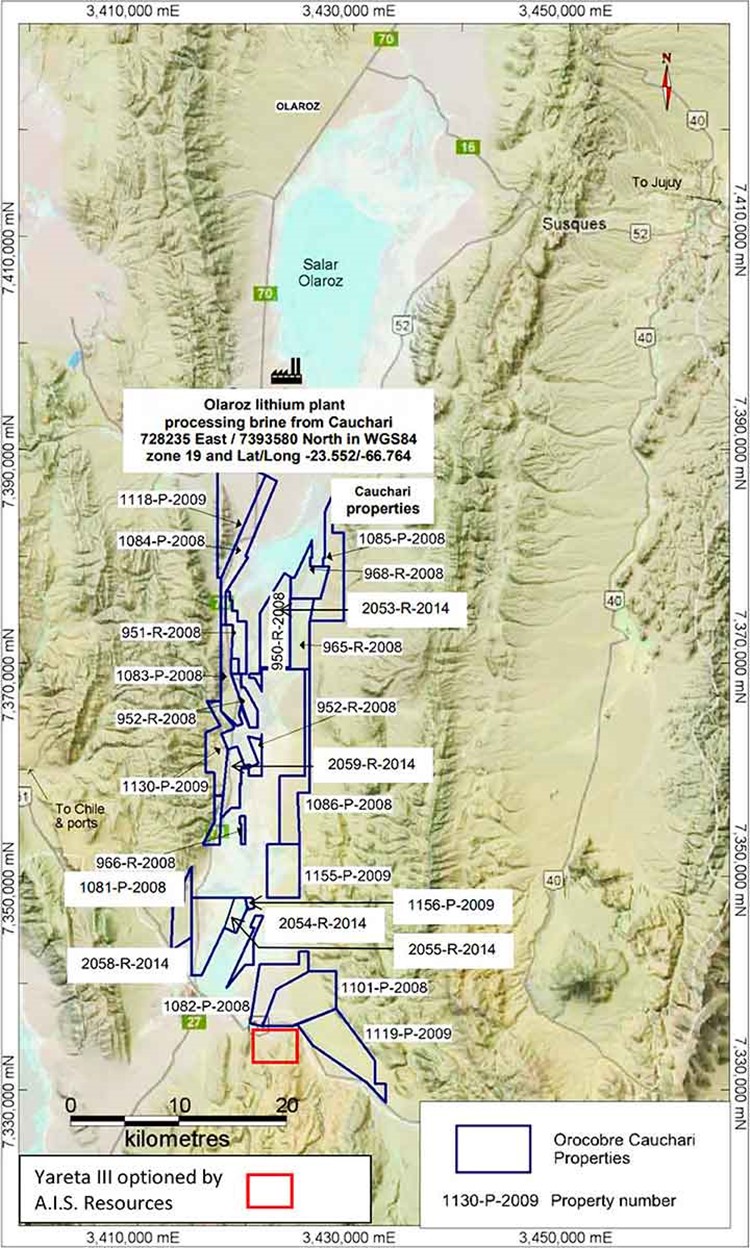

Yareta III is located at the southern end of the Cauchari salar near the Orocobre (now Allkem ASX:AKE) properties. The project is not located on the halite of the salar. Orocobre conducted a gravity and TEM survey in 2010 (the Southeast Survey), the results of which indicate that if the brine is concentrated at the southern end of the salar, it will be at depth.

Figure 2 – Yareta III Exploration License at Orocobre/Allkem

Conclusion: AIS Resources is struggling with its gold projects in Australia at the moment. Recent drill holes at the historic Bright Gold Project in the state of Victoria, Australia, have not immediately yielded the hoped-for success. This makes the lithium assets that AIS has secured from earlier times all the more important. Each individual lithium brine project could easily be worth many times AIS’ current (modest) stock market value of USD 6 million. The 2.5 million shares in SPEY could also become worth a lot. AIS hopes that SPEY’s trading halt in SPEY will be lifted shortly. In order for that to happen, SPEY apparently needs to complete Candela II’s 43-101 report. Reportedly, the report will be submitted shortly.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of both Spey Resources and A.I.S. Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the companies at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by A.I.S. Resources for reporting on the company. This is another clear conflict of interest.