The silver price corrected by around 30% at its peak on Friday. As brutal as that seems, a sharp correction is not uncommon after a parabolic rise – on the contrary, it often seems healthy and trend-confirming. Overheating is reduced, the market “breathes out.”

Why did silver collapse so sharply?

- Fed Personnel / “Interest Rate Shock”: The Warsh nomination was equated with less interest rate cut fantasy.

- US dollar jumped upwards: Classic headwind for metals.

- Profit-taking: After the rally, a trigger was enough for waves of selling.

- Margin pressure: Higher security deposits on the derivatives exchanges force position reductions and accelerate downward movements.

- Stops/“Algos”: Stops are taken out, triggering a chain reaction – the decline is accelerated and becomes self-perpetuating in the short term.

- Reinforcement on the derivatives market: Short players who were “wrong” for a long time and had to cover have also used the correction for sales and thus dynamized it.

Surprisingly, our precious metal indicator has even risen slightly – despite a massive increase in precious metal prices in the weeks before. This is very unusual and shows that large, well-informed players such as the “Commercials”, who usually trade counter-cyclically, obviously did not expect such a sharp correction. Current value at 0.97 (December 0.94). This means that the neutral level remains high. Classification: 0.6 sell, 0.6 to 1.0 neutral, ≥1.0 strong buy. The indicator bundles 10 weighted components.

Important: Precious metal stocks have often not followed the metal movement 1:1 – this suggests catch-up potential with an intact trend rather than an “end of the story”.

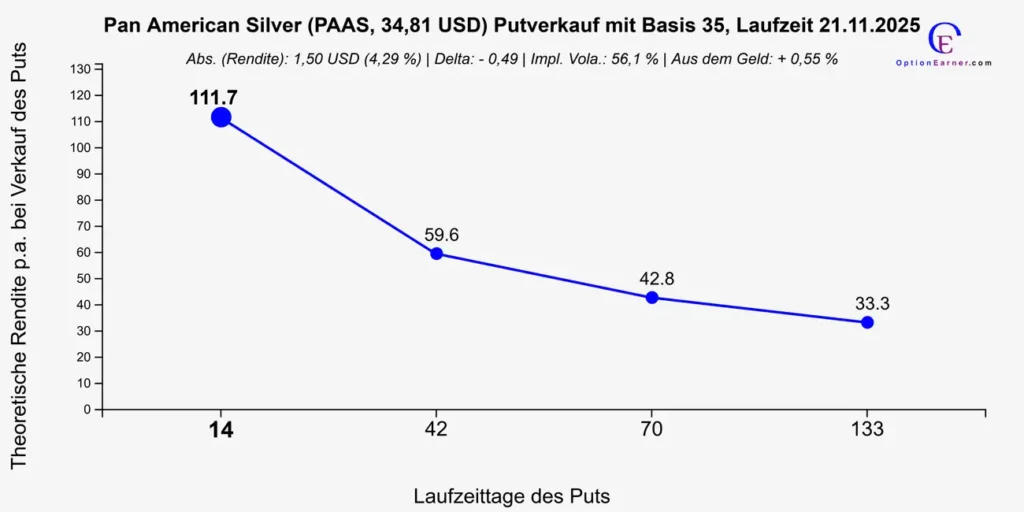

Instead of guessing the correction low, we rely on risk-reducing options strategies in such phases: Volatility becomes premium. This is exactly what worked for Pan American Silver in October last year – we implemented an options sale into a temporary weakness there and achieved a 4.3% premium in 14 days (equivalent to over 111% annualized).

Pan American Silver, one of the world’s largest producers of gold and silver with resources of over 1 billion ounces of silver, can now compete with an Nvidia in terms of margins.

The advantages of this approach are clear: High premium as a safety buffer, less timing stress (you don’t have to hit “exactly the low”), a rule-based entry – and a significantly more controlled chance/risk profile in turbulent phases.

Constellation after price correction at Pan American Silver in October 2025: Sale of a covered put with high premiums

Why do the higher-level factors continue to favor precious metals and precious metal stocks?

Silver remains structurally scarce and in deficit: Too little investment in the past; By-product – supply reacts sluggishly.

- Industrial demand is increasing: Electronics, solar, infrastructure and strategic applications.

- Paper currencies are losing confidence: Inflation experience interventions increase the “insurance demand” for tangible assets.

- Government debt is rising worldwide: Deficits put pressure on real interest rates and currency stability in the medium term.

- Financial repression possible: Politically capped interest rates with simultaneous real devaluation.

- Geopolitics drives the raw materials battle: Supply chains, sanctions, block formation: more need for valuable reserves.

- Mining stocks with catch-up potential: Many producers have not fully reflected the metal trend – with rising (free) cash flows

New on YouTube: Video “Silver Crash: An Opportunity to Buy? Chance: Feel free to share your comment and leave a like.

Source of the report: OptionEarner.com