The Mining Sector Benefits from the Rally in Silver and Platinum

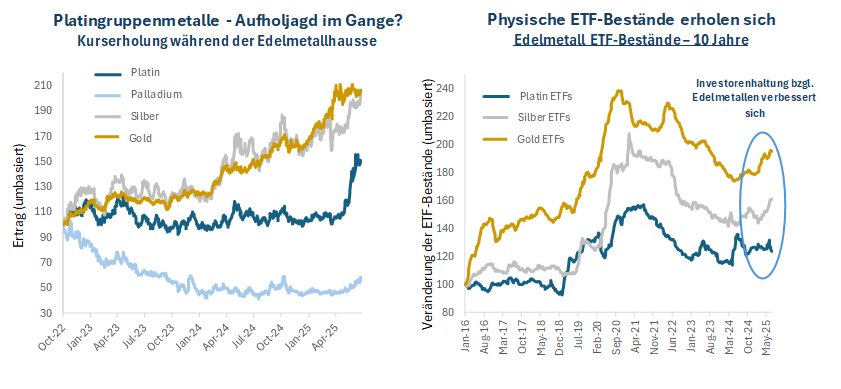

Gold has led the new precious metals bull market in recent years, but investor attention is increasingly turning to silver, platinum group metals (“PGM”), and the mining companies that produce these precious metals. This is because historically, pronounced upward movements in gold prices have preceded strong performance in the broader precious metals complex, attributable to their shared role as a safe haven and portfolio diversification.

Silver and platinum are now benefiting from a dual tailwind of industrial demand and signs of nascent investor interest recovery. Silver demand from photovoltaics (“PV”), electronics, and AI technologies, as well as platinum demand from automotive catalysts and the potential hydrogen economy, underscore the strategic role of these key metals for the new industrial revolution. Concurrently, inflows into physical exchange-traded funds appear to have reached an inflection point, while mining stocks are experiencing an upturn.

Crucially, both silver and platinum continue to face a structural supply deficit, with prices remaining well below historical highs. This tight fundamental environment, coupled with rising demand and increasing investor conviction, points to higher prices and a potential re-rating of undervalued silver and platinum mining companies. As an active manager, Baker Steel seeks opportunities across the mining sector, focusing on undervalued mining companies with positive growth trends.

In a new precious metals bull market, silver and PGMs will shine –

- Silver – The Silver Squeeze is Underway

Industrial demand from solar, electronics, and artificial intelligence continues to support silver’s fundamentals. A resurgence in investment demand could trigger a rally towards all-time highs, potentially reaching new peaks.

- PGMs – Platinum Leads the Way

Platinum is experiencing its strongest bull run in over a decade, supported by robust industrial demand and persistent supply tightness. The outlook for platinum is increasingly optimistic given heightened investor interest.

- Precious Metals Mining Stocks – Significant Re-rating Potential

Mining companies remain attractively valued despite recent strong performance. With strong balance sheets and expanding margins, silver and PGM producers, alongside gold miners, are poised to benefit from the next phase of the cycle.

Figure 1

Source: Bloomberg, Baker Steel Capital Managers LLP. As of: July 15, 2025.

Silver Squeeze – Time for a Breakout?

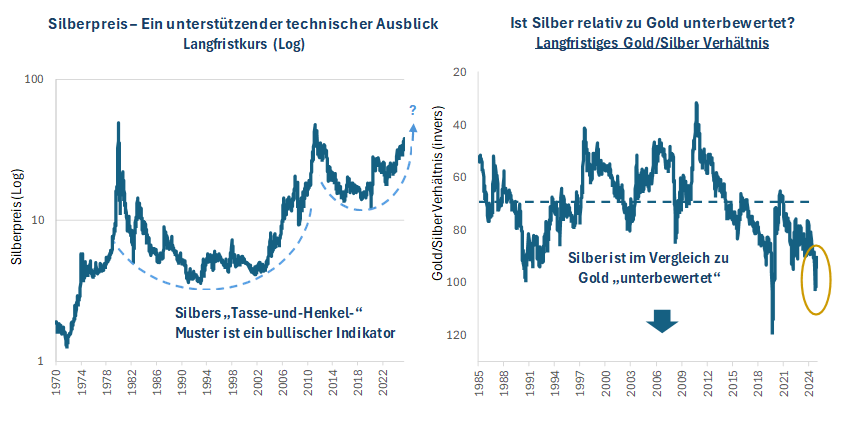

Silver typically follows gold’s trajectory, albeit with higher volatility, and often outperforms in the latter stages of a precious metals bull run, with industrial demand being a key price determinant. Historically, gold has led recoveries, with silver catching up and often surpassing gold as momentum builds. Silver has recently risen to new highs of approximately $39/ounce. However, the gold-to-silver ratio (see chart below) highlights how elevated silver’s valuation is relative to gold: it stands at 90, far from its long-term average of 60. Given a current gold price of approximately $3,300/ounce, a simple return to a longer-term average valuation would imply a silver price of about $55/ounce, or a 45% increasei, indicating significant upside potential for the metal, even without considering long-term silver demand trends. Similarly, silver miners offer significant re-rating potential compared to the broader gold mining sector, especially during periods of silver outperformance. Given the favorable technical outlook for silver prices and positive supply-demand dynamics, we believe we are entering a propitious phase for silver mining companies to deliver strong performance.

Figure 2

Source: Bloomberg. As of: July 11, 2025.

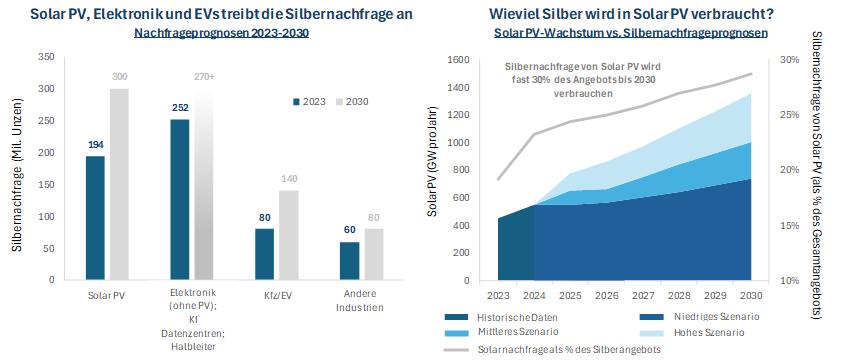

Silver’s dual role as an industrial and precious metal underscores its unique appeal. In 2024, approximately 58% of total silver demand came from industrial applicationsii. Among these, solar PV and electronics are the primary drivers. Since 2016, silver demand from the solar industry has increased by 139%, and demand from the electronics industry by over 50%iii. Looking ahead, silver demand from photovoltaics alone is projected to reach almost 30% of annual supply by 2030, up from approximately 23% in 2024iv. Despite this strong structural demand trend, silver’s technological significance is often underestimated, making it, in our view, the “unsung hero” of the new industrial revolution.

Figure 3

Source: Silver Institute, Sprott, BloombergNEF, Baker Steel Capital Managers LLP. Note: 2030 estimates are based on known technology trends (solar cell architecture, EV rollout) and CAGR assumptions (PV ~6-8%, EVs ~10%, Electronics ~2%).

It is worth noting that while industrial off-takers provide a solid demand floor, they tend to act defensively, sensitive to policy changes such as tariffs, and seek clarity before committing to large-scale procurement. This creates a dynamic where industrial demand steadily supports prices, while investment flows can amplify upside potential when sentiment shifts.

Regarding investment demand, silver is showing signs of renewed momentum after a period of subdued investor interest. As a precious metal, silver shares many of the same macroeconomic drivers as gold, including its role as a store of value and a hedge against inflation, currency debasement, and geopolitical uncertainty. While silver has not benefited from central bank purchases like gold in recent years, it possesses a similarly deep historical monetary heritage, having served as foundational currency in many ancient and modern economies. Its greater geological abundance makes it more affordable and accessible to a broader base of retail investors, particularly during periods of rising inflation expectations or declining real interest rates. As gold prices rise, silver’s appeal as an investment is being re-evaluated, while its historical tendency to outperform gold in later stages of a bull market further underpins its upside.

Silver exchange-traded funds recorded net inflows of €95 million in the first half of 2025, supporting the recent rise in silver pricesv. Total holdings in exchange-traded funds have recovered towards their 2021 peak, suggesting encouraging re-engagement from investorsvi. Retail investment trends have been mixed. Indian demand rose 7% year-on-year, reflecting growing interest in physical silver as an accessible store of value. In contrast, retail investment in the US has not yet returned, indicating that sentiment in Western markets has not fully turned positivevii. Taken together, these trends suggest initial signs of a recovery in investor sentiment towards silver, while also indicating that broader investor participation has significant upside potential in the current cycle.

Figure 4

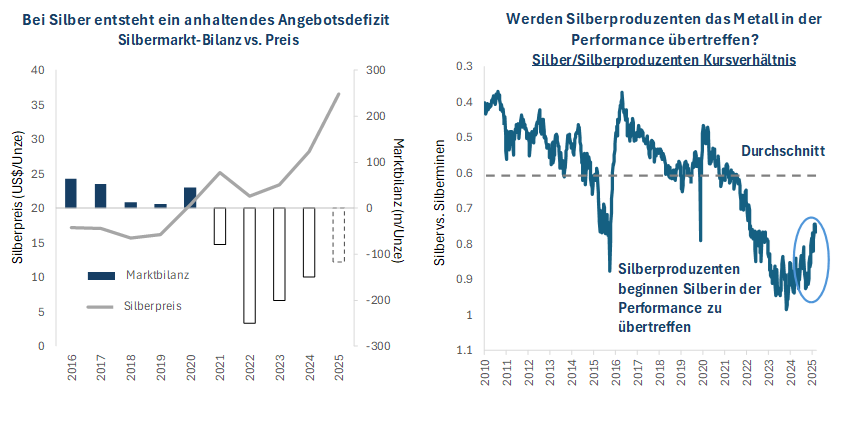

Source: Bloomberg, Metals Focus, Silver Institute. Note: The market balance for 2025 is a forecast. Data as of July 11, 2025.

Silver demand continues to outstrip supply, making 2025 the fifth consecutive year of a silver market deficit, following a 149 million ounce deficit in 2024viii. Silver mine supply remains tight, with a limited pipeline of primary silver projects, discovery rates lagging depletion for many years, and silver also being a byproduct. Only about 30% of silver supply comes from primary silver mines; the majority is extracted alongside gold, lead, zinc, and copper, which limits the industry’s ability to respond to higher prices with targeted investmentsix. Global silver production is expected to increase marginally by 1.9% to 835.0 million ounces by 2025x.

A structural deficit like this tends to increase the likelihood of price spikes, and so it is perhaps surprising that the silver price has not risen faster. Secondary supply has filled the gap, with the silver deficit being offset by a drawdown in silver inventories. Since 2021, inventories at the Shanghai Futures Exchange, the London Bullion Market Association, and COMEX have drastically declined. Within four years, a total of 678 million ounces were drawn down from inventoriesxi, raising the question of how much longer secondary supply can offset the deficit.

Against this backdrop, the bull case for silver miners is clear. Margins are expanding as silver prices rise, and costs remain contained. Silver mining companies’ costs declined in 2024, with total cash costs down 13% and all-in sustaining costs (“AISC”) down 15%, supported by byproduct creditsxii. Silver producers’ hedging activity has fallen to multi-decade lows, while streaming and royalty deals increased by 5% in 2024xiii. M&A activity in the silver sector has picked up, reflecting growing corporate interest in securing production assets. In June 2025, Pan American Silver announced its intention to acquire Mag Silver in a transaction valued at approximately $2.1 billion. This follows other significant transactions announced in the past year, including Coeur Mining’s acquisition of SilverCrest Metals in October 2024, valued at approximately $1.7 billion, First Majestic Silver’s acquisition of Gatos Silver, valued at approximately $970 million, and numerous smaller transactions. These transactions reflect a strategic shift towards scale consolidation to benefit from production synergies, as well as strong price-driven confidence supported by improving investor sentiment towards the sector.

Platinum – Renewed Momentum Offers Recovery Potential for Miners

Platinum, the most well-known of the platinum metals, rose to an 11-year high in June 2025, marking a significant turnaround after a prolonged period of weakness across the entire platinum metal complex, which also includes palladium, rhodium, ruthenium, osmium, and iridium, among others. This development follows years of price pressure caused by extensive above-ground inventories, mixed industrial demand prospects, and the normalization of supply chains after COVID-era disruptions.

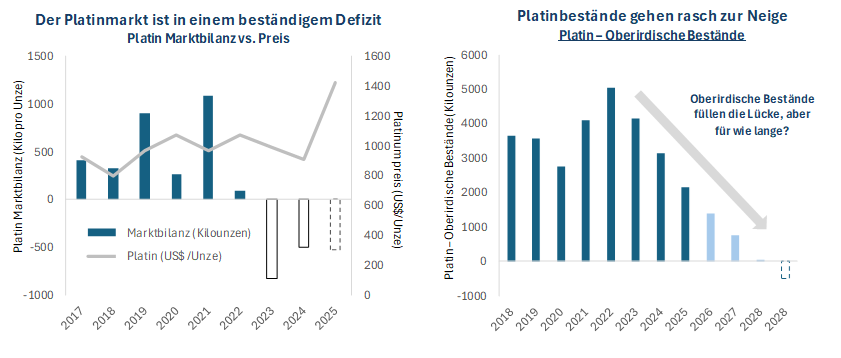

The recent rally reflects a nascent recovery in demand from the industrial, jewelry, and investment sectors. Importantly, this demand emerges against a backdrop of a multi-year structural supply deficit and the ongoing drawdown of above-ground inventories, as shown in the charts below. While investor interest in platinum metals has been subdued in recent years, the solidifying fundamentals of the platinum market are now beginning to attract renewed attention.

Figure 5

Sources: World Platinum Investment Council, Metals Focus (2018 – 2025f), 2026-2028 forecasts based on WPIC research.

Automotive platinum use accounts for approximately 33%, primarily for catalytic convertersxiv. While EV adoption continues to advance, internal combustion engine vehicles, particularly those with high diesel content, remain reliant on platinum for catalysts. Substitution between platinum and palladium in catalysts is a key factor in price formation between these two platinum metals. Over the past three years, automakers have increased platinum loading in catalysts to offset palladium costs, which sent palladium prices plummeting while supporting platinum. European vehicle production rebounded in the first half of 2025, boosting platinum demandxv. Furthermore, a surge in plug-in hybrid electric vehicle (“PHEV”) production in early 2025 has supported platinum prices, as demand for PHEVs as a pragmatic middle ground between internal combustion and full electrification is once again rising for many consumers.

Platinum benefits from broader industrial demand, accounting for approximately 23% of total demand, with applications in the chemical industry, refining, manufacturing, and medicinexvi. A significant new driver for platinum and other platinum metal demand is the nascent hydrogen economy, where platinum is primarily used in fuel cells. While the hydrogen economy is estimated to account for less than 2% of platinum demand in 2025, this share could quintuple by 2030xvii. The increasing announcement of hydrogen projects in Europe and Asia has recently supported investor sentiment.

Platinum jewelry demand, accounting for approximately 23% of total demandxviii, was mixed in 2025, with signs of renewed interest in platinum as a luxury alternative to gold. While demand in China has been structurally declining in recent years, the World Platinum Council reports a boom in the opening of new platinum showrooms in Shuibei, a major gold and jewelry hub, for 2025. This expansion is reportedly accompanied by an increase in platinum production capacity to meet growing local demand, suggesting this upturn could be sustainedxix.

Investment demand, which includes exchange-traded funds, bars, and coins, has been subdued in recent years and currently accounts for approximately 20% of total platinum demandxx. Following a prolonged period of outflows, exchange-traded fund holdings stabilized in 2025, with initial signs of investor interest recovery supported by a broader rotation into real assets. A sustained return of investor demand, especially if supported by stronger price performance, could serve as a key catalyst for renewed upward momentum in the platinum market.

The cautious optimism regarding platinum demand is set against a backdrop of tight supply. Platinum production is highly concentrated, with approximately 70% originating from South Africa, a region prone to intermittent disruptions from power shortages and rising cost pressures. These factors have tightened the physical market and supported prices in early 2025. Adding to this is the concern among US investors about the potential imposition of tariffs on platinum metals. For mining companies, higher platinum prices have improved profit margins, although producers continue to focus on cost-reduction strategies in an uncertain operating environment. It is worth noting that platinum’s recent strength contrasts with palladium, which continues to exhibit a structural surplus. Despite strong year-to-date price performance, the share prices of key PGM producers, including Valterra Platinum, Impala Platinum, and Sibanye-Stillwater, remain 50-60% below their 2021-2022 peaksxxi.

Active Management – Value Creation Through Stock Selection and Tactical Asset Allocation

The fundamentals of silver and platinum highlight the compelling opportunities available to investors in the mining sector, supported by persistent multi-year supply deficits, robust industrial demand, and improving investor sentiment. At Baker Steel, we have recently maintained an overweight position in silver and platinum mining producers, reflecting our conviction in their upside potential. We see compelling opportunities in high-quality silver and PGM producers with healthy margins and strong leverage to rising prices.

Despite positive long-term demand trends, mining stocks have experienced a broad re-rating in recent years compared to the general equity markets. This discrepancy offers a compelling value appreciation opportunity for investors seeking to capitalize on structural themes such as the clean energy transition, the new industrial revolution, and the increasing importance of precious metals in the global financial system, particularly gold, which is now the second-largest reserve asset after the US dollarxxii.

The sector’s undervaluation largely reflects the limited interest of Western investors, who remain focused on mainstream equities. As a result, many have missed the initial phase of the current bull market in the metals and mining industry, which has been led by strong performance in the precious metals segment. While concerns about costs and capital discipline persist, recent corporate results have shown encouraging trends, including tighter cost control, expanding profit margins, and – in the case of precious metal producers – increased share buybacks. Given stable or rising metal prices, we believe a re-rating is likely as company performance continues to improve. It would only take a modest rotation from standard equities to generate significant capital inflows into the sector.

A favorable macroeconomic environment strengthens investment opportunities for mining stocks, especially for precious metal producers. Potential interest rate cuts by major central banks in the coming months are likely to benefit the sector, as lower interest rates have historically supported precious metal prices. US monetary policy remains particularly important for gold. Recent market reactions to Trump’s criticism of Fed Chairman Jerome Powell and his clear preference for lower interest rates highlight gold’s sensitivity to US interest rate expectations. Inflationary pressures also continue to support demand for precious metals, including silver. Trump’s proposed “One Big Beautiful Bill” is expected to increase budget deficits and national debt, further exacerbating concerns about the stability of the US financial system. In this environment, we believe the attractiveness of precious metals as safe havens will remain strong.

We are convinced that active management in the mining equity sector offers the potential for outsized returns with effective risk management. Success in this area requires careful differentiation between companies based on fundamentals, such as asset quality, operational performance, and risk exposure, alongside top-down considerations, including commodity-specific trends and geopolitical dynamics. Our active investment approach at Baker Steel Capital Managers LLP has a proven track record of delivering superior returns in the metals and mining sector. While market volatility is likely to persist, we are confident that our strategies are well-positioned to capitalize on the opportunities we see. Through active management and flexible asset allocation, our funds are able to navigate uncertain times, manage risks, and offer greater upside potential compared to passive investment in precious metals.

Sources

i Baker Steel Capital Managers LLP, Bloomberg. As of July 15, 2025.

ii Silver Institute, World Silver Survey 2025.

iii Silver Institute, World Silver Survey 2025.

iv IEA, Energy Institute, The Economist, BNEF, Baker Steel internal forecasts.

v Silver Institute, As of June 30, 2025.

vi Metals Focus, Global Silver Investment Escalates in 2025.

vii Silver Institute. As of June 30, 2025.

viii Silver Institute. As of June 30, 2025.

ix Sprott.

x Metals Focus.

xi Metals Focus Presentation on World Silver Survey 2025.

xii Source: Metals Focus Silver Mine Cost Service. Please note that costs are based on by-product accounting.

xiii Metals Focus, Silver Institute.

xiv World Platinum Investment Council – Platinum Quarterly Q1 2025 Presentation.

xv S&P, June 2025 Light Vehicle Production Forecast.

xvi World Platinum Investment Council – Platinum Quarterly Q1 2025 Presentation.

xvii CME Group.

xviii World Platinum Investment Council – Platinum Quarterly Q1 2025 Presentation.

xix World Platinum Investment Council – Platinum Quarterly Q1 2025 Presentation.

xx World Platinum Investment Council – Platinum Quarterly Q1 2025 Presentation.

xxi Bloomberg, USD, As of June 15, 2025.

xxii Financial Times.

About Baker Steel Capital Managers LLP

Baker Steel Capital Managers LLP manages three award-winning investment strategies covering precious metal equities, specialist metal equities, and diversified mining.

Baker Steel has a strong track record of outperforming its competitors and passive investments in the metals and mining sector. Fund managers Mark Burridge and David Baker were awarded two Sauren Gold Medals for 2022 and received the “Fund Manager of the Year” award at the 2019 Mines & Money Awards.

Baker Steel’s precious metal equity strategy is a Lipper Fund Awards winner for the fifth consecutive year in 2022, while the Baker Steel Resources Trust was named Investment Company of the Year 2021, 2020, 2019, Natural Resources, by Investment Week.

Sources: S&P, USGS, Benchmark Mineral Intelligence, Albemarle, Bloomberg, Bloomberg New Energy Finance.

Important

Note: This document is a financial promotion issued by Baker Steel Capital Managers LLP (a limited partnership registered in England under No. OC301191 and authorized and regulated by the Financial Conduct Authority) for the information of a limited number of institutional investors (as defined in the Fund Prospectus) on a confidential basis and solely for use by the person to whom it was addressed. This document does not constitute an offer to issue or sell, nor a solicitation of an offer to subscribe for or purchase shares or other interests, nor is it or the fact of its distribution the basis for or may be relied upon in connection with any such contract. Recipients of this document who intend to subscribe for shares or interests in Baker Steel funds are advised that any such application may only be made on the basis of the information and opinions contained in the relevant prospectus or other offering document, which may differ from the information and opinions contained in this document. This report may not be reproduced or distributed to any other person, and no other person should rely on its contents. The distribution of this information does not constitute an offer to participate in an investment, nor is it part of any such offer. This report does not constitute investment advice in any way. Past performance should not be taken as an indication of future performance. Future performance may be significantly worse than past performance and may result in substantial or complete losses.