As of: September 26, 2025 by Florian Grummes

Since the central bank meeting in Jackson Hole on August 21, the precious metals markets have experienced impressive upward momentum. After a four-month consolidation phase, the gold price rallied within a few weeks from 3,311 to a new record high of 3,791 US dollars per troy ounce.

In parallel, silver reached its highest level in 14.5 years, standing at 45.23 US dollars. The mining sector also shows strong performance: The GDX Gold Miners ETF effortlessly broke through its 2012 highs and has continued to rise since then.

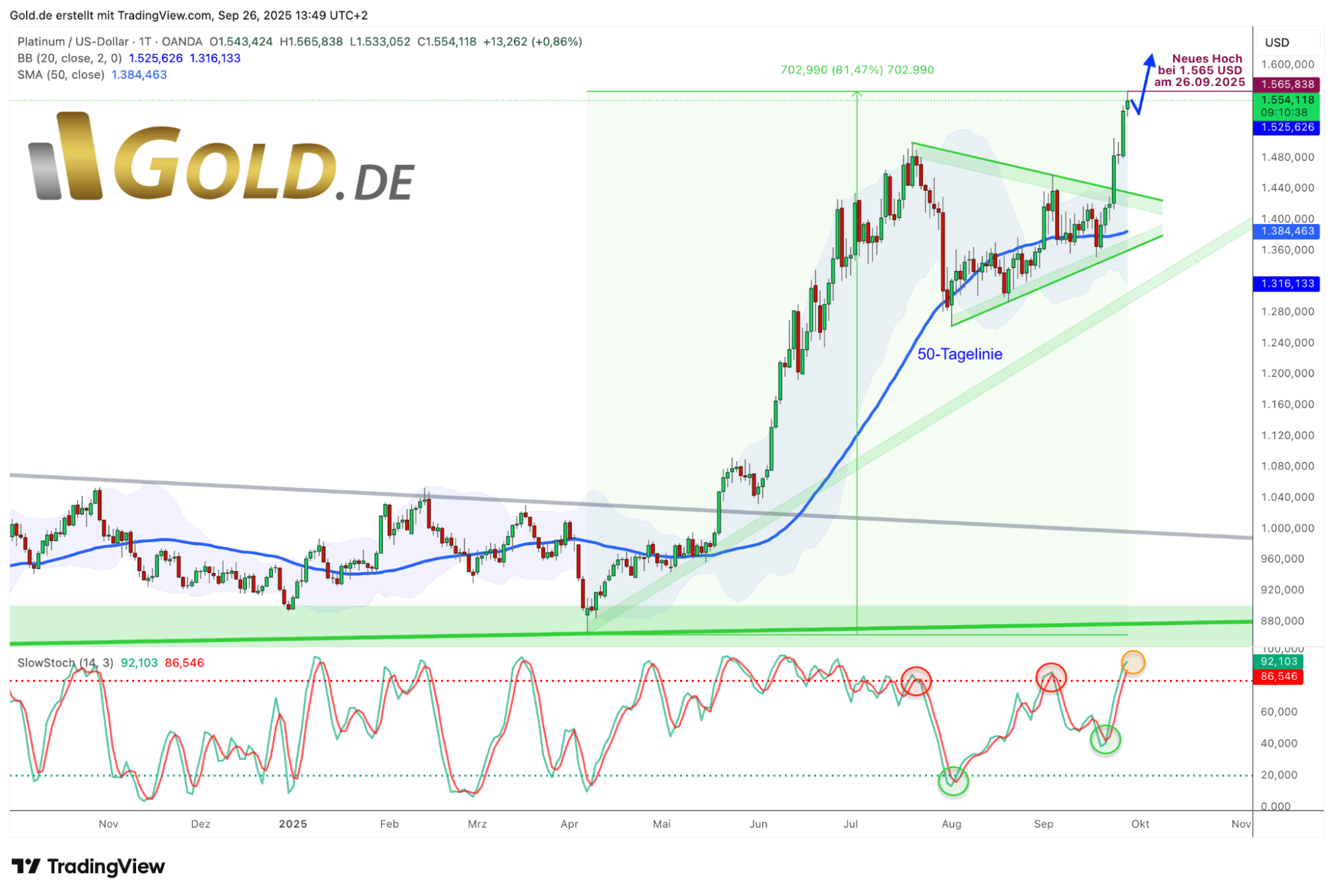

However, the undisputed leader of the last two quarters is the platinum price. Since April 1, the price per troy ounce has risen by an impressive 81.5%, marking a remarkable comeback. Particularly in June, the breakout above the nearly 17-year downtrend led to significant price increases.

While a healthy pullback at the end of July briefly calmed the market, platinum quickly recovered and reached a new 12.5-year high in the current trading week. This definitively ends platinum’s years of obscurity, positioning it once again as a strong investment vehicle in the precious metals sector.

Although platinum was already used by ancient cultures, such as the Egyptians and pre-Columbian South Americans, it was long devalued in Europe as “Platina,” or “little silver,” because it was difficult to melt and process. When Spanish conquerors found large quantities of platinum while panning for gold in South America in the 17th century, they considered it inferior or unripe gold and threw it back into the rivers. Its unclear and difficult-to-control availability also played a political and economic role.

Physical Properties and Geological Occurrences of Platinum

Platinum is characterized by its extraordinary physical and chemical properties. It is dense, ductile, malleable, extremely stable, and highly resistant to chemical reactions and aggressive acids. Furthermore, platinum has a high melting point and excellent catalytic properties, which make it indispensable in industry. With its silvery-white luster, it is one of the most coveted precious metals and is approximately 30 times rarer than gold.

In the Earth’s crust, platinum is present only in very low concentrations. It often occurs in association with nickel and copper ores or in the form of so-called placer deposits, where it is washed out of the parent rock by natural erosion and enriched in river sediments.

Approximately 90 percent of the annual production comes from a few regions worldwide – including Russia’s Ural Mountains, Colombia, Canada’s Sudbury Basin, and especially South Africa, which holds the largest reserves and supplies 70 to 80% of the total annual production.Globally, only approximately 170 to 200 tons are produced annually, which further underscores the metal’s scarcity and value.

Its broad industrial significance makes platinum a sought-after raw material. Particularly in the automotive industry, it is indispensable for catalytic converters. Additionally, it is used in laboratory equipment, electrodes, measuring instruments, the glass industry, and as a high-quality material in dentistry.

The jewelry industry also benefits, especially when the gold price reaches record highs, as it currently does. Then, many consumers, particularly in China, increasingly turn to platinum as an elegant yet more affordable alternative to gold. Unlike gold and silver, which have been established as monetary metals for centuries, platinum is used almost exclusively for industrial purposes. Investment demand accounts for only about eight percent of the total demand.

Supply Shortages and Rising Demand as Price Drivers for Platinum in 2025

Fundamentally, this year’s price increases can be explained not only by the strong gold price, but also by the structural supply deficit, as well as adverse weather conditions and other logistical problems in the main producing country, South Africa.

Despite slight recoveries, production volume remains at one of the lowest levels of the last five years. Recycling plays a supplementary, but not offsetting, role in the quantity of mined platinum. New projects, such as the Platreef Mine in South Africa, are expected to supply additional quantities in the medium term, but are still under development.

In contrast, there is stable or even rising demand from China and the jewelry sector. Furthermore, a weak US dollar, combined with growing investment interest and ETF inflows, creates additional upward pressure.

Geopolitical tensions, such as sanctions against Russia, trade barriers, and uncertainties, also contribute to the increased demand for platinum as a safe haven. Overall, the limited availability makes platinum a metal of high geopolitical and economic importance.

Platinum in US Dollars – the Breakthrough Has Occurred

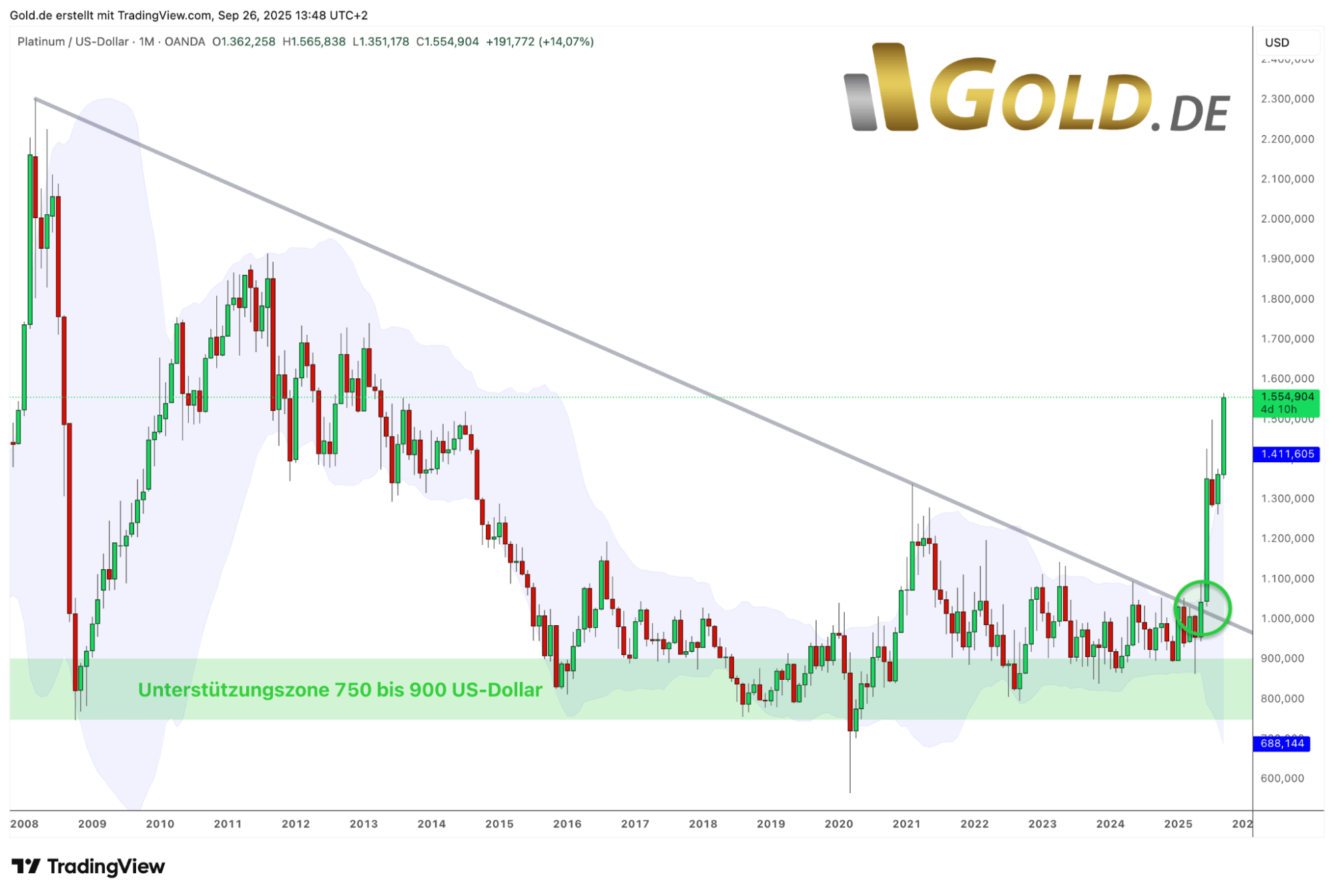

The platinum price reached its all-time high of 2,308.80 US dollars per troy ounce in March 2008. Reasons for the sharp increase at that time were primarily the growth of government debt in the USA and Europe, the weakening of the US dollar against other world currencies, a global supply shortage, and rising demand, especially from the automotive industry, as South Africa, which produces around 75 percent of the platinum, faced production problems due to electricity shortages.

However, during the international financial crisis, which began in the summer of 2007 with the US housing crisis, the platinum price came under immense pressure. By October 2008, the platinum price had fallen by approximately 67 percent from its all-time high to 762 US dollars, as the liquidity crisis at that time heavily impacted all asset classes and demand for industrial metals drastically declined.

With the end of the financial crisis and fueled by the gold bull market, the platinum price was able to recover to 1,915 US dollars per troy ounce by autumn 2011. However, new all-time highs, as seen with gold, did not materialize.

During the multi-year correction phase in the precious metals sector, the platinum price subsequently fell back to the level of the lows from autumn 2008. For almost a decade, platinum remained in a sideways movement within the significant support zone between 750 and 900 US dollars, leading an obscure existence. The Covid crash in February 2020 even pushed the price temporarily to a low of 565 US dollars.

Only in May 2025 did the breakthrough above the 17-year downtrend occur. This significant breakout fundamentally changed the market structure and initiated a steep and sustainable bull market phase for the platinum price, which continues to this day.

At the beginning of the week, the two-month consolidation triangle was clearly and decisively broken upwards. The next price target from this formation is at least 1,600 US dollars.

In the broader context, the platinum price still needs to rise by approximately 48% to reach its all-time high. Given the extremely bullish developments across the entire precious metals sector, we anticipate that platinum will easily reach prices above 2,000 US dollars as early as next year.

In the short term, the market situation is certainly somewhat overheated, nevertheless, a very favorable risk/reward ratio for platinum can still be constructed in the big picture. Any pullbacks should therefore be interpreted as buying opportunities to profit from the bull market that has just begun.

Conclusion: Platinum – Awakened from Slumber

The platinum price awakened from its 17-year slumber in May of this year and has set out to quickly catch up with gold’s significant lead.

Long-time precious metals investors will recall that platinum used to be twice as expensive as gold. Currently, the platinum/gold ratio trades at merely 0.415! Thus, there is enormous catch-up potential for the platinum price.

The strong upward movement of the last six months is not merely a consequence of the impressive gold and silver bull market. Rather, the new platinum bull market primarily follows fundamental changes in the market. The structural supply deficit, caused by production problems in South Africa and exacerbated by sanctions against Russia, combined with stable and growing demand, particularly from China and the jewelry industry, form the basis for the sustainable price rally.Geopolitical uncertainties, a weak US dollar, and increasing investment demand further reinforce this dynamic.

Historically, platinum was long underestimated and played a rather subordinate role compared to gold and silver. However, with its outstanding physical properties and indispensable industrial significance, especially in the automotive sector, it possesses high geopolitical and economic relevance. Its limited availability, coupled with rising investment demand, makes platinum a highly exciting and significantly undervalued asset in the precious metals universe.

Technically, the breakout above the long-term downtrend marks a turning point with significant opportunities. Even if short-term pullbacks are possible, the risk-reward ratio for platinum appears extremely favorable. Investors should view any pullbacks and corrections as opportunities to profit from the bull market that has just begun and to consider platinum as a valuable investment in their portfolios.

As of: September 26, 2025

Written by:

Florian Grummes

Technical Analyst, Precious Metals Expert