Mining Stocks Before the Catch-up Race?

As of: 02/07/2025 by Florian Grummes

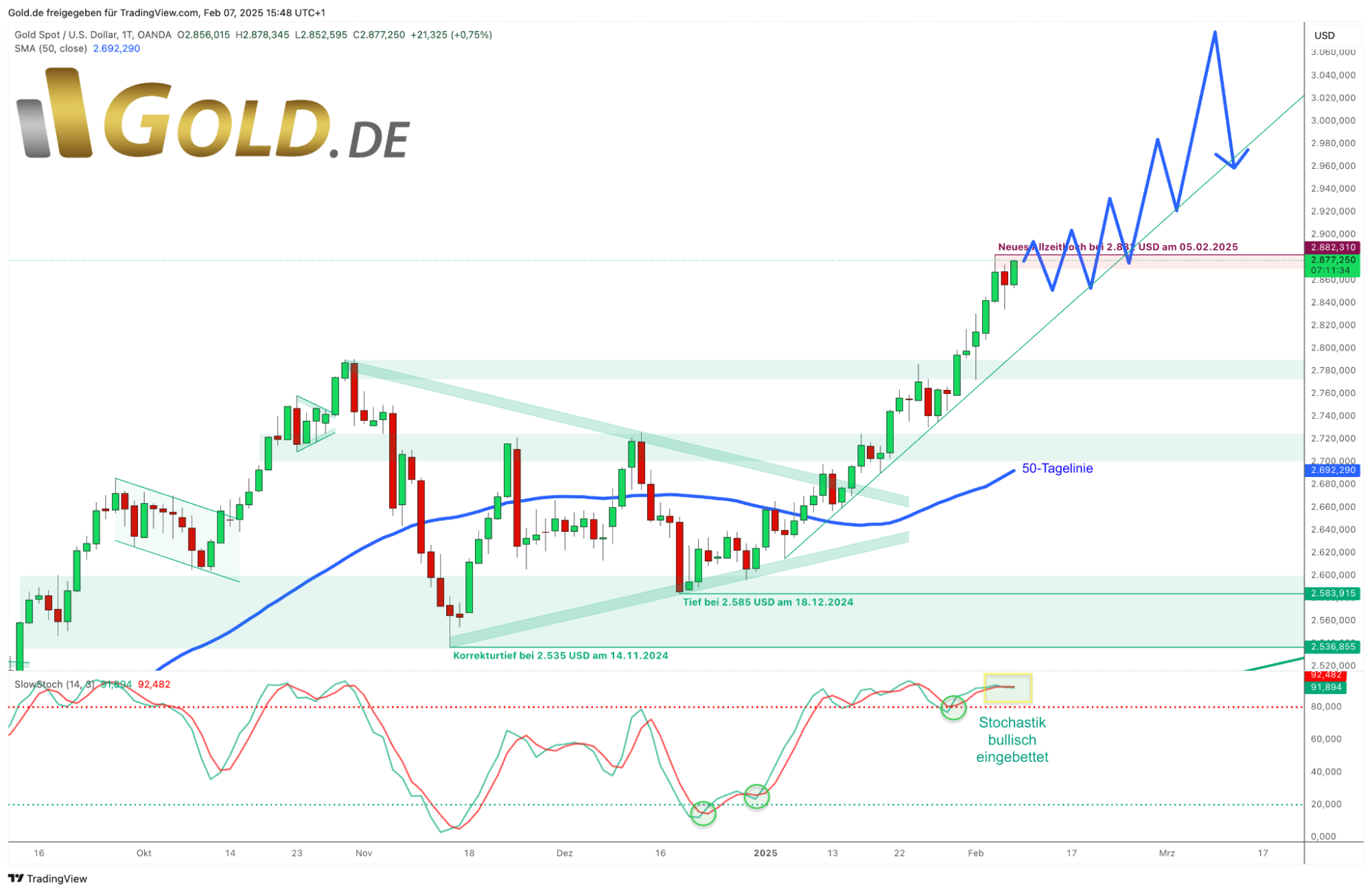

As expected, the US interest rate decision on December 18, 2024, initiated the trend reversal in the gold market. After an initially moderate recovery, gold prices literally exploded in the last four weeks and reached a new all-time high of $2,883.11 (intraday) today. (Gold is currently trading at around $2,906 USD; Ed.)

As always, such a dynamic development can be attributed to several key factors. In particular, the technical breakout from the consolidation triangle that had limited the gold price since the end of October brought a lot of trend followers into the market.

Additionally, the Chinese central bank resumed its gold purchases after a six-month interruption. On top of that, fears of possible tariffs by the new Trump administration are causing a significant supply shortage in London.

All of this was garnished with traditionally high physical gold demand for the Chinese New Year (Year of the Snake).

This combination of macroeconomic, geopolitical, and seasonal factors has catapulted the gold price to a record level and underscores the continued attractiveness of gold as a safe haven and store of value.

Gold Shortage in London

Since the US election in November, traders have moved nearly 400 tons of gold worth $82 billion from London to New York. The reason for this is the fear that the Trump administration could impose tariffs on gold imports. This has led to a serious shortage in London, where the waiting time for gold withdrawals from the Bank of England’s vaults has increased from a few days to up to eight weeks.

However, the relocation of gold is not only due to tariff fears but also to arbitrage opportunities. Recently, the futures prices for gold in New York were above the spot prices in London, prompting traders to ship the precious metal across the Atlantic.

This situation is reminiscent of the events during the Covid-19 pandemic when uncertainties about gold deliveries and lockdowns led to a similar rush on gold storage in London and New York.

The massive gold transfer has had significant impacts on the London gold market. London is the global center for spot and physical gold transactions as well as gold lending. The costs for short-term gold loans have risen sharply, from typically under 0.5% to temporarily up to 12%. This is forcing short sellers to close their positions, which has led to a strong increase in gold prices.

Driven by this, the gold price has broken through important resistance levels and easily surpassed its all-time high of $2,790. Every trader who was positioned on the wrong side here had to cover their short positions, creating additional buying pressure.

Despite the turmoil in the London gold market, physical gold naturally remains a safe haven for investors. What we are experiencing is not a gold shortage per se, but a shift in how it is stored and traded, as well as a short squeeze in paper gold.

Once again, it confirms how important it is to only buy physical and directly allocated gold from trusted and independent precious metal dealers to protect oneself against the uncertainties of the financial system.

Gold in US Dollars – Upward Trend Firmly Established

Starting from the low on December 18 at $2,585, the gold price has significantly increased by almost $300 over the last seven and a half weeks.

We have repeatedly written that favorable seasonality in January and February should provide tailwinds.

Not much is missing now to reach the round psychological mark of $3,000.

However, the fulminant rise has naturally cost strength, so intermediate consolidations and short but sharp pullbacks should not be surprising now.

At the same time, the rally remains completely intact and unendangered. In particular, the daily stochastic is moving with both signal lines above 80, thus securing the upward trend for the time being.

Regardless of short breathers, it should soon continue upwards towards 2,900 and 2,945 US dollars. On a higher level, our second major price target still awaits at around 3,080 US dollars.

Gold – Rally Running Like Clockwork

The rally in the gold market has been continuing upwards like clockwork in recent weeks. In the process, the gold price is climbing to one new all-time high after another. An end to this impressive upward movement is not yet in sight. Rather, we can assume that the party could well continue into late spring, as the silver price has not yet made an appearance.

The dynamic development in precious metal prices is accompanied by a ‘melt-up‘ in the stock markets.

In this context, it would not be surprising if the heavily undervalued mining stocks were now to start catching up.

Author: Florian Grummes

Technical Analyst, Precious Metals Expert

www.goldnewsletter.de