Is a New Titan Emerging?

Fairchild Gold (TSXV FAIR / WKN A3D1D5) is picking up momentum in Nevada: The Canadian company has signed a letter of intent with Emergent Metals to secure 100% of the Golden Arrow project! The property is located in the Walker Lane Shear Zone, east of Tonopah and not far from the Round Mountain gold mine, which has been in production for many years and is owned by industry giant Kinross. Fairchild Gold is thus expanding its Nevada project pipeline with what we believe to be an extremely promising project!

Golden Arrow: Historical Resources and Great Exploration Potential

And we believe this move makes a lot of sense, too. Golden Arrow is an advanced gold and silver project with two core zones, Gold Coin and Hidden Hill. A model prepared by Mine Development Associates (MDA) in 2018, shows historical resources based on more than 361 drill holes (approximately 61 km total length):

- – In the measured indicated categories: 12,172,000 tonnes averaging 0.82 g/t gold and 11.3 g/t silver – approximately 296,500 ounces of gold and 4,008,000 ounces of silver.

- – In the inferred category: 3,790,000 tonnes with 0.45 g/t gold and 11.3 g/t silver – approximately 50,400 ounces of gold and 1,249,000 ounces of silver.

(Important: The information is considered historical. The Qualified Person (QP) has reviewed the data but has not converted it to a current NI-43-101 status. Fairchild Gold therefore does not treat the estimate as current.)

Geologically, Golden Arrow is located on the western edge of the Kawich Caldera in a volcanic field. Epithermal gold-silver systems with structural control are typical – a setting that allows for large-volume disseminated mineralization as well as higher-grade veins. In addition to the known resource bodies, there are several larger target areas and step-out opportunities that have only been tested to a limited extent to date.

Advanced permitting process

Another advantage of Golden Arrow is its existing permitting base: a previous plan of operations and an environmental assessment by the US Bureau of Land Management already allow for up to approximately 73 kilometers of drilling. This will enable Fairchild Gold to fairly quickly start a planned work program – from geological mapping and sampling to geophysics and step-out drilling at Gold Coin and Hidden Hill, as well as in previously little-explored areas in the south and west of the property.

The initial focus will be on consolidating historical data collected over decades by several large mining companies. The aim is to refine the modeling and systematically test possible extensions of the resource bodies. At the same time, potential new target horizons will be evaluated in the Walker Lane Shear Zone – a trend that has been synonymous with robust gold production for years and where the nearby Round Mountain Mine serves as a reference.

Team Reinforcement and Classification for Fairchild Gold

To support the implementation of these plans, Fairchild Gold is appointing mining engineer Guy Lauzier as Technical Director for Golden Arrow to the Technical Advisory Board. Lauzier brings decades of experience from technical leadership roles at Barrick, Newmont, Agnico Eagle, and Teck – from feasibility studies to mine development to the operation of larger projects. The appointment is intended to accompany the next project phase with clear technical standards.

Milestone in Fairchild Gold’s Nevada Strategy

From a corporate perspective, the planned acquisition of Golden Arrow marks a significant milestone in Fairchild Gold’s Nevada strategy. The combination of historical resource base, approved drilling quota, and location in a productive district points to rapid further exploration of the project.

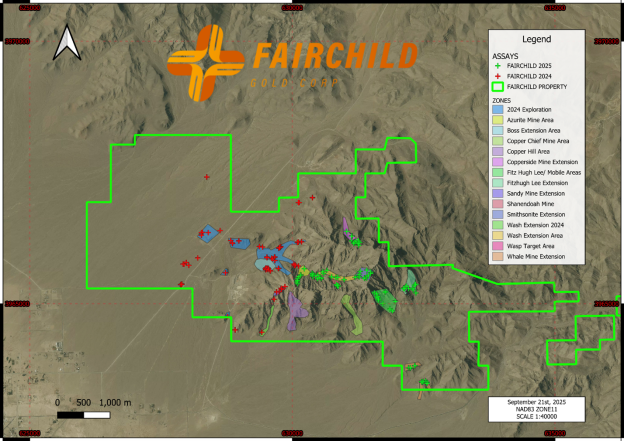

In addition, the company is exploring the Nevada Titan project in Clark County, Nevada, just 45 minutes southwest of Las Vegas. The company is following clear geological indications – including an identified breccia pipe and a 1.5-kilometer-long copper corridor – with a structured work program that is expected to run until 2026. The focus is on copper as a key commodity, associated metals such as gold and silver, and other critical minerals.

The Nevada Titan property encompasses a historic mining district with more than 20 small mines whose activities date back 80 to 120 years. Fairchild Gold interprets this cluster of mineralized deposits as the surface expression of a deeper copper porphyry system with skarn-related occurrences. The central component of this working hypothesis is a hydrothermal breccia pipe: in comparable deposits, such “pipes” form vertical ascent pathways for mineralized fluids and may indicate a magmatic heat source at depth – i.e., the potential “engine” of a porphyry system.

Mapping and sampling already indicate the potential. Individual surface samples yielded strikingly high copper grades: up to 34.0% copper (Copperside area), 26.5% copper, and 22.6% copper (including Fitzhugh Lee Mine) were detected. In addition, gold (up to 1.27 g/t) and silver (up to 134 g/t) were measured; PGEs (platinum group elements), cobalt, and antimony occur in parts. The mineralization occurs in pods and lenses, making delineation at depth a key issue for the next phase of the project. Important for classification: Such outcrops are selective and not representative of average ore grades in a potential large-tonnage system – however, they provide clear vectors for further exploration.

Clearly Defined Work Program for Titan

Fairchild Gold’s program at Nevada Titan is also divided into clearly defined steps. The first step is structural mapping based on high-resolution drone data (DEM) and geochemistry, including portable XRF analysis. This will be followed by drone magnetics (scheduled for late September/early October 2025) to outline structural zones and possible intrusive bodies. IP (induced polarization) measurements are planned for the fourth quarter of 2025 through the first quarter of 2026, which can specifically map sulfide conductivity anomalies – often a useful marker in porphyry environments.

In parallel, the company plans to integrate all data using AI-supported methods (starting in 2025/26) to prioritize exploration targets. Based on this, the final target definition for the first phase of a drilling campaign is expected to be made in early Q2 2026. In addition, management is working on an early, focused initial drill hole in the transition from late third to early fourth quarter 2025 – in the near future! The company considers this drill hole to be the first robust test of the porphyry thesis and thus potentially the next important short-term catalyst in the course of the project!

With Golden Arrow, Fairchild Gold now also has an advanced gold-silver project in its portfolio that, in our opinion, perfectly complements the copper-dominated Nevada Titan project, which has not yet been explored in as much detail. In the current market environment, which has recently been very positive for copper and especially for gold and silver, we believe the company now has two extremely hot irons in the fire!