Analysts at BMI, a unit of Fitch Solutions, are cautiously optimistic about the metal and mining year 2026. The experts expect most metals to achieve higher average prices than in 2025 – driven by an easing of tariffs, structural demand from the energy transition and tight supply sides. At the same time, the risk of volatility and growth disappointments, particularly in China, remains a central issue.

Metals: More stable economy, less tariff anxiety, more energy transition demand

According to BMI’s year-end report, the global economy is likely to stabilize further in 2026, while trade policy tensions will ease compared to 2025. The analysts expect the average prices of many metals to be higher in the coming year than in the previous year.

The uncertainty surrounding new tariffs peaked in August 2025. Although further conflicts between the US and individual economies are conceivable, BMI expects a gradual easing over the course of the next year. This would generally support demand for raw materials – even if individual metals could once again become the target of US trade policy.

The focus here is on copper: By June 30, 2026, the US Secretary of Commerce is to assess the domestic copper market and decide whether to introduce a general import tariff of 15% on refined copper from 2027, which could rise to 30% from 2028. Such measures could shift trade flows and exacerbate regional bottlenecks – with corresponding consequences for copper prices.

On the demand side, the situation remains divided. China’s ailing real estate sector continues to have a dampening effect on the consumption of classic industrial metals such as steel components, copper and aluminum. At the same time, BMI analysts point to robust development in sectors of the “green” transformation: grid expansion, electromobility, renewable energies and storage applications are driving the demand for critical metals such as copper, aluminum, lithium and nickel.

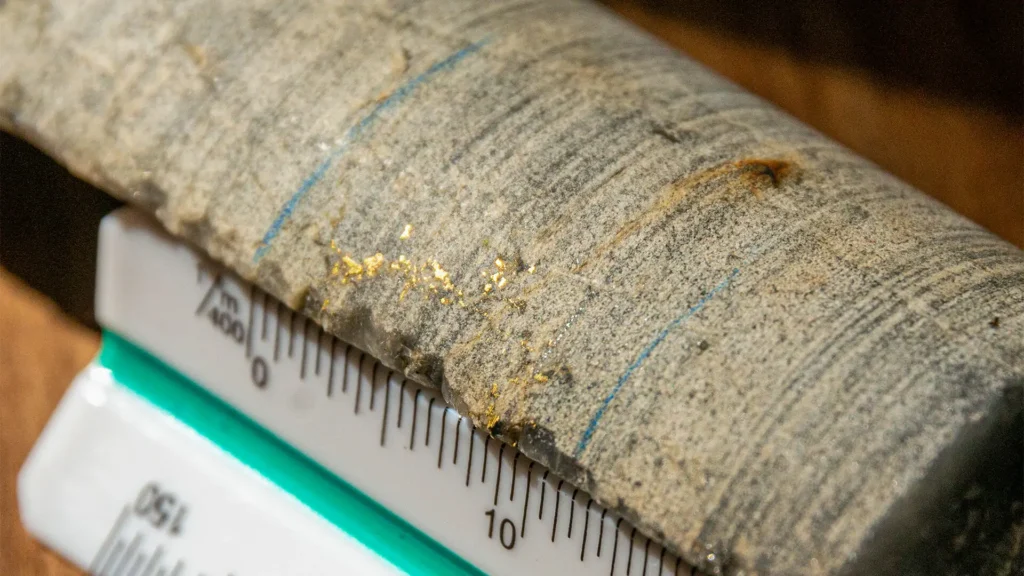

Precious metals: Gold benefits – but rally could lose its shine from the third quarter

BMI also expects precious metals – and thus in particular gold – to have higher average prices in 2026 than in the previous year. The drivers remain low real interest rates, high government deficits, geopolitical tensions and continued central bank purchases. However, the analysts see an increasing probability that the gold rally will lose momentum in the course of the year.

The reason: Global monetary policy is already in the middle of an easing cycle that began in 2024. BMI expects the US Federal Reserve to gradually slow down and ultimately pause interest rate cuts over the course of 2026. In this environment, the gold price could fall below the mark of 4,000 US dollars per ounce in the later course of the year, according to the analysis.

Another factor is the US dollar. The experts expect the dollar index (DXY) to fluctuate within a range of approximately 95 to 100 in 2026, but without the strong fluctuations of 2025. Should the US economy perform better than expected, the dollar could even gain slightly – a scenario that would limit the scope for further price increases for both industrial and precious metals.

BMI emphasizes that the risks for metal price development overall remain more downward-oriented. Decisive uncertainties are global demand development and in particular growth in China, the largest consumer of industrial metals. The continuing weakness of the Chinese real estate sector remains a potential burden for a broad range of metals.

Critical metals, industrial policy and new alliances

The analysts expect Western countries to further expand their investments along the value chains of critical raw materials in 2026 – both in their own country and in resource-rich regions. Industrial policy has become the central adjusting screw to achieve security of supply for critical metals.

This includes not only metals such as copper, lithium, nickel and rare earths, but also the infrastructure for their further processing. BMI expects that increasing emphasis will be placed on local value creation, particularly in regions such as Africa. Resource nationalism remains an issue, but governments and local communities today have more bargaining power. In view of the intense competition for critical raw materials, international mining companies have little scope to evade national requirements and new mining rules.

The increasing strategic importance of metals in the energy transition and in high-tech sectors is also likely to strengthen cooperation between mine operators and end users. BMI expects that projects will increasingly benefit from partnerships with companies from the technology, automotive and aerospace industries – for example through offtake agreements, joint ventures or direct investments. The background to this is the threat of bottlenecks that could slow down growth in areas such as AI, robotics, defense or battery technology.

M&A in the commodities sector: Focus on critical metals and controlled risk

At the corporate level, BMI expects M&A activity in the metal and mining sector to remain strong. The race for critical minerals is accelerating, and many companies are prioritizing transactions that strengthen their commitment to raw materials with high strategic importance – above all copper, lithium and rare earths.

Although large-scale projects in the capital sector remain an issue, the report sees an increase in “risk-averse” developments: more gradual expansions of existing assets, modular project phases and cooperations that distribute investment risks more broadly. At the same time, BMI expects mining investments in so-called frontier markets to continue to increase in 2026. These markets often offer geologically attractive deposits, but are associated with higher political and regulatory risks.