American West Metals (ASX: AW1; OTCQB: AWMLF; WKN: A3DE4Y) is intensifying its engagement with potential US shareholders. As reported today, the company’s shares are now qualified for trading on the OTCQB Venture Exchange, increasing its reach and visibility in North America. In parallel, management emphasizes its US-focused strategy for the West Desert Project in Utah, which is said to host one of the most significant indium resources in the USA and also contains a gallium component that American West now intends to investigate further. In light of the political debate surrounding critical minerals and recent export restrictions from China, American West Metals is thus gaining attention from institutional and private investors in the United States.

American West Metals: OTCQB Listing Strengthens Access to US Investors

With the ticker symbol AWMLF on the OTCQB, US market participants can now trade American West Metals significantly more easily. This opens up a broader network of North American retail and institutional investors for the company, while research and media coverage typically increase. The timing is strategic: In the USA, attention to critical raw materials and their supply chains is growing, from raw material extraction and processing to the technology and security industries.

Management points out that this step improves the capital market position with regard to future financing and partnership options. Furthermore, American West Metals is examining additional measures to increase visibility in the USA – including a possible listing on NASDAQ or NYSE. According to the company, unsolicited inquiries have already been received from US investors who wish to position the story as an “All-American” provider of critical minerals.

West Desert in Utah: Indium Resource and Gallium Targets in Focus

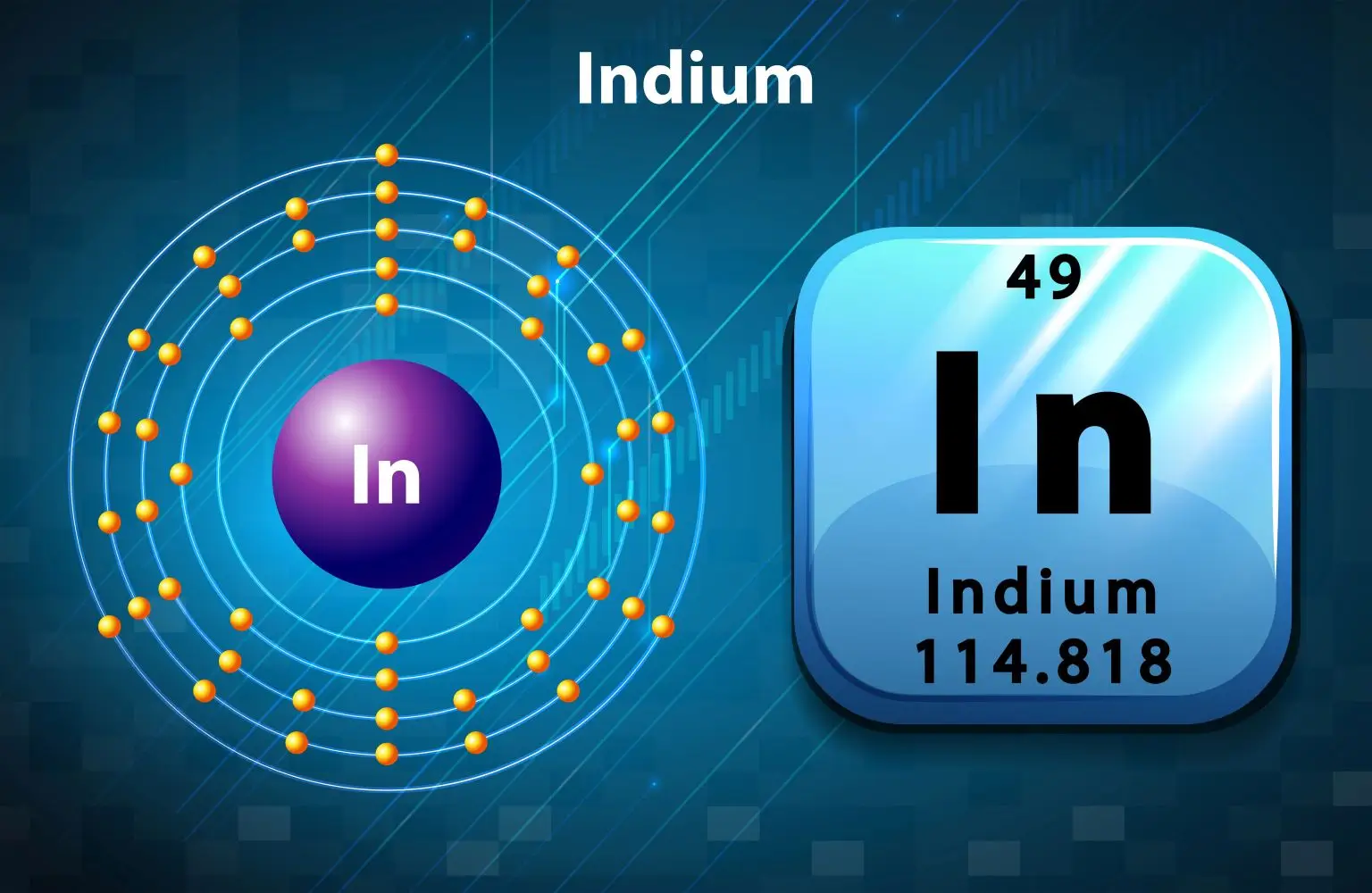

Central to American West Metals’ operational US focus is the 100% owned West Desert Project in Utah. The deposit includes, in addition to

Against the backdrop of geopolitical tensions and supply chain risks in parts of the raw material value chain, West Desert is moving into a key role for US raw material security. American West Metals emphasizes that the project could help underpin domestic supply routes for indium and potentially gallium – raw materials classified as critical in the USA. The combination of resource size, metal mix, and location within an established mining region in Utah also facilitates engagement with local stakeholders, authorities, and potential off-takers.

From the company’s perspective, the focus is on further refining the project parameters of West Desert – from geology and resource definition to permitting and infrastructure issues and metallurgical studies. Relevant for investors are classic milestones such as updated resource estimates, technical assessments (e.g., scoping/PEA studies), and potential off-take or development partnerships with industry players. The strong demand from US investors for projects with indium and gallium leverage, mentioned in the update, underscores that American West Metals is working with West Desert in an area prioritized by policy and the market.

Conclusion: American West Metals combines a US-centric raw material strategy with capital market measures to expand investor reach. The OTCQB launch (AWMLF) improves tradability for US investors, while West Desert in Utah gains profile as a potential domestic building block for indium and gallium.