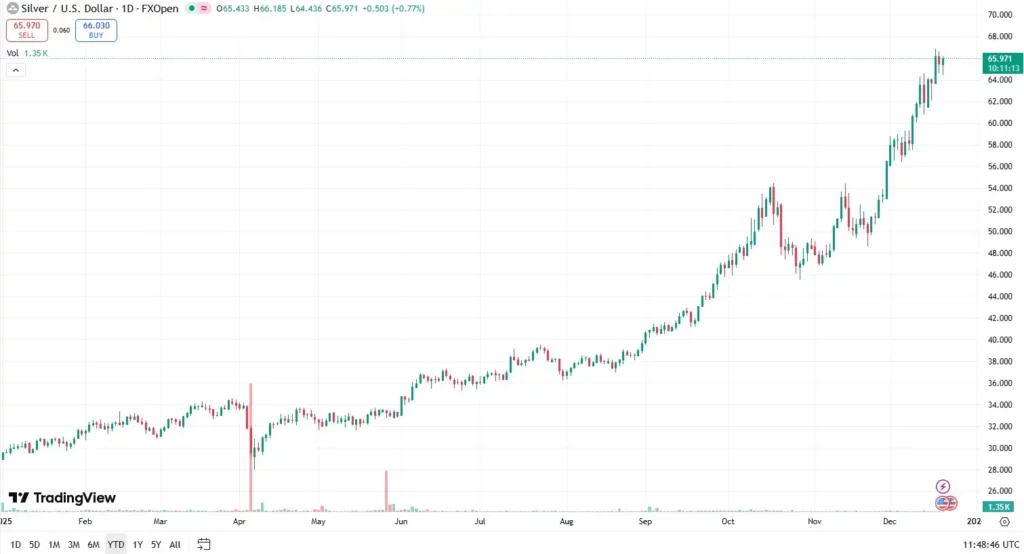

Silver is the strongest focus at the end of 2025 as it has been for decades. Driven by massive investment demand, its classification as a critical raw material in the USA and sustained speculative interest, the silver price has marked a new all-time high. For the first time, silver climbed above the 65 US dollar mark per ounce and even peaked at 66.87 US dollars. This means that the price of the precious metal has more than doubled since the beginning of the year – an increase of over 120 percent – and even clearly beats the impressive rally of the gold price.

Silver reaches record high and clearly overtakes gold

While gold as a classic safe haven has gained around 65% in value in 2025, the development of silver is even more dynamic. The spot price broke through the threshold of 65 US dollars per ounce for the first time this week and, according to LSEG data, has delivered the best annual performance since records began in the early 1980s.

Market observers see the recent rise in silver primarily driven by investor money. In addition to a fundamental tailwind – such as a sustained supply deficit – short-term capital flows play a central role. Rhona O’Connell, Head of Market Analysis at broker StoneX, describes the current phase as heavily investment-driven: Fundamentals support the trend, but daily price movements are significantly influenced by capital inflows and speculative positioning.

This makes it clear that silver is now perceived not only as an industrial raw material, but increasingly as an investment vehicle again – in competition and at the same time in addition to gold.

Industrial demand strengthens the fundamental basis of silver

The recent rally in silver is not taking place in a vacuum. On the fundamental side, there has been a supply deficit for some time, while demand from key sectors of the energy transition and digital economy continues to increase.

Silver is being used increasingly in photovoltaics, the automotive industry – especially in electric vehicles – as well as in the infrastructure surrounding data centers and artificial intelligence. In solar cells, for example, silver is a central component of the conductor tracks, and although the silver content per module has been reduced over the years, the global growth of installed capacities more than compensates for this effect.

Demand is also increasing in the field of electromobility: Electric vehicles require significantly more silver than vehicles with combustion engines, including in power electronics, battery management, high-voltage components and charging infrastructure. At the same time, the demand for electricity is growing due to the rapid increase in data centers and AI applications – another trend that structurally supports the demand for silver in electronic components.

In addition, silver, like gold, benefits from an environment of geopolitical tensions and trade conflicts. In such phases, capital traditionally flows more into precious metals, which are considered a store of value and a hedge against political and monetary risks.

Silver as a critical raw material: US policy and global flows

Another driver for silver in 2025 was the US government’s decision to add the metal to the list of critical raw materials. This classification emphasizes the strategic importance of silver for key industries and has immediate effects on trade flows and warehousing.

In the run-up to and after the inclusion in the US criticality list, there were noticeable shifts in the physical market. The concern that silver could be affected by tariffs or export restrictions in the future led to larger quantities being diverted to the USA. As a result, the supply of freely available metal at other important trading venues – especially in London – became scarcer, which contributed to lower liquidity in the spot market and increased upward price pressure.

At the same time, demand from Asia has increased. Analysts refer in particular to purchases from India and China. In China, the strong price development traditionally attracts additional speculative market participants, which is reflected in rising trading volumes and growing open interest on the local futures exchanges.

This combination of political tailwind in the USA, growing inventories in North America and, at the same time, tight inventories elsewhere contributes to the fact that silver is increasingly perceived as a strategic raw material – not only as a classic precious metal.

Outlook: Silver between further rally and high volatility

Looking ahead, analysts paint a mixed but overall constructive picture for silver. Some market observers believe further price increases are possible in the coming year. Nitesh Shah, commodity strategist at WisdomTree, sees a scenario in which silver could rise towards 75 US dollars per ounce by the end of 2026, provided that investment demand remains high, industrial demand continues to grow and global inventories outside the USA remain limited.

Other experts point to the typically high volatility of silver. Historically, the market reacts much more strongly than gold to larger movements – both upwards and downwards. It is pointed out that silver often follows a percentage deviation of gold with a factor of about two to two and a half. This increases the potential for strong rallies, but also the risk of abruptly starting corrections.

With a view to the macro situation, silver remains closely linked to the same factors that also influence gold: expectations of further interest rate cuts in the USA, the development of the US dollar, the global economy and geopolitical tensions. Should the US Federal Reserve continue its course of interest rate cuts and the dollar continue to tend to weaken, this could support demand for precious metals as a whole.

One thing is certain: Silver has impressively returned to the center of the commodity markets in 2025. The combination of structural industrial demand, its new role as a critical raw material and a distinctive investment component makes the metal one of the most exciting objects of observation in the precious metal sector – with considerable movement, but also not to be underestimated risk of setbacks.