Gelogoical models holding up

Since May, the share price of the Canadian silver company Golden Tag Resources (WKN 869423 / TSXV GOG) has roughly halved under the blue downtrend line and reached the previous low of 0.085 Canadian dollars for the first time in mid-August. In the following weeks, this level proved to be a massive support and held several times.

While the first breakout above the downtrend line in September was only successful for a short period of time, things are currently looking better – the price has now been trading above this line for two weeks and, fortunately, was also able to reach an even higher top than in September at CAD 0.13.

What is still negative at the moment is the fact that both average lines are moving downwards – at least, the 200-day line seems to have been moving mostly sideways for about a week now.

The MACD indicator, which generates signals very quickly for this stock, is possibly already facing a sell signal again after the buy signal two weeks ago (this would be given if the blue line intersects the red line downward) – this could reflect the rapid consolidation after the recent top. The trend confirmer is clearly above the neutral 100 in positive territory with levels at 110 and is currently horizontal. The Overbought/ Oversold indicator is trading near the neutral midpoint and is currently giving no indication. Interestingly, though, the Chaikin Money Flow shows an outflow of capital from the stock since mid-July (extension in the red zone). This trend has been weakening since September; currently, inflows and outflows balance each other out – the indicator is trading at zero.

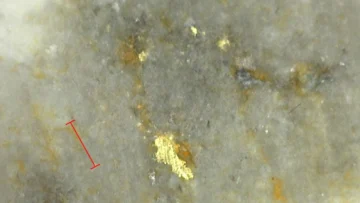

Figure 3: Regional map of the Alpha Gold Project

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, however, any liability for financial loss or the content guarantee for timeliness, accuracy, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

In accordance with §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Golden Tag Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, there is a contractual relationship between Golden Tags Resources as well as Homerun Resoruces and GOLDINVEST Consulting GmbH, which includes that GOLDINVEST Consulting GmbH reports about Golden Tag Resources and Homerun Resources. This is another clear conflict of interest.