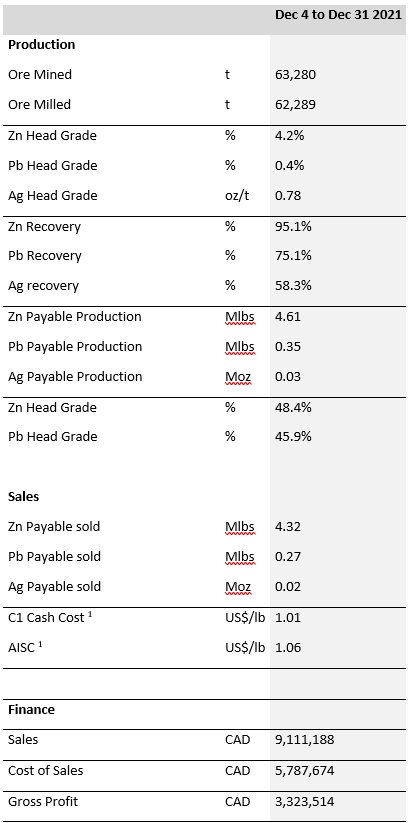

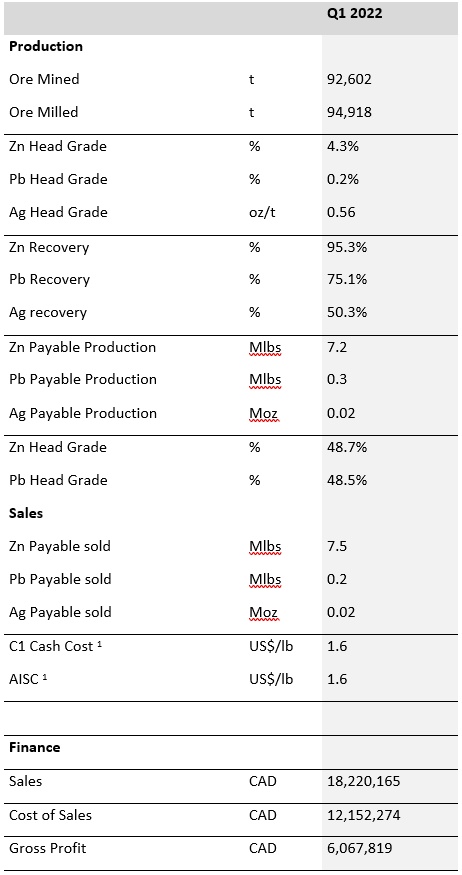

{kanada_flagge}Since acquiring the Santander Mine in Peru on December 3, 2021, Cerro de Pasco Resources Inc. (CSE: CDPR; FRA: N8HP) has generated a total gross profit of CAD 9.4 million through the end of the first quarter of 2022. CAD3.3 million of this profit is attributable to the period from Dec. 4 to Dec. 31, 2021, and another CAD6.1 million to Q1 2022. In Q1, operations had to be shut down for 19 days due to a fatal accident. Otherwise, the figures for the first quarter would have been correspondingly better. In the December period, 62,289 ore were processed. In the first quarter, the figure was 94,918 tons.

New resource at Magistral and Pipe

On January 25, 2022, the Company announced the results of a mineral resource estimate for the Magistral and Pipe deposits at the Santander Project. The Company is currently conducting a 30,750 m exploration and infill drilling campaign at its Santander Mine to increase mineral resources and reserves. In addition, CDPR plans to develop the Santander Pipe ore body by connecting the existing underground mine, increasing the amount of payable zinc equivalent metal and reducing operating costs after two years.

Drilling on Quiulacocha tailings at Cerro de Pasco in Q3

The Company is planning a sonic drilling campaign on its Quiulacocha Tailings at Cerro de Pasco in the third quarter of 2022, which is expected to include 40 short holes. This is expected to result in a 43-101 resource for the Quiulacocha Tailings before the end of the year.

Hydrogen initiative jointly with German Aerospace Center moves forward

On December 15, 2021, Cerro des Pasco partnered with Prof. Bernhard Dold to establish a German company, H2-SPHERE GmbH (“H2-SPHERE”), to develop the large-scale conversion of mineral waste into green hydrogen and other valuable components. The German subsidiary of CDPR, H2-SPHERE GmbH is expected to announce the results of the study report with the German Aerospace Center (DLR) m September 2022. DLR is Germany’s aerospace research center; the research will be conducted by the Institute for Future Fuels, Department of Solar Chemical Process Development, recently established by DLR to prioritize the development of chemical storage systems (fuels, i.e., green hydrogen). The report will develop optimal techniques for converting mining waste into green hydrogen and other byproducts. In the second phase, the company will conduct laboratory tests, culminating in a template for industrial production.

Santander Highlights Dec. 4 to Dec. 31, 2021

Santander Highlights First Quarter 2022

Conclusion: Cerro de Pasco has made a very good transition to producer despite a fatal accident at the Santander Mine. The high zinc price provides excellent margins. Revenues are benefiting the further development of the Santander Mine. In particular, the underground development of the second higher-grade Pipe ore body will sustainably improve productivity in the coming years. In all this, it should be remembered that Cerro de Pasco acquired the Santander project at the bargain price of CAD1 million and 10 million shares, and the seller thankfully left Trevali with some CAD7.5 million cash in its coffers. Trevali will receive a 1 percent net smelter royalty.

In all this, Cerro de Pasco has not lost sight of its main asset “Cerro de Pasco”. Finally, the drilling permits for the Quiulacocha tailings are in place, so drilling can start in Q3. It is expected to be one of the shortest and most efficient exploration programs ever. 40 holes of 40 meters each are expected to be sufficient to determine how much metal – gold, silver, copper and zinc – has accumulated in the tailings over the past 100 years of mining. Determining this resource should be a transformative moment for Cerro de Pasco, as the benefit of a resource that does not require mining is evident. Cerro plans to hydraulically pump the tailings and transport them away in a pipeline for processing. At this point, at the latest, there are likely to be new discussions with Glencore, its well-known neighbor, which has huge processing capacity but no longer has a “social license” to extract fresh material from the open pit. It will be an exciting fall for Cerro de Pasco. We are looking forward to it.

Disclaimer: The contents of www.goldinvest.de and all other used information platforms of the GOLDINVEST Consulting GmbH serve exclusively the information of the readers and do not represent any kind of call to action. Neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice, but rather represent advertising / journalistic texts. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities involves high risks, which can lead to the total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

According to §34 WpHG we would like to point out that partners, authors and/or employees of GOLDINVEST Consulting GmbH may hold or hold shares of the mentioned companies and therefore a conflict of interest may exist. Furthermore, we cannot exclude that other stock exchange letters, media or research firms discuss the stocks we discuss during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, between the mentioned companies and GOLDINVEST Consulting GmbH directly or indirectly a consulting or other service contract may exist, which may also cause a conflict of interest.