Rocket Lab and AST SpaceMobile to benefit from this development

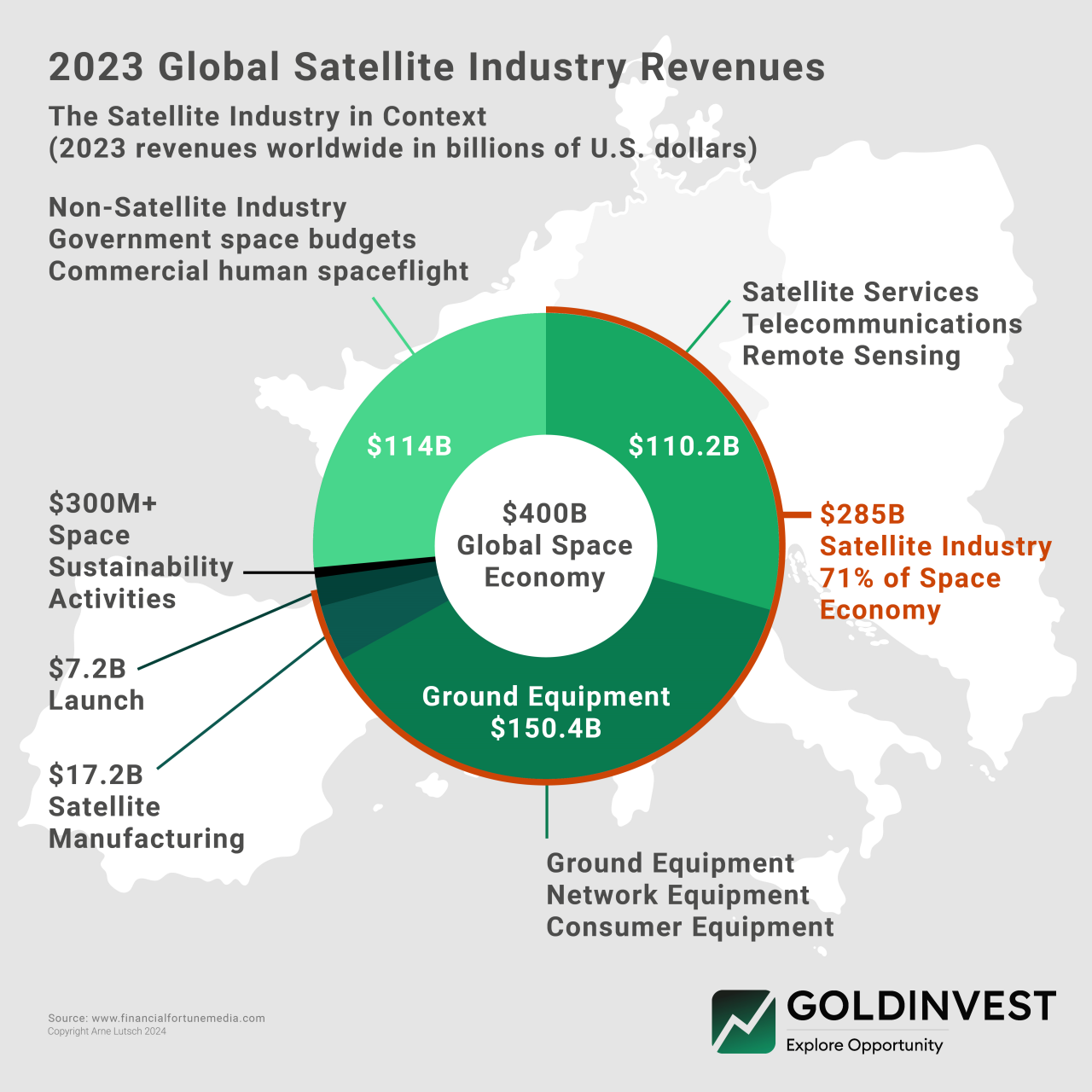

The corporate strategy of Rocket Lab (NASDAQ: RKLB, WKN: A3CY7P) is not only to develop individual modules of the space business, but to cover all components of the value chain from the launch of rockets to data management from space. AST SpaceMobile (NASDAQ: ASTS, WKN: A3CL8W), on the other hand, is pursuing the goal of eliminating dead spots from our everyday lives by providing a satellite-based connection system that is easily accessible for every cell phone. At first glance, both sound like expensive ambitions and a narrow market. But this impression is wrong, because space is currently being developed as a business location and the space economy is expected to grow to a volume of 1.8 trillion US dollars in the next ten years.

The space economy is thus approaching a new frontier. It makes it clear that technologies based on satellites and rockets will not only be used more and more frequently but will also generate desired profits. If it were otherwise, state-subsidized research would continue to be carried out in space, but no one would think of developing and expanding an industry that could grow to a volume of 1.8 trillion US dollars by 2035.

This development is possible because modern space technologies are now so broadly positioned that they offer a wide range of benefits to many interest groups. These stakeholders include traditional sectors such as retail, consumer goods and lifestyle products. However, supply chains, the transportation industry and civil protection also benefit from services from space.

Falling costs are a strong driver

Falling costs are a driving factor in this development. They increase the accessibility of these technologies and thus boost their universal use. It is therefore to be expected that space technology will influence and change our lives over the next ten years to a similar extent as computers did in the 1980s, the internet in the late 1990s and the smartphone from 2007 onwards.

The estimate that the industry will grow to 1.8 trillion US dollars by the middle of the next decade comes from the World Economic Forum, which, in close collaboration with McKinsey, has produced a comprehensive study outlining the most important developments for space and related sectors over the next ten years.

This report was written not only by experts from the space industry itself, but also by specialists from other sectors. This made it possible to draw a detailed picture of both the development of space technology itself and its impact on other sectors.

Four main lines of development are emerging

Four main lines of development are emerging. The first is that space travel will make up an increasingly large part of the global economy. This can be seen in the strong annual growth of the industry, which was “only” worth 630 billion US dollars in 2023, but is expected to grow by nine percent annually to 1.8 trillion US dollars by 2035. The strong drivers of this growth will be space-based technologies such as communication, positioning, navigation, time measurement and earth observation, i.e. the business areas with which Rocket Lab and AST SpaceMobile also want to earn their money.

A second important line of development will be that the impact of the various activities in space will increasingly extend beyond space itself. This will happen by increasingly combining services such as transportation apps with technologies from space.

In space itself, the focus will increasingly be on connecting people and goods with each other. This is the third line of development that will come into play. Experts expect the five sectors of supply chain and transportation, food and beverage, retail, defense and digital communications to account for around 60% of the total global space economy by 2035.

However, it is not only these areas that will benefit from space. Technology from space will also play an increasingly important role in overcoming global challenges such as disasters and humanitarian measures. The return on investment in space travel will therefore not only be financial, but will go far beyond this aspect.

The number of launches is rising rapidly, while costs are falling massively

Space is becoming increasingly attractive thanks to falling launch costs, which Rocket Lab in particular wants its customers to benefit from, and ongoing commercial innovations such as those being pursued by AST SpaceMobile. This development has been apparent for several years, because while the number of satellites launched each year has increased by 50%, launch costs have fallen tenfold in the last twenty years. Lower costs are enabling more launches, so that both effects are mutually beneficial.

The costs for data traffic have also fallen. They are crucial for connectivity and are what make satellite calls, such as those offered by AST SpaceMobile, possible and affordable. In addition, the technology for mega-rockets will be developed and generally available by the early 2030s. This will again significantly reduce launch costs, which should further boost growth in the industry.

Investments have already risen to new all-time highs of more than 70 billion US dollars in 2021 and 2022. But this is just the beginning, as experts estimate that the market for space tourism alone will grow to around four to six billion US dollars by 2035. The lion’s share of this income is expected to come from stays in space by wealthy individuals and from people on board space stations.

This makes it clear that, like the internet around 30 years ago, space travel has the potential to fundamentally change our world. Rocket Lab and AST SpaceMobile are two of the very early pioneers who have set themselves the goal of benefiting from this exciting development right from the start.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents are exclusively for the information of the readers and do not represent a call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they are in no way a substitute for individual expert investment advice and do not constitute an offer to sell the discussed stock(s) or a solicitation to buy or sell securities. It is expressly not a financial analysis, but a promotional/journalistic text. Readers who make investment decisions or execute transactions on the basis of the information provided here do so exclusively at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities is associated with high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

Pursuant to §34b WpHG and §48f Abs. 5 BörseG (Austria) we point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares in Ucore Rare Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Ucore Rare Metals for reporting on the company. This is another clear conflict of interest.