Reminiscent of the 3D survey published by Hercules Silver

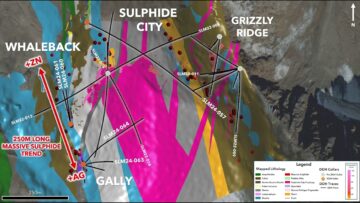

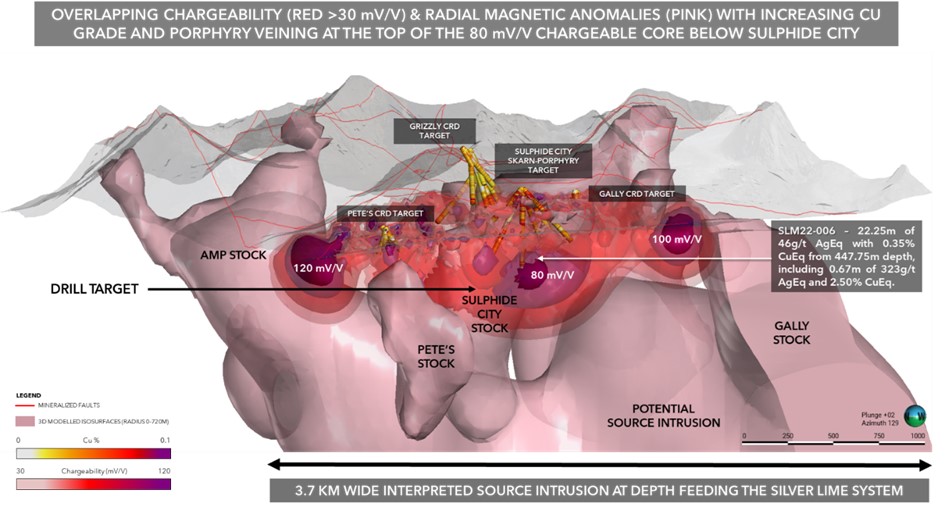

A picture is worth a thousand words, they say. That’s even truer of the new imaging geophysics Core Assets Corp. (CSE:CC; FSE:5RJ; OTC.QB:CCOOF) is using for the first time to plan this year’s drill program at its Silver Lime CRD porphyry project in the central Blue property in the Atlin Mining District of northwestern British Columbia. The new model shows the spectacular interpretation of a three-dimensional magnetic vector inversion model where the suspected source intrusion is clearly visible for the first time. The 3D model suggests that the Sulphide City Mo-Cu porphyry target is connected to a larger magnetic body ~3.7 kilometers wide that feeds at least three additional porphyry stocks beneath the Pete’s CRD and AMP targets and south of the Gally CRD target (Figure 1).

The integrated interpretation of all geophysical survey data is in exact agreement with the findings of previous drilling. In 2022, drill hole SLM22-006 at Sulphide City reached a depth of 471 meters and showed significant porphyry-style alteration, veining and elevated molybdenum (Mo) and copper (Cu) grades at approximately 315 meters depth. Grades near the EOH returned up to 2.50% CuEq. We will commence drilling to test the Sulphide City Mo-Cu porphyry stock (80 mV/V) (Figure 1) and potential source intrusion. Drilling is scheduled to commence this week at the Silver Lime CRD porphyry project. Core Assets plans to drill up to 5,000 meters of diamond drilling this season.

Nick Rodway, President & CEO of Core Assets commented, “The overlaps we have observed between our favourable magnetics, highly chargeable and conductive zones, downhole Cu and Mo grades and the current drilled extent of the Sulphide City Mo-Cu porphyry all point to the continuation of the mineralized Sulphide City porphyry to depths in excess of one kilometer. These overlapping data sets indicate the presence of a large, long-lived and multi-stage mineralized porphyry system that feeds the high-grade Silver Lime Skarn and CRM targets. This interpretation is coupled with an improved understanding of our 3D project geology and the structures that served as fluid pathways for the high-grade massive sulphide and epithermal mineralization observed outside the Sulphide City target.”

Conclusion: With its freshly modeled data, Core Assets supports the hypothesis that the near-surface CRM and skarn system found at the Silver Lime project is very likely associated with a deeper porphyry Cu system. In many ways, Core Asset’s findings are reminiscent of the 3D survey published by Hercules Silver (TSXV: BIG) in 2022 that subsequently led to the discovery of the Leviathan Porphyry Copper System in Idaho. It is noteworthy that the values of 80 to 120 mV/V measured by Core Assets are interpreted by experts as extremely high values. “MilliVolt per Volt” is a unit of electrical voltage. It indicates the energy per unit charge between two points in an electric field. This year’s Core drilling campaign will reveal the cause of this anomaly. In the best case a Cu-Mo-rich porphyry body.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish comments, analyses and news on https://www.goldinvest.de. This content is intended solely for the information of readers and does not represent any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, they are in no way a substitute for individual expert investment advice; rather, they are advertising/journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially in the case of penny stocks, involves high risks that can lead to the total loss of the capital invested. GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete. Please also note our terms of use.

In accordance with §34b WpHG i (Germany) and §48f paragraph 5 BörseG (Austria) we would like to point out that clients, partners, authors and employees of GOLDINVEST Consulting GmbH hold shares in Core Assets and therefore a conflict of interest exists. Furthermore, we cannot rule out the possibility that other market letters, media or research companies may discuss the stocks we recommend during the same period. This may result in the symmetrical generation of information and opinions during this period. Furthermore, there is a consultancy or other service agreement between Core Assets and GOLDINVEST Consulting GmbH, which gives rise to a conflict of interest.