Based on LOI with Galaxy Magnesium projected to deliver up to USD 100 million year one annual revenue.

WHY Resources (TSXV: WHY; FRA: W0H) is a unique company among the thousands of resource juniors on the Canadian stock exchange – in more ways than one. Which commodity company can say that 94% of its defined resource consists of valuable products?

For comparison: an average copper mine with a standard copper content of 0.5% has to dump 99.5% of the mined material unused, as there are only 5 kg of copper in one tonne of ore (1,000 kg). At WHY Resources’ Record Ridge project in British Columbia, the ratio is exactly the opposite. 1,000 kg of raw ore contains approximately 430 kg of magnesium oxide (MgO), 420 kg of silica, 90 kg of iron oxide and 2-3 kg of nickel – a total of approximately 940 kg of valuable products with magnesium and silica as the main value. With the initially planned extraction of up to 200,000 tons per year, the project would have a theoretical lifespan of over 200 years. Even then, only a fraction of the 7.5 square kilometer rock formation, which is primarily composed of the same material, would be eventually mined. WHY therefore does not have to worry about the size of its resource.

Straight forward operation resembling a quarry

The planned open pit operation is straight forward and resembles a quarry. The material will be mechanically crushed on site, with no chemical processing on site required, ensuring no tailings will be produced. The First Nations participate as a contractor for project development and mine operations and will benefit. What’s more, the project is only five kilometers from the US border. The distance to the two ports of Vancouver and Seattle is 400 km each. From there, the prospective off-taker Galaxy Magnesium, a private US based company, intends to ship the raw ore offsite where it will be refined into various end products. Based on a formal letter of intent, WHY Resources expects to receive USD 500 per delivered ton of raw ore. This would correspond to an annual turnover of USD 100 million. The planned EBIT is expected to be USD 72 million in the first year of production and increase to USD 92 million thereafter. This is in comparison to a capex of just USD 25 million, of which USD 10 million is earmarked for the road. Payback would therefore be possible in less than a year.

Doesn’t that sound almost too good to be true? Why, if WHY Resources is so promising, is the company not better known? Why is the company’s market capitalization at CAD 25 million? There are several reasons for this. First of all, the saying “Magnesium is probably the most important mineral you’ve never thought about” probably applies. Who knows that modern steel production is inconceivable without magnesium oxide? Who is aware of the many other uses, including magnesium-based metal alloys, which are used for the lightweight construction of (military) vehicles? At 30 million tons per year, the market is very manageable and is firmly in Chinese hands. 90% of the world’s commercially mined magnesium comes from China. How is a western mining company supposed to compete? The answer lies in the special geological nature of the resource, which gives WHY a unique advantage.

WHY Resources’ Record Ridge project avoids CO₂ emissions and is amenable to recyclable chemistry

The most common source of MgO production in China and globally is magnesite (MgCO₃). The primary method for producing MgO is through the calcination of magnesite, where it is heated to high temperatures to decompose into MgO and CO₂. (Link to FTM on magnesite ore processing) Magnesite contains about 24% Mg and roughly 40% MgO by weight, and the remaining 60% of the ore consists of CO₂ and other impurities. So, when magnesite is processed to produce MgO, 60% of the material becomes waste. To provide more details: the CO₂ constitutes approximately 52% of the mass of MgCO₃ (since MgCO₃ has a molar mass of 84 g/mol, with 44 g/mol being CO₂). All CO₂ is released as gas during calcination. The remaining 8% consists of other impurities that do not contribute to the MgO output.

But the resource of WHY Resources’ Record Ridge project is not Carbon but Silica based. Therefore the processing of the materials is amenable to using recyclable chemistry in the form of Chloride leaching which has been developed in the past ten years. This is where the true competitive advantage of WHY Resources lies and why the project actually can compete with Chinese supply. The WHY material not only allows for more value-add products (94% vs. 40%) but it also allows for a much smaller environmental footprint with superior ESG-credentials and ultimately much lower operating cost.

Approval process nearing completion after more than 10 years

However, there is an even more important reason why WHY Resources has not been able to collect many laurels on the stock market. The permitting process for the “quarry” described above has dragged on for more than a decade. This is hard to imagine, but it speaks volumes about the priorities of western countries (including Canada). The Nimby policy is always convenient as long as nobody is bothered by the dependence on China. Due to geopolitical developments, a rethink is probably taking place here. The engineering for the road is already underway. If the permit is granted in time, construction could start as early as August this year! The contractor responsible has already indicated that, if necessary, the entire 200,000 tons could potentially be mined and stockpiled before the onset of winter. The off-taker, who understandably can only give a final commitment after permit approval, has repeatedly emphasized in discussions with WHY management that he is still very interested in the ore delivery despite the delays.

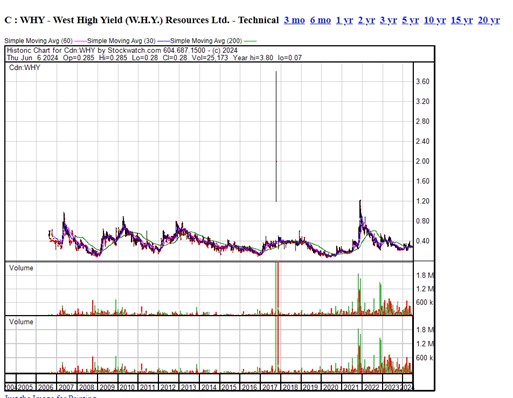

Figure 1: The chart of West High Yield going back 18 years says a lot about the company. Few companies in the junior space survive this long and stay on a project this long – and under the same CEO to boot. The company was never rolled back. At current levels, the company is trading at just its long-term average price.

Summary: West High Yield’s advanced Record Ridge project in British Columbia is a true sleeper. Management has preserved the project for years against all odds and quietly developed it to production readiness. The decisive turning point for the company will be the due approval of the mining permit by the authorities. When WHY succeeds in securing a definitive off-take agreement, financing the project should no longer be an insurmountable hurdle. USD 25 million may not be small change, but it is not a huge amount given the return on investment. In addition, many different forms of financing are conceivable, including hybrid models with long-term loans and equity. If everything goes according to plan, WHY Resources could still catch the window for the start of production this year. If all this comes together, WHY could become a stock market star practically overnight after 18 years of latency despite the niche commodity MgO and make an important contribution to reshoring in the long term. After all, all of the mined raw materials are on the list of strategically important raw materials. In the long term, WHY Resources has the vision of building its own chemical plant in North America, but that is still a ways off. For the time being, we are concentrating on the pending approval and the subsequent off-take contract. We will follow the company’s development closely from now on.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in WHY Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by WHY Resources for reporting on the company. This is another clear conflict of interest.