Major step forward

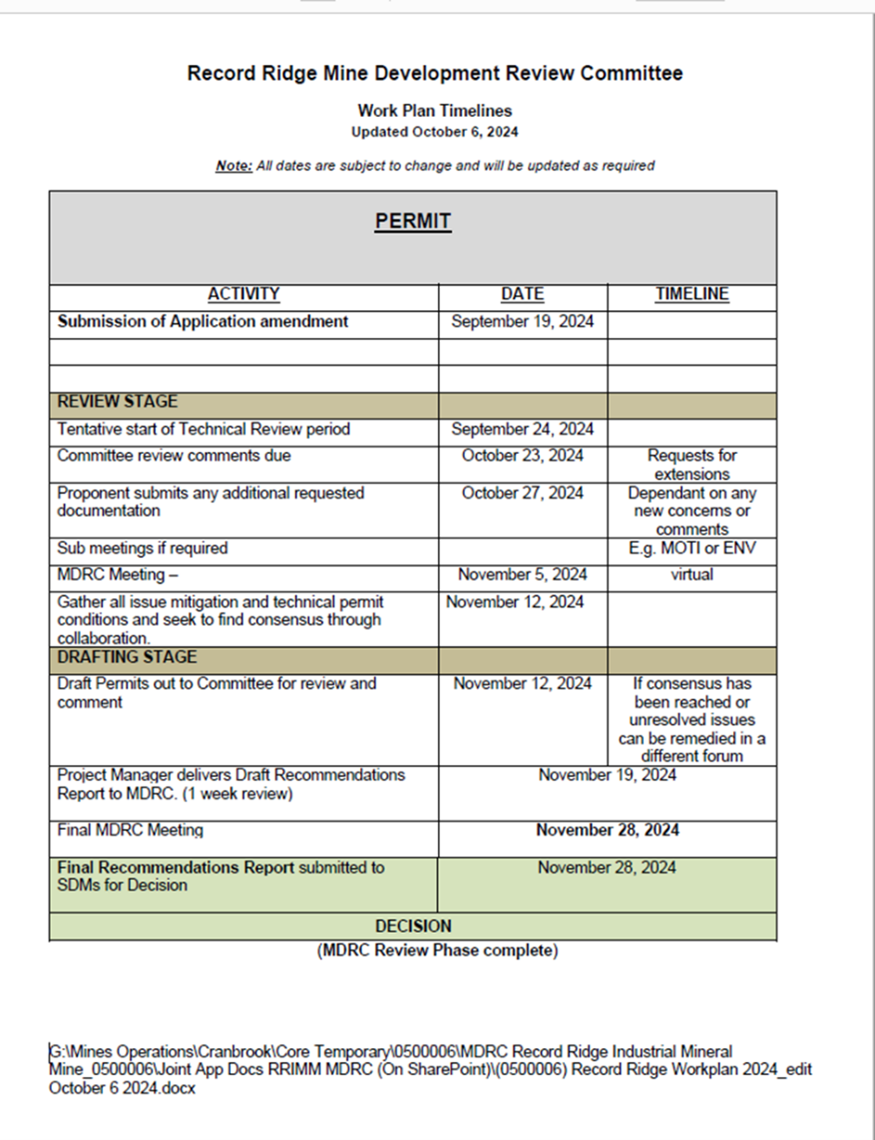

The approval process for West High Yield Resources Ltd.’s (TSXV: WHY; FRA: W0H) Record Ridge industrial mineral project in British Columbia is nearing a successful conclusion. The company has recently received a detailed written schedule for the approval process from the British Columbia Ministry of Energy, Mining and Low-Carbon Innovation (EMLI). According to the schedule, the Review Committee intends to make a final recommendation on November 28, 2024. While the dates are subject to adjustements, WHY Resources remains optimistic that the process is on track to secure permit approval in early December 2024. WHY Resources has recently taken a major step towards meeting the authorities’ requirements by reducing the future production from 200,000 tpa to 63,500 tpa. This step, in particular, eliminates the need for the costly and time-consuming environmental assessment.

Figure 1: Record Ridge permitting schedule. The responsible panel is expected to make its final decision at the end of November.

West High Yield continues to collaborate closely with the project stakeholders and regulatory agencies to ensure that the approval process proceeds efficiently.

Conclusion: The Record Ridge industrial mineral project in British Columbia is outstanding from a technical perspective: For every 1,000 kg of raw ore processed containing approximately 430 kg of magnesium oxide (MgO), 420 kg of silicon dioxide (SiO2), 90 kg of iron oxide and 2-3 kg of nickel, a total of approximately 940 kg of valuable products, with magnesium oxide and silicon dioxide as the primary products, are produced.

What makes the resource at Record Ridge unique is that it is silica based, unlike most magnesium projects, which are carbon-based. This distinguishes Record Ridge from the most common source for MgO production in China and worldwide, where the primary source material is magnesite (MgCO₃). The standard method of producing MgO involves calcining magnesite, which requires heating it to high temperatures to break it down into MgO and CO₂. Magnesite contains about 24% Mg and about 40% MgO by weight, with the remaining 60% of the ore consisting of CO₂ and other impurities. So, when magnesite is processed to produce MgO, 60% of the material becomes waste. In contrast, 94 percent of the material mined at Record Ridge can be recovered as valuable products. The anticipated permit should have a significant effect on WHY Resources’ valuation, as the project would finally become bankable once the permit is secured.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in WHY Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by WHY Resources for reporting on the company. This is another clear conflict of interest.