{kanada_flagge} In nature, swarms offer protection from predators because the sheer mass of the animals and their rapid change of direction confuse the attacker. A swarm is not meant to attack predators in turn. But this is exactly what is happening on the stock exchanges.

The attacking swarm in this case are the many small investors, the attacked predators the hedge funds, which are being fought with their own weapons when they have sold shares short in anticipation of falling prices. Mass coordinated buying leads to what is known as a short squeeze, in which the shares in question become extremely expensive when institutional investors have to stock up. Mass buying and short squeeze together create new, unprecedented swings in the stock market.

On the online forum Reddit and its amplifying social media channels, a huge mass of private investors is organising itself – always with the active assistance of Twitter follower millionaires like Elon Musk etc. This global Reddit swarm prefers to use the sub-forum “Wallstreetbets” and in recent weeks has driven up the bankrupt stock Gamestop (NYSE: GME) to an unimaginable USD 30 billion market value (today still USD 22 billion) and now seems to have set its sights on the price of silver as a new target. In the case of Gamestop shares, the clockers had issued a target price of USD 420.69. This price was even briefly exceeded thanks to the short squeeze. The watchword for silver is now: from 25 USD to 1000 USD! On Friday, prices of up to USD 30 were promptly reached. This is reminiscent from afar of the Hunt brothers’ enterprise in the mid-70s, who wanted to corn the silver market. Only in the digital age everything is happening much faster and more explosively and also more vociferously. For already voices are coming forward that the attack on the silver price could in turn be a feint by the hedge funds. Are the predators hitting back?

The timing for a short squeeze in silver shortly after the announcement of an American energy turnaround by the new US President Biden could be strategically well chosen. Biden’s policy should boost real silver demand, as many renewable technologies need silver. However, very few silver speculators are currently even thinking about the consequences for the real economy. They want to make as much money here and now as quickly as possible. The shares of silver producers, which have a high short share, are particularly suitable for this. We show here a current overview by Cormark Securities.

Figure 1: List of top short positions for silver companies with US listing, source Cormark Securities Inc.

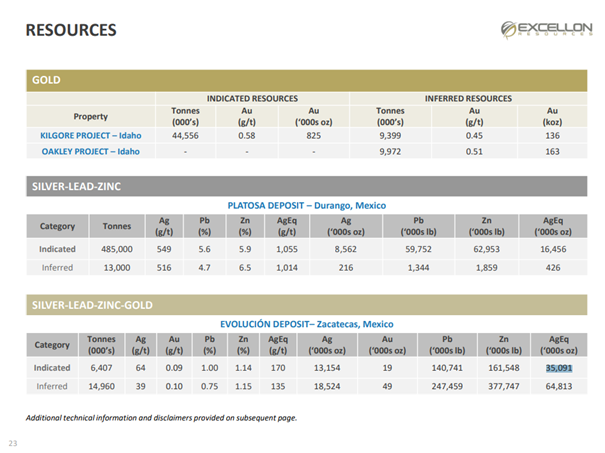

It is not surprising that First Majestic (TSE: FR; NYSE: AG), with 23 per cent short interest, already broke out violently to the upside on Friday. More is likely to follow, as First Majestic already hit $30 in pre-market trading. Excellon Resources (TSE: EXN; NYSE: EXN), in second place on the Cormark list, has less short interest in percentage terms, but could well become a target for Reddit pundits due to its comparatively illiquid trading, as it would take an average of 6.5 days to cover this short position. Although fundamentals may play a subordinate role at the moment, it is worth mentioning here: First Majestic has around 2 silver ounces per share, while Excellon – through the inclusion of Otis Gold – still comes to a factor of 5.3 silver equivalent ounces per share. However, Excellon has only been trading on the NYSE since September 2020. In conjunction with the listing, the stock was consolidated at a ratio of five to one, which is why there are only about 33 million shares left on the market. This could be extreme leverage, however Excellon is still much less well known than First Majestic.

Figure 2: One share of Excellon equals 5.3 ounces of silver equivalent.

Pre-market trading is already pointing to a big day for silver stocks; Avino (TSE: ASM) is up 100 percent at CAD 3.75, Coeur Mining is up about 30 percent at CAD 11.56 and Silvercrest Metals (NYSE: SIL) is up about 20 percent at CAD 12.43.

One should probably also keep a special eye on the silver ETFs: SILJ and SIL and all the companies that are included in these ETFs. The following is the content of the silver ETF SILJ:

Component Name Ticker Weight

|

Component Name |

Ticker |

Weight |

|

FIRST MAJESTIC SILVER CORP |

AG |

13.47% |

|

PAN AMERICAN SILVER CORP |

PAAS |

12.47% |

|

HECLA MINING CO |

HL |

11.24% |

|

YAMANA GOLD INC |

AUY |

5.44% |

|

MAG SILVER CORP |

MAG |

5.33% |

|

HOCHSCHILD MINING PLC |

HOC |

4.63% |

|

SILVERCREST METALS INC |

SIL |

4.18% |

|

SSR MINING INC |

SSRM |

3.67% |

|

SILVERCORP METALS INC |

SVM |

3.63% |

|

HARMONY GOLD MNG-SPON ADR |

HMY |

2.83% |

|

COMPANIA DE MINAS BUENAVENTURA SA |

BVN |

2.61% |

|

ENDEAVOUR SILVER CORP |

EXK |

2.52% |

|

TURQUOISE HILL RESOURCES LTD |

TRQ |

2.39% |

|

COEUR D ALENE MINES CORP |

CDE |

2.37% |

|

ELDORADO GOLD CORP |

ELD |

2.10% |

|

HUDBAY MINERALS INC |

HBM |

1.59% |

|

FORTUNA SILVER MINES INC |

FVI |

1.53% |

|

SEABRIDGE GOLD INC |

SEA |

1.40% |

|

NEW GOLD INC |

NGD |

1.37% |

|

NEXA RESOURCES SA |

NEXA |

1.24% |

|

DUNDEE PRECIOUS METALS INC |

DPM |

1.23% |

|

ALEXCO RESOURCE CORP |

AXU |

1.23% |

|

NEW PACIFIC METALS CORP |

NUAG |

1.09% |

|

ORLA MINING LTD |

OLA |

1.06% |

|

AYA GOLD & SILVER INC |

AYA |

1.05% |

|

AMERICAS GOLD AND SILVER CORP |

USA |

1.03% |

|

CAPSTONE MINING CORP |

CS |

0.90% |

|

BEAR CREEK MINING CORP |

BCM |

0.79% |

|

SABINA GOLD & SILVER CORP |

SBB |

0.70% |

|

PREMIER GOLD MINES LTD |

PG |

0.63% |

|

SIERRA METALS INC. |

SMT |

0.55% |

|

MCEWEN MINING INC |

MUX |

0.53% |

|

METALLA ROYALTY AND STREAMING LTD |

MTA |

0.46% |

|

GRAN COLOMBIA GOLD CORP |

GCM |

0.32% |

|

LIBERTY GOLD CORP |

LGD |

0.31% |

|

GREAT PANTHER MINING LTD |

GPL |

0.31% |

|

EXCELLON RESOURCES INC |

EXN |

0.31% |

|

KOOTENAY SILVER INC. |

KTN |

0.26% |

|

GT GOLD CORP |

GTT |

0.24% |

|

GOLD RESOURCE CORP |

GORO |

0.22% |

|

MANDALAY RESOURCES CORP |

MND |

0.17% |

|

GOLDEN MINERALS CO |

AUMN |

0.14% |

|

MINAURUM GOLD INC |

MGG |

0.13% |

|

TREVALI MINING CORPORATION |

TV |

0.13% |

|

MINCO SILVER CORP |

MSV |

0.08% |

|

CANADA SILVER COBALT WORKS INC |

CCW |

0.06% |

|

MIRASOL RESOURCES LTD |

MRZ |

0.02% |

|

FORTITUDE GOLD |

GOROSpin |

0.02% |

Prime Junior Silver Index

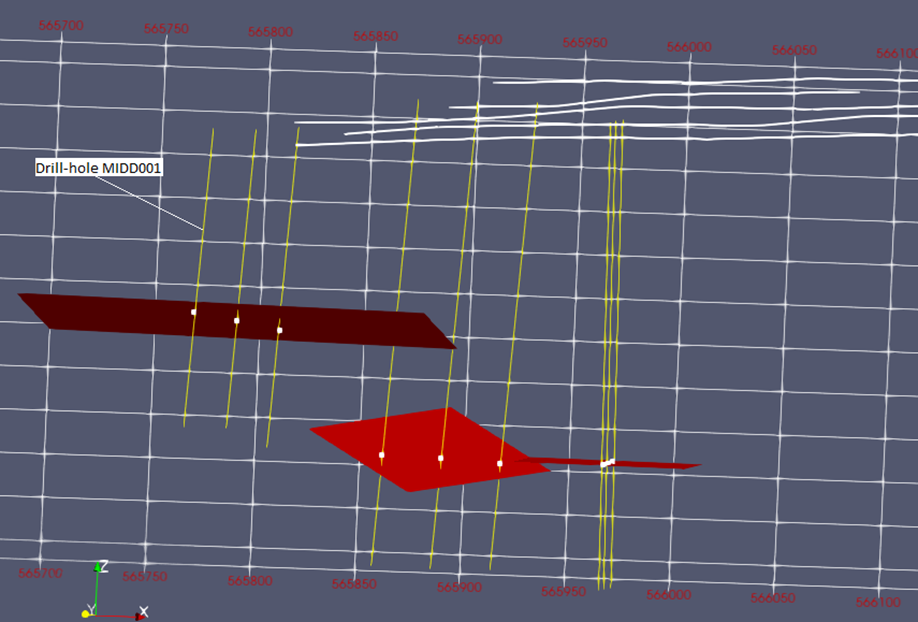

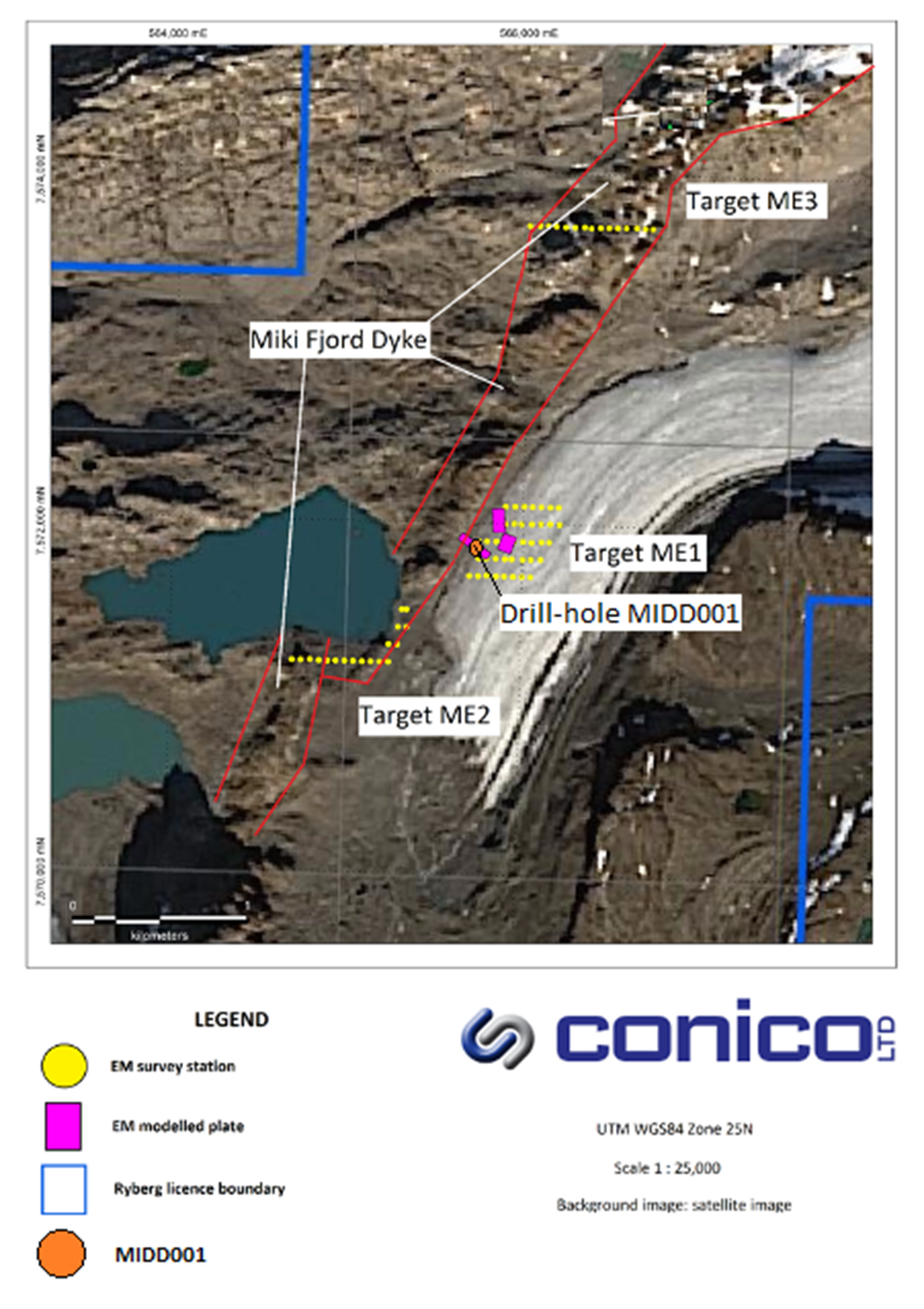

Excellon with excellent drill results

In view of the excited overall situation, it is almost a side note that Excellon today also released recent drill results from its Platosa silver project in Mexico. Drilling returned a very respectable 1,170 g/t silver equivalent (“AgEq”) over 4.2 metres (741 g/t Ag, 7.5% Pb, 4.8% Zn and 0.9 g/t Au) in EX20UG485, including 1,812 g/t AgEq over 2.0 metres (1. 153 g/t Ag, 12.3% Pb, 6.1% Zn and 1.7 g/t Au); and 1,886 g/t AgEq over 2.4 metres (728 g/t Ag, 21.2% Pb and 17.8% Zn) in EX20UG463, including 2,109 g/t AgEq over 1.9 metres (818 g/t Ag, 24.7% Pb, 19.1% Zn).

Two drill rigs are currently operating underground. The drilling is part of a comprehensive resource definition programme at the Platosa deposit, which has never been effectively drilled from surface.

Figure 3: Excellon resources at a glance

Abonnieren Sie unseren kostenlosen Newsletter: https://goldinvest.de/newsletter

Folgen Sie uns auf Twitter: https://twitter.com/GOLDINVEST_de

Risikohinweis: Die Inhalte von www.goldinvest.de und allen weiteren genutzten Informationsplattformen der GOLDINVEST Consulting GmbH dienen ausschließlich der Information der Leser und stellen keine wie immer geartete Handlungsaufforderung dar. Weder explizit noch implizit sind sie als Zusicherung etwaiger Kursentwicklungen zu verstehen. Des Weiteren ersetzten sie in keinster Weise eine individuelle fachkundige Anlageberatung, stellen vielmehr werbliche / journalistische Texte dar. Leser, die aufgrund der hier angebotenen Informationen Anlageentscheidungen treffen bzw. Transaktionen durchführen, handeln vollständig auf eigene Gefahr. Der Erwerb von Wertpapieren birgt hohe Risiken, die bis zum Totalverlust des eingesetzten Kapitals führen können. Die GOLDINVEST Consulting GmbH und ihre Autoren schließen jedwede Haftung für Vermögensschäden oder die inhaltliche Garantie für Aktualität, Richtigkeit, Angemessenheit und Vollständigkeit der hier angebotenen Artikel ausdrücklich aus. Bitte beachten Sie auch unsere Nutzungshinweise.

Laut §34 WpHG möchten wir darauf hinweisen, dass Partner, Autoren und/oder Mitarbeiter der GOLDINVEST Consulting GmbH Aktien der erwähnten Unternehmen halten können oder halten und somit ein Interessenskonflikt bestehen kann. Wir können außerdem nicht ausschließen, dass andere Börsenbriefe, Medien oder Research-Firmen die von uns besprochenen Werte im gleichen Zeitraum besprechen. Daher kann es in diesem Zeitraum zur symmetrischen Informations- und Meinungsgenerierung kommen. Ferner kann zwischen den erwähnten Unternehmen und der GOLDINVEST Consulting GmbH direkt oder indirekt ein Beratungs- oder sonstiger Dienstleistungsvertrag bestehen, womit ebenfalls ein Interessenkonflikt gegeben sein kann.