{kanada_flagge}Canada’s Victoria Gold (TSX VGCX / WKN A2PVRH) produced 164,222 ounces of gold last year. This represents a 41% increase over the 116,644 ounces mined the year before.

The company attributes the improvement to an increase in ore mined and stockpiled, as well as higher gold grades at its Eagle mine in the Yukon. The company thus posted revenue of $356.5 million in 2021, up from $178.7 million the year before. That, however, had had only six months in which significant revenue was generated, as Victoria Gold did not announce commercial production until July 1, 2020.

The company further reported that 2021 net income was $110.4 million, or $1.77 per share, up from $14.9 million the previous year. That represents a 641% increase.

Victoria Gold CEO John McConnell stated that the company’s growth initiatives, such as the 250 Project and exploration activities at Eagle and Raven, were expected to continue throughout 2022. McConnell went on to say that these initiatives were expected to result in a tangible increase in production as well as reductions in unit costs from 2023 and beyond.

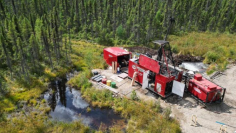

Situated in the Yukon, too, and in fact in direct neighborhood to Victoria Gold, is exploration company Sitka Gold (WKN A2JG70 / CSE SIG), which has been observed by GOLDINVEST.de for some time. The company had made a spectacular discovery on its RC Gold project at the end of last year, detecting 220 meters with 1.17 g/t gold from surface!

Since then, for the first time – and unusual for the region – they have initiated a winter drilling program to expand this high-grade mineralization. Especially as Sitka believes it could be a high-grade gold corridor up to 2 kilometers long. Most recently, CEO Corwin Coe had reported visible gold in the first drill cores of the winter drill program. If these are indicative of similar or even higher gold grades than in the late 2021 drilling, we believe the market could react explosively – as it did begin to when Sitka reported the visible gold.

Of course, Sitka Gold is a pure exploration company and thus the risk is considerably higher than for a (new) producer like Victoria Gold, interested parties should always keep that in mind. However, we believe that this is also offset by stronger upside potential. We will report further on both companies.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The purchase of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.