{kanada_flagge}Usha Resources Ltd (TSXV: USHA; OTCQB: USHAF; FRA: JO0) has received a drilling permit from the United States Bureau of Land Management (BLM) for its Jackpot Lake lithium brine project 35 km northeast of Las Vegas, USA. (Figure 1) The authorities have approved six exploration wells with a drilling volume of 2,700 meters and a maximum depth of approximately 600 meters per well.

Conclusion: the American carmaker Tesla has revolutionized the market for electric mobility. But when it comes to mining lithium, the U.S. relies almost entirely on imports. Albemarle’s Silver Peak Mine in the U.S. remains the country’s only producing lithium mine to date. Usha therefore has several advantages with its Jakepot Lake project. The project is located in the U.S., in the mining-friendly state of Nevada just outside Las Vegas, but just far enough out that no residents or water users will be disturbed. The geology is well known and strongly reminiscent of Albemarle’s Silver Peak Mine, just a four-hour drive away. The chances of a discovery are therefore good. Usha could report its first resource as early as the end of the year. The transition to a resource company is usually rewarded by the stock market with a premium. Currently, Usha trades at a market value of around CAD 10 million, making it by far the lowest valued stock among lithium explorers in Nevada.

{kanada_flagge}Usha Resources Ltd (TSXV: USHA; OTCQB: USHAF; FRA: JO0) has received a drilling permit from the United States Bureau of Land Management (BLM) for its Jackpot Lake lithium brine project 35 km northeast of Las Vegas, USA. (Figure 1) The authorities have approved six exploration wells with a drilling volume of 2,700 meters and a maximum depth of approximately 600 meters per well.

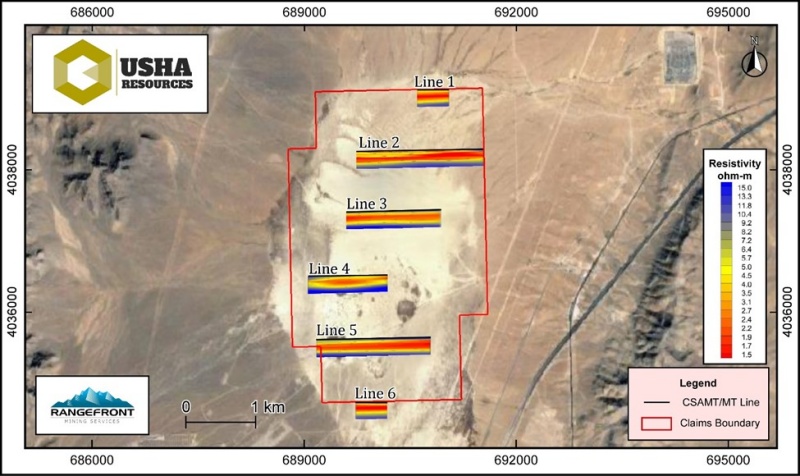

The focus within the 2 by 5 kilometer salar is on lithium brine targets up to 380 meters thick identified by geophysical analysis. (Figure 2) Usha has contracted Nevada-based specialist Rangefront Mining Service to plan and conduct exploration work and resource estimation. The company has filed an environmental bond with the BLM in the amount of $45,985 to secure reclamation of 1.27 acres approved for development.

Figure 1: USHA’s Jackpot Lake project is located in the same geologic formation as Albemarle’s lithium mine, a four-hour drive away, which is also the only producing lithium mine in the United States.

Figure 2: Geomagnetic and geoelectric field measurements suggest highly enriched lithium brines across the Jackpot Lake project.

Deepak Varshney, CEO of Usha Resources, commented, “With the start of exploration drilling, we are taking the next step towards achieving our corporate goal of establishing ourselves as one of North America’s leading lithium producers. We believe this project is part of the path we must follow in North America to secure domestic lithium supplies.”

Jackpot Lake Lithium Brine Concession Area.

The Jackpot Lake lithium brine concession area is located in Clark County, 35 kilometers northeast of Las Vegas, Nevada, and consists of 140 mineral concessions totaling 2,800 acres (11.3 km²). The project explores a shallow bed (playa) that lies within a closed basin. The geological model is similar to that of Albemarle’s Silver Peak Mine in Nevada, which has been in continuous operation since 1966 and where sediments from lithium-rich surrounding source rocks have accumulated and filled the deposit, resulting in a concentration of lithium brine due to successive evaporation and concentration.

The planned drilling was preceded by extensive preliminary work indicating the existence of a closed basin of highly concentrated brine on the 11km² salar. 129 near surface drill core samples returned average lithium grades of 175 ppm and a maximum of 550 ppm. Gravity studies identified, with which a closed basin in which the brines remain without dilution from external water sources.

Figure 3: Topographic map of the Jackpot Lake lithium brine project with MT survey results overlaid. Resistances of < 2.7 ohm-meters are assigned to brines with a potentially higher concentration and resistances between 2.7 and 5.0 ohm-meters are assigned to brines with a potentially moderate concentration.

Conclusion: the American carmaker Tesla has revolutionized the market for electric mobility. But when it comes to mining lithium, the U.S. relies almost entirely on imports. Albemarle’s Silver Peak Mine in the U.S. remains the country’s only producing lithium mine to date. Usha therefore has several advantages with its Jakepot Lake project. The project is located in the U.S., in the mining-friendly state of Nevada just outside Las Vegas, but just far enough out that no residents or water users will be disturbed. The geology is well known and strongly reminiscent of Albemarle’s Silver Peak Mine, just a four-hour drive away. The chances of a discovery are therefore good. Usha could report its first resource as early as the end of the year. The transition to a resource company is usually rewarded by the stock market with a premium. Currently, Usha trades at a market value of around CAD 10 million, making it by far the lowest valued stock among lithium explorers in Nevada.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Usha Resources and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, there is a contractual relationship between Usha Resources and GOLDINVEST Consulting GmbH, which includes that GOLDINVEST Consulting GmbH reports about Usha Resources. This is another clear conflict of interest.