Tucano Gold – Can Duckhead make a comeback ?

We thought our Sertão deposit to be high grade, but Tucano Gold’s “Duckhead” might turn out to be richer. Sertão won 3 Ballon ‘Dors between 2003-2005 when 260,000 were produced at an open pit grade of 29 g/t, giving Troy Resources celebrity status on the ASX. We will reopen Sertão in 1H’24 as an underground mine.

Duckhead made Beadell Resources famous also on the ASX between 2012-14 but it had one incredible last hurrah in its final month in September 2016 when it produced 19,830 ounces at a staggering 51 g/t. That was an average of 661 ounces a day. Apparently at the time, the helicopter was making a gold pickup every 3 days.

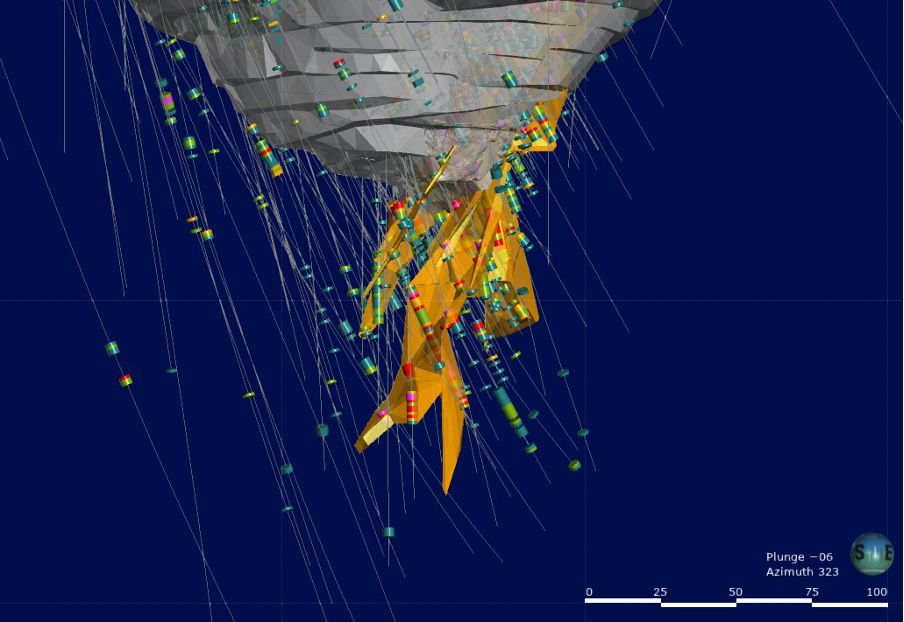

What is interesting is that directly underneath the current pit sitting in fresh rock, are holes FVM560 with 48m @ 11.62 g/t from 66m including 3m @ 88 g/t from 97m and 4m @ 49 g/t from 124m. FVM561 also returned 10m @ 13.81 g/t from 81m. Interestingly these holes were part of the last drilling campaign at Duckhead and reported to the ASX on August 1st, 2016.

Go to pages 21-23 of our presentation to see more of these intersections but the picture below tells a 1000 words. Look how few holes were drilled underneath the pit.

Senior geologists Paulo Aguirre and Roberto Cobra think there is a large high-grade system around the current Duckhead pit open in all directions. Duckhead is not part of our near-term production plans, but it is definitely a drilling priority. Please see the Duckhead video here where Roberto presents on leapfrog the potential of this high-grade system.

Like Sertão, Duckhead never went underground. At the time both operators only wanted to take the easy open pit ounces. These days gold miners would not leave such high-grade systems early, but managements change, companies come and go and 10 years of bear market in gold sometimes give you these sorts of opportunities.

Click on the Tucano Gold presentation here – we encourage you to look at the Cap Table on page 5 where post-finance our market cap fully diluted will be approximately $C26m, which is roughly equivalent to our projected cash position upon closing this round. The pricing allows for very favourable upside for our seed round investors and proceeds from this funding will be used for the restart of operations planned for next month.

This seed round must close at the latest by Friday the 20th and if you’d like to find out more please join our second webinar this Friday at 2.15pm GMT/9.15am EST which is co-hosted by Battery Commodity on Youtube live – click here to attend on the day

This is a business that took Great Panther to a market cap of $C400 million in 2020 and we see no reason why this incredible operation cannot get back to 100,000 ounces of production a year.

Kind Regards,

Jeremy Gray | CEO of Tucano Gold

Jeremy.Gray@TucanoGold.com

+44 7769 388 376

Julio Carneiro | CFO of Mina Tucano

Julio.Carneiro@TucanoResources.com.br

+55 21 98245 2211

Charles Chebry | President of Tucano Gold

Charles.Chebry@TucanoGold.com

+1 403 680 8511

Paulo Aguirre | Senior Group Geologist

Paulo.Aguirre@PilarGold.com

+55 62 99637 3097

Edward Balme | Head of IR

Edward.Balme@TucanoGold.com

+44 7514 584 610

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially with shares in the penny stock area, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here expressly. Please also note our terms of use.

Pursuant to §34b WpHG (Securities Trading Act) and in accordance with Paragraph 48f (5) BörseG (Austrian Stock Exchange Act) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares in American West Metals and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss American West Metals during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between American West Metals and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists.