{australien_flagge}Tennant Minerals (ASX: TMS; FRA: UH7A) has again been spectacularly successful in its recent drilling (Phase 3) at the Bluebird copper-gold discovery at the Barkly project on the eastern edge of the historic Tennant Creek mining district in the Northern Territory: The strike length of the project has been doubled to 500 meters!

Summary: A CEO friend of mine spontaneously described the now released Tennant Minerals results as “nuts” – which is exactly how the market is behaving – “nuts”. One rubs one’s eyes how it can be possible that Tennant’s shares do not react with a price jump after the publication of such results, but even turns slightly negative with almost 37 million shares traded. As the saying goes, the market is always right. In this case, however, the market reaction can confidently be described as irrational reaction. In our view, this is precisely where the opportunity for investors lies. Tennant’s market capitalization is currently around AUD 28 million. We are convinced that it will not stay that way. The parallels to successful historic projects in the neighborhood are already too obvious. Time will tell. We are looking forward to the upcoming results.

{australien_flagge}Tennant Minerals (ASX: TMS; FRA: UH7A) has again been spectacularly successful in its recent drilling (Phase 3) at the Bluebird copper-gold discovery at the Barkly project on the eastern edge of the historic Tennant Creek mining district in the Northern Territory: The strike length of the project has been doubled to 500 meters!

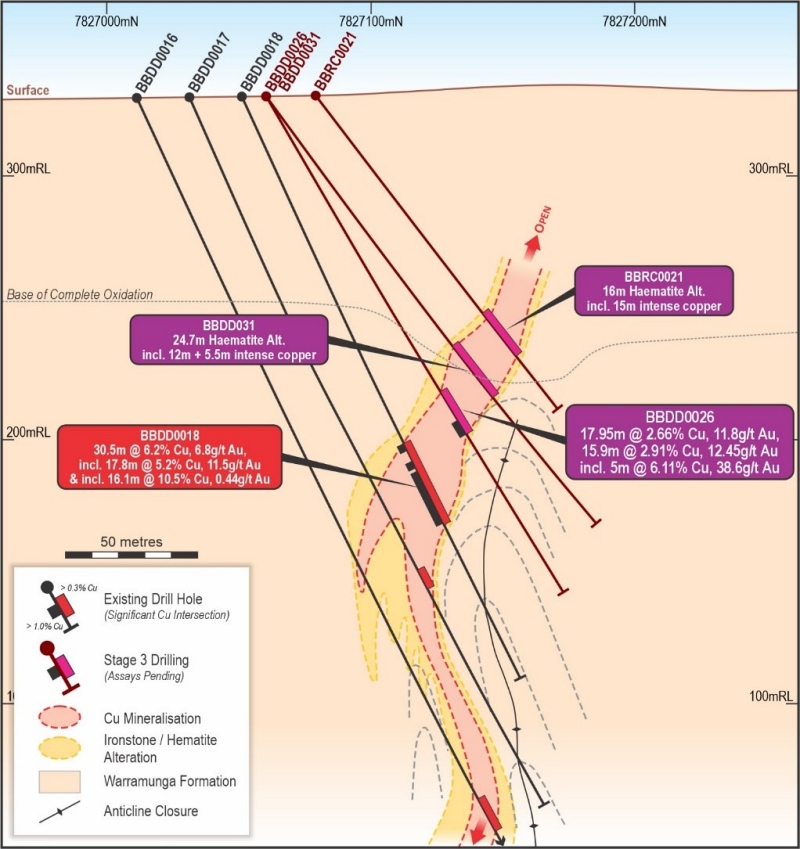

In addition, mineralization can now be seen from a shallow depth of 60m and the best drill hole BBDD0026 returned 17.95m @ 11.08 g/t Au, 2.66% Cu from 131m, including exceptionally high gold and copper values of 15.9m @ 12.45 g/t Au, 2.91% Cu from 131.8m and 5m @ 38.6 g/t Au, 6.1% Cu from 142.7m, including 2.25m @ 64 g/t Au, 9.57% Cu. The latest Bonanza results are up dip and on the same section t as the spectacular intercept in hole BDD0018, which contained a massive copper sulphide zone @ 30.5m @ 6.2% Cu and 6.8 g/t Au (see Figure 1). Additional assay results from other thick zones of mineralization intersected in the recent 14 hole program are expected shortly.

Figure 1: Bluebird cross-section 448.320mE showing high-grade gold-copper intercepts in BBDD0026.

Tennant Minerals’ Board of Directors commented; “This bonanza intersection from our recent drill program at Bluebird is further evidence of a true high grade copper-gold discovery at our Barkly Project. Aside from the high copper and gold grades, our drilling has also doubled the strike length of the Bluebird deposit and extended the mineralized zone to shallow depths, highlighting the potential for initial open pit mining.”

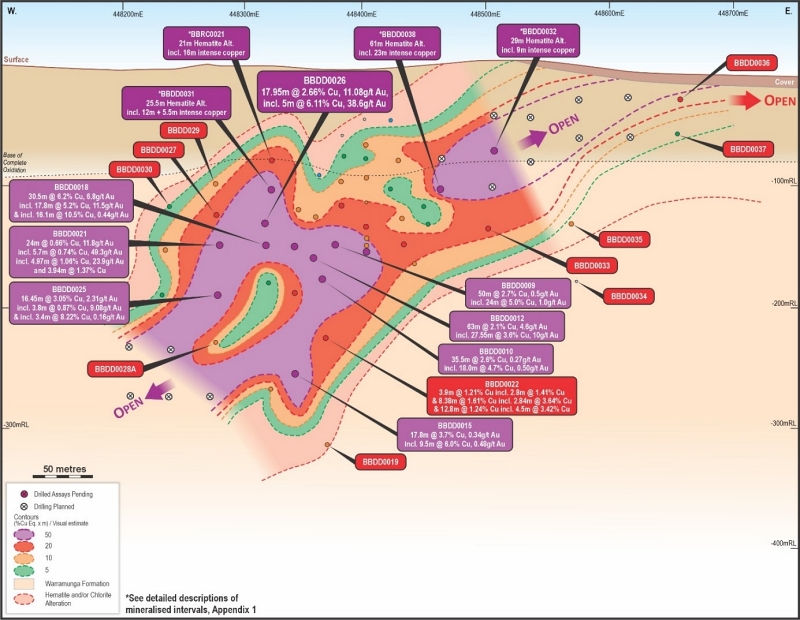

Figure 2: Longitudinal projection of Bluebird showing previous3,4,5 and current drill results and pending drilling.

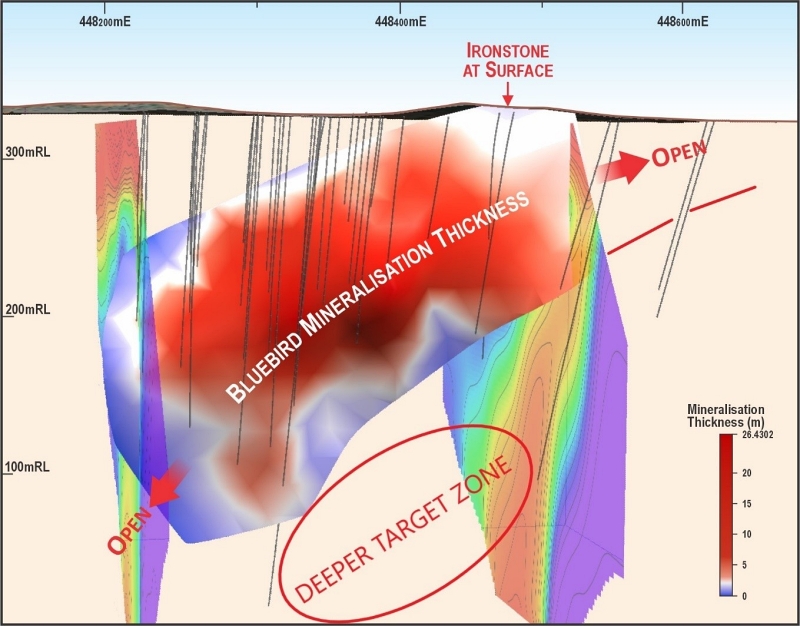

Figure 3: 3-D perspective view of Bluebird showing IP resistivity intercepts.

The mineralization intersected at Bluebird is typical of the high-grade copper-gold orebodies in the Tennant Creek mineral field. Already, the extent of the Bluebird discovery exceeds the dimensions of the Peko mine, located just 20 km west of Bluebird, which produced 3.7 million tonnes of ore grading 4% Cu and 3.5 g/t Au in the 1930s and was closed in the 1970s. The Warrego deposit, which was the last major mine at Tennant Creek, is located on the western edge of the Tennant Creek field and produced 6.75 million t grading 6.6 g/t Au and 1.9% Cu from a fully preserved deposit (not eroded). Bluebird is also fully preserved with the upper portion of the deposit less than 60 m below surface (Figure 2) and geophysical surveys indicating continuity at depths greater than 300 m below surface.

Bluebird is a greenfield discovery where no previous mining has occurred except for the historic Perseverance mine, located 1.5 km west of Bluebird, which was a small high-grade gold producer mined only at shallow depths.

Tennant Minerals is taking a two-pronged approach, defining the resource potential of the Bluebird discovery and testing other key targets in the Bluebird-Perseverance corridor based on gravity, magnetic and IP resistivity survey models, with further modeling and new IP resistivity results to follow.

Summary: A CEO friend of ours spontaneously described the now released Tennant Minerals results as “nuts” – which is exactly how the market is behaving – “nuts”. One rubs one’s eyes how it can be possible that Tennant’s shares do not react with a price jump after the publication of such results, but even turns slightly negative with almost 37 million shares traded. As the saying goes, the market is always right. In this case, however, the market reaction can confidently be described as irrational reaction. In our view, this is precisely where the opportunity for investors lies. Tennant’s market capitalization is currently around AUD 28 million. We are convinced that it will not stay that way. The parallels to successful historic projects in the neighborhood are already too obvious. Time will tell. We are looking forward to the upcoming results.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on https://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they in no way replace an individual expert investment advice, it is rather promotional / journalistic publications. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. The acquisition of securities, especially with shares in the penny stock area, carries high risks, which can lead to a total loss of the invested capital. The GOLDINVEST Consulting GmbH and its authors expressly exclude any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here. Please also note our terms of use.

Pursuant to §34b WpHG (Securities Trading Act) and according to Paragraph 48f (5) BörseG (Austrian Stock Exchange Act) we would like to point out that principals, partners, authors and employees of GOLDINVEST Consulting GmbH hold or may hold shares of Tennant Minerals and therefore a possible conflict of interest exists. We also cannot exclude that other stock letters, media or research firms discuss the stocks we recommend during the same period. Therefore, symmetrical information and opinion generation may occur during this period. Furthermore, there is a consulting or other service contract between Tennant Minerals and GOLDINVEST Consulting GmbH, which means that a conflict of interest exists.