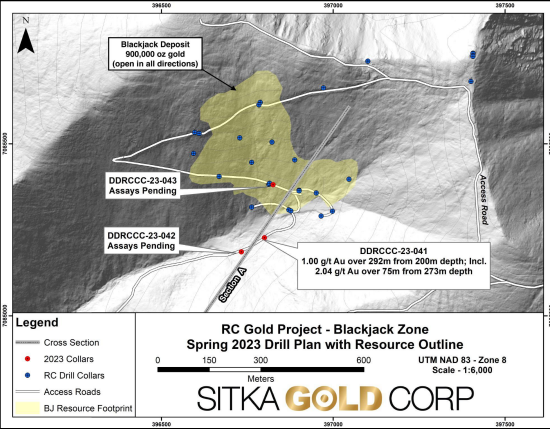

{kanada_flagge} For Sitka Gold Corp (CSE: SIG; FSE: 1RF; OTCQB: SITKF), it was well worth the effort to continue drilling during the winter months on its Blackjack discovery at the RC Gold Project in the Yukon. Laboratory results from the first of three winter drill holes, DDRCCC-23-041 (“Hole 41”), provided some of the best results ever from the entire exploration campaign. The hole intersected 1.28 g/t Au over 203.9 metres within a larger interval of 1.00 g/t Au over 292.0 metres. 292.0 metres (m) of 1.00 g/t Au from 200.0 m to 492.0 m including 203.9 m of 1.28 g/t Au from 243.0 m; 75.0 m of 2.04 g/t Au from 273.0 m; 30.0 m of 3.11 g/t Au from 320.0 and 19.9 m of 1.04 g/t Au from 418.0 m.

Bottom line: the Blackjack discovery could become a company maker for Sitka Gold. Virtually every drill hole adds to the already confirmed resource of 1.34 million ounces. Sitka is both bold and highly efficient in its drilling. The high continuity of mineralization is enabling major advances with a minimum of drilling. In addition, it is becoming increasingly clear that the Blackjack Zone, in particular, is clearly differentiated from surrounding competitors by its comparatively higher gold grades. Sitka’s project looks like the proverbial “low hanging fruit” compared to the surrounding intrusion-related gold deposits. With each drill, this fruit ripens and the appetite of its neighbors is likely to increase. Sitka’s stock market value is currently around CAD 21 million.

For Sitka Gold Corp (CSE: SIG; FSE: 1RF; OTCQB: SITKF), it was well worth the effort to continue drilling during the winter months on its Blackjack discovery at the RC Gold Project in the Yukon. Laboratory results from the first of three winter drill holes, DDRCCC-23-041 (“Hole 41”), provided some of the best results ever from the entire exploration campaign. The hole intersected 1.28 g/t Au over 203.9 metres within a larger interval of 1.00 g/t Au over 292.0 metres. 292.0 metres (m) of 1.00 g/t Au from 200.0 m to 492.0 m including 203.9 m of 1.28 g/t Au from 243.0 m; 75.0 m of 2.04 g/t Au from 273.0 m; 30.0 m of 3.11 g/t Au from 320.0 and 19.9 m of 1.04 g/t Au from 418.0 m.

Figure 1: DDRCCC-23-41 was a bold step-out drill hole. The result should significantly expand the future resource estimate of the Blackjack Zone.

Cor Coe. CEO and Director of Sitka, commented, “Step-out drilling at our Blackjack gold deposit continues to be impressive, with hole 41 intersecting some of our best gold to date. This hole demonstrates that the high grade mineralization intersected at surface at this deposit continues to depth, as evidenced by the sub-intercept of 2.04 g/t Au over 75 m. The Blackjack deposit is higher grade than the typical low grade heap leach deposits in these intrusion related gold systems. This hole is returning significant tonnage of high grade gold and demonstrates that the high grade gold mineralization is consistent and continues to the southeast of the current deposit boundary. Visible gold and significant vein densities have been observed in all three holes completed so far this year (see press releases dated April 12 and May 8, 2023) and we are optimistic that assay results from the remaining two holes drilled as part of the 1500 meter winter drill program will continue to confirm the expansive gold occurrences in the area.”

Both the Blackjack and Eiger gold deposits, from which the initial mineral resource of 1.34 ounces of gold announced earlier this year, remain open in all directions. Sitka is therefore confident that significant ounces can be added to the near-surface gold deposits. CEO Coe is confident that the project can be expanded to a district-level gold resource.

Additional aggressive step-out drilling is planned this season at the Blackjack and Eiger deposits and along the 1.5 km mineralized corridor that could potentially connect these deposits.

Bottom line: the Blackjack discovery could become a company maker for Sitka Gold. Virtually every drill hole adds to the already confirmed resource of 1.34 million ounces. Sitka is both bold and highly efficient in its drilling. The high continuity of mineralization is enabling major advances with a minimum of drilling. In addition, it is becoming increasingly clear that the Blackjack Zone, in particular, is clearly differentiated from surrounding competitors by its comparatively higher gold grades. Sitka’s project looks like the proverbial “low hanging fruit” compared to the surrounding intrusion-related gold deposits. With each drill, this fruit ripens and the appetite of its neighbors is likely to increase. Sitka’s stock market value is currently around CAD 21 million.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content exclusively serves the information of the readers and do not represent any kind of call to action;, neither explicitly nor implicitly are they to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, however, any liability for financial loss or the content guarantee for timeliness, accuracy, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

Pursuant to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time which could affect the share price. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.