{kanada_flagge}Sitka Gold Corp. (CSE:SIG; FRA:1RF; OTCQB:SITKF) has further consolidated and enlarged its Carlin-style discovery at the Alpha project in Nevada with only four targeted holes (AG22-09 – AG22-12; 1,374 metres) in the past year. The geological setting at Alpha is consistent with those at neighboring large projects such as Goldrush and other gold deposits along the Cortez Trend.

Conclusion Sitka has made tremendous progress with its minimal budget in Nevada. In particular, Sitka has been able to prove the thesis that large-scale Carlin-type gold mineralization exists at the Alpha project, extending over a trend of at least 2.5 kilometers, but very likely well beyond that. Now Sitka geologists are focused on finding the high-grade core of this newly discovered system. If Sitka can deliver this last missing piece of the puzzle, the Alpha Project can become a mega-project along the lines of other industrial gold mines in the Cortez Trend. In the meantime, large gold mining companies are certainly sensing this opportunity, and they are certainly following the development at Sitka very closely. On top of that, Sitka’s successes at the more advanced RC project in the Yukon are impressive with the recent announcement last month of a maiden resource of 1.34 million ounces of gold. Sitka is currently valued on the market with a stock market value of CAD 21 million.

{kanada_flagge}Sitka Gold Corp. (CSE:SIG; FRA:1RF; OTCQB:SITKF) has further consolidated and enlarged its Carlin-style discovery at the Alpha project in Nevada with only four targeted holes (AG22-09 – AG22-12; 1,374 metres) in the past year. The geological setting at Alpha is consistent with those at neighboring large projects such as Goldrush and other gold deposits along the Cortez Trend.

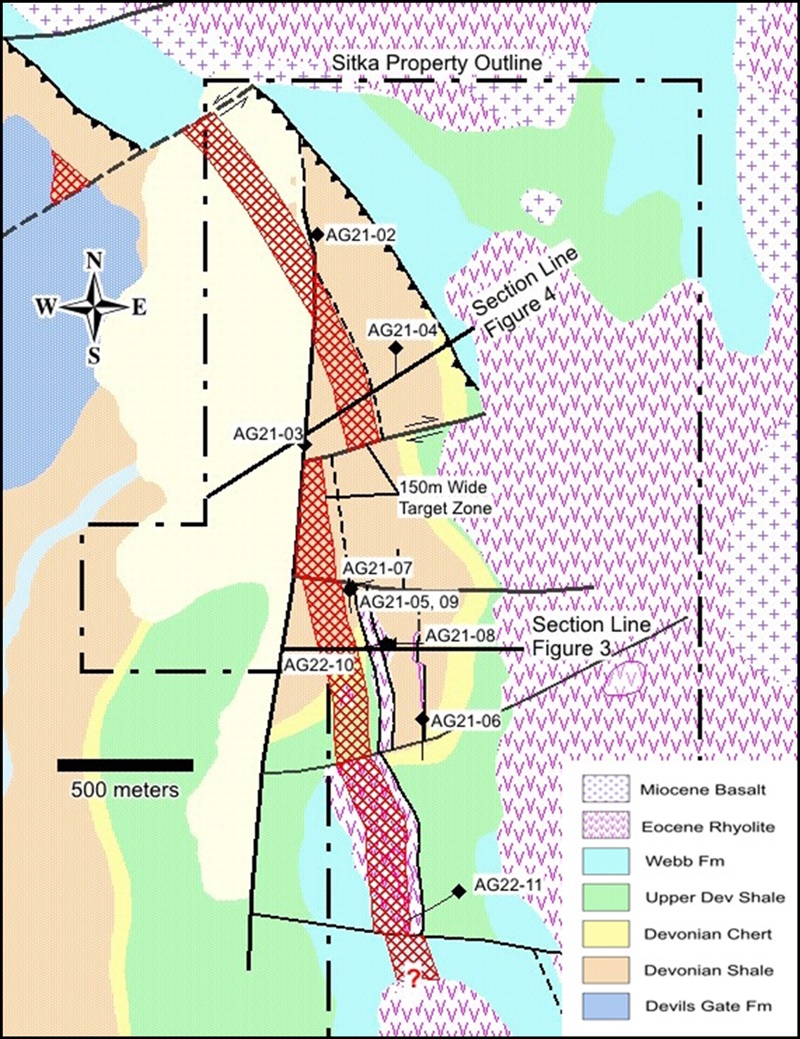

Today, the Company presented results from the last two holes drilled in 2022 (AG22-11 and AG22-12). Both holes were aggressive step-out drilling: AG22-11 was drilled 940 meters south-southeast of AG22-10, which intersected 21.3 meters of 1.21 g/t gold, including 1.5 meters of 4.62 g/t gold. The location of AG22-12 was as much as 5.6 km further south than AG22-10. Sitka was again able to confirm all elements of a large Carlin-type gold system. The Horse Canyon Equivalent bedrock horizon has gold mineralization and Carlin pathfinders in all holes intersected at Alpha and correlates with analogous horizons at known mines such as Goldrush or Gold Bar in the Cortez Complex of Nevada.

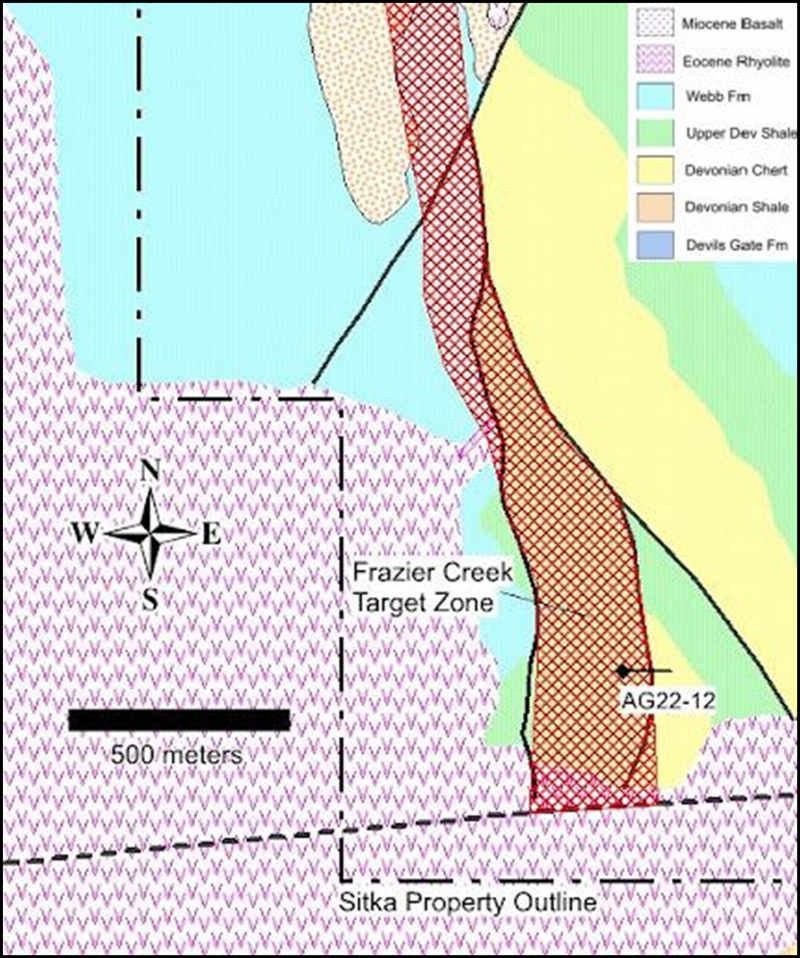

Hole AG22-11 intersected 12.2 m of 0.50 g/t gold, including 1.5 m of 2.32 g/t gold within strong Carlin-style alteration. The second step-out hole AG22-12 failed to penetrate to target depth due to unfavorable conditions and therefore missed the critical Horse Canyon Equivalent host rock horizon. However, gold in the shale above the host rock was more anomalous in AG22-12 than in AG22-11. In addition, surface alteration at Frazier Creek is visually the strongest to date on the Alpha Gold property with 2 km of continuous alteration interpreted as leakage from a potential Carlin-type gold system at depth.

In sum, Sitka has extended the extent of Carlin-type gold mineralization to at least 2.5 km within the 8 km long north-northwest trending target zone (Figure 2). Had drill hole AG22-12 penetrated to the target depth, there is probably a chance that the zone would have been even longer.

NEW: Follow us on Twitter for more English content!

Cor Coe, P.Geo., CEO and Director of Sitka Gold, commented, “Results from our final 2022 drill holes continue to demonstrate the potential of this area to host one or more significant Carlin-type gold deposits, as has been observed at other locations along the Cortez Trend. The intercept from AG22-11 is particularly exciting as it has extended the extent of known Carlin-type gold mineralization by an additional 940 meters from hole 10 and indicates the proximity of a potential high-grade core zone.”

“This was an important step in confirming the mineralization trend, considering there is no significant gold in the surface alteration. The next step at Alpha will be to locate the anticline and core of gold mineralization with additional drilling across the trend aimed at finding higher grade gold zones similar to those that made the Cortez trend famous.”

Figure 1: North-northwest trending target zone at Alpha Gold.

Confirmation of a large Carlin-type gold system.

A deeper horizon in the McColley Canyon Fm (equivalent to the Goldrush Wenban Fm Unit 5) has not yet been tested at depth. A NNW anticline has been identified by mapping and confirmed by drilling that largely controls gold mineralization, just as at Goldrush 40 km further NNW. Gold mineralization is now defined by drilling for 2.5 km along the anticline in the Horse Canyon Equivalent Host. Drill results ranging from broad zones at 0.10 g/t in AG21-02 and 03 to stronger intercepts such as 21.3 m at 1.21 g/t Au in AG21-10 may reflect their proximity to the crest of this anticline. A higher grade core coincident with the crest of the anticline can now be surmised in this manner. The location of this interpreted high priority drill target zone is shown in Figure 2. The target is also based on the gold distribution pattern at Goldrush, where gold greater than 5 g/t is confined to mostly narrow, elongated zones.

Targeting high-grade gold mineralization

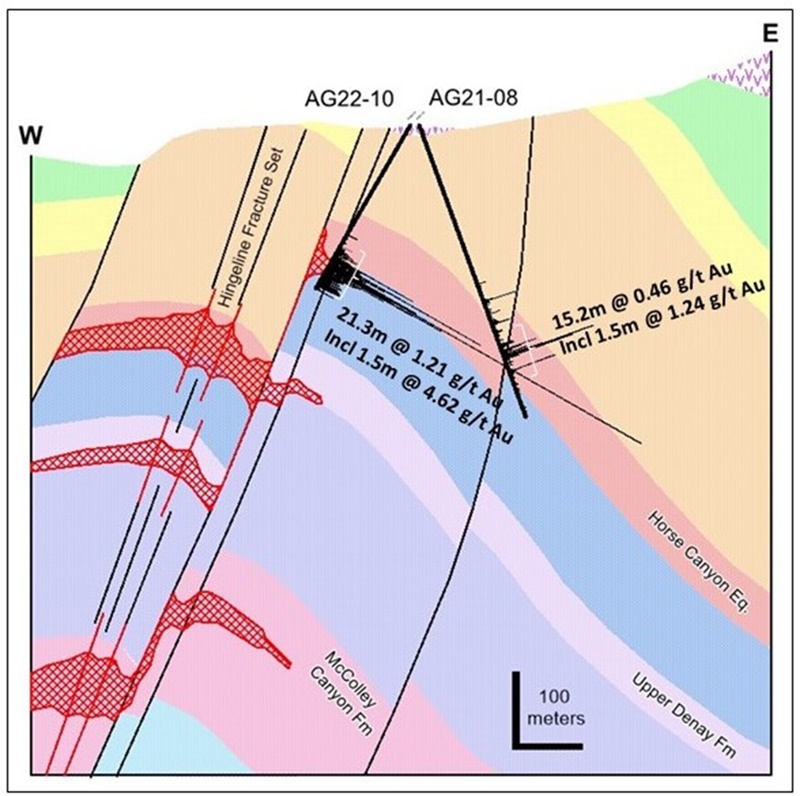

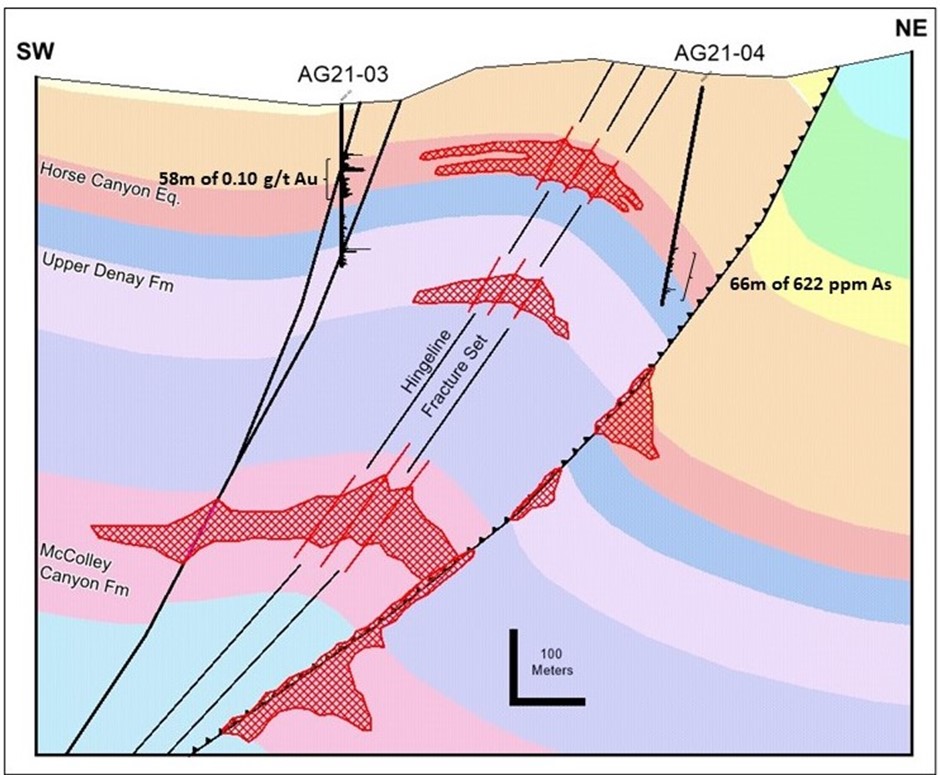

The highest gold grades in Carlin-type systems generally occur where ore fluids, optimal host rocks, and highly fractured or brecciated zones meet. Figures 3 and 4 are drill intercepts illustrating such targets at Alpha. Figure 3 shows the fold crest target west of AG22-10, with gold grades increasing from 1.24 g/t in AG21-08 to 4.62 g/t in AG22-10. Gold grades should continue to increase to the crest and hinge line of the fold, where fracture intensity should be greatest.

Figure 2: Cross-section of AG21-08 and AG21-10 showing interpreted core gold mineralization in the target area (red shaded areas).

Figure 3: Cross section of AG21-03 and AG21-04 with interpreted core gold mineralization targets (red shaded areas).

Figure 3 shows goldrush-like anticline targets at the projected position of the core zone between AG21-03 and 04. Targets interpreted along the reverse fault are similar to breccia zone orebodies on the Sadler reverse fault at the new Fourmile deposit. AG21-03 intersected 58 m at 0.10 g/t Au around a large karst cavity. AG21-04 had the highest sulfide and arsenic concentrations of all holes, including 66 m of 622 ppm As associated with an altered intrusive body in the Horse Canyon Equivalent to Devils Gate contact. The potentially even more prospective McColley Canyon Fm (Goldrush Wenban Fm Unit 5 Equivalent) target in this section is less than 600 m deep and has not been drill tested here or elsewhere on the property. Testing these core system targets with drilling across the trend and then moving them along the trend as shown on the target zone map in Figure 2 is the next step for the Alpha Gold project.

Figure 4: Frazier Creek target area.

Conclusion Sitka has made tremendous progress with its minimal budget in Nevada. In particular, Sitka has been able to prove the thesis that large-scale Carlin-type gold mineralization exists at the Alpha project, extending over a trend of at least 2.5 kilometers, but very likely well beyond that. Now Sitka geologists are focused on finding the high-grade core of this newly discovered system. If Sitka can deliver this last missing piece of the puzzle, the Alpha Project can become a mega-project along the lines of other industrial gold mines in the Cortez Trend. In the meantime, large gold mining companies are certainly sensing this opportunity, and they are certainly following the development at Sitka very closely. On top of that, Sitka’s successes at the more advanced RC project in the Yukon are impressive with the recent announcement last month of a maiden resource of 1.34 million ounces of gold. Sitka is currently valued on the market with a stock market value of CAD 21 million.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content exclusively serves the information of the readers and do not represent any kind of call to action;, neither explicitly nor implicitly are they to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, however, any liability for financial loss or the content guarantee for timeliness, accuracy, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

Pursuant to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time which could affect the share price. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.