Potential for a multi-million ounce deposit

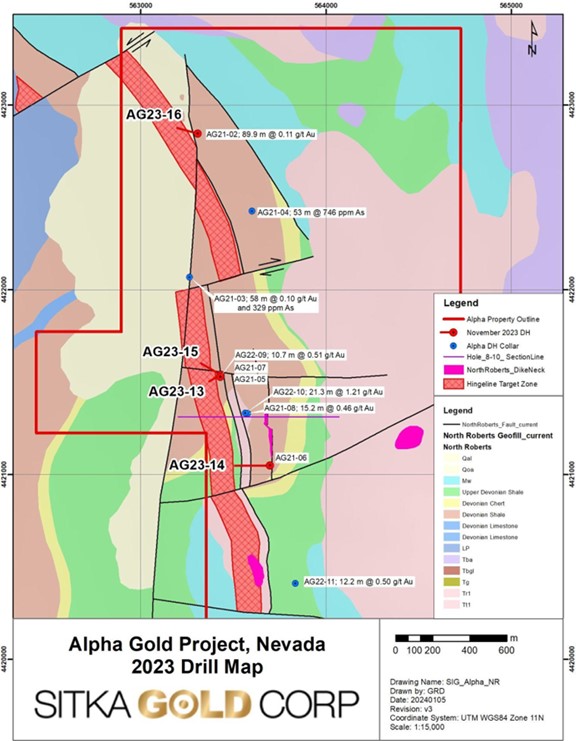

Sitka Gold Corp (CSE:SIG; FSE:1RF; OTCQB:SITKF) provides new evidence to support its belief that an extensive Carlin gold system exists at its Alpha Gold property at the southeast end of the Cortez Trend. Shortly before year-end 2023, Sitka completed four strategic drill holes totaling 1027.3 metres (see Figure 1). As geologists had hoped, all four holes encountered significant intercepts of strong alteration and mineralisation coincident with known Carlin-type gold deposits in Nevada at the exact contact zones important for Carlin mineralisation!

The preliminary findings not only confirm the underlying Carlin model for Alpha, but also identify a 7.5 kilometre long hinge zone as the area where the highest gold grades are likely to be encountered. So far, only the northern, approximately 2 kilometre long section has been tested. The drill core analyses of the four drill holes are still pending. Sitka has drilled a total of 16 holes over a total length of 5006 metres at Alpha over several years in order to substantiate its Carlin concept.

Cor Coe, P.Geo, Director and CEO of Sitka, commented: “We are extremely encouraged by what has been observed in this round of drilling at Alpha. These holes have significantly increased our confidence in the current geological model which suggests that the targeted hinge zone is the most likely place to find the highest gold grades in this system. This model should be broadly applicable along the entire 7.5 km long NNW anticlinal trend hosted on the property and provide the ideal framework for the discovery of a large, multi-million ounce Carlin-type gold deposit at a mineable depth. We look forward to announcing the results from these drill holes as they are received and compiled.”

Figure 1: Overview map of 2023 drilling at Alpha Gold. The target is the so-called Hingeline Target Zone (shaded red). This ridge of folds has now been specifically tested for the first time by drilling at four locations, with each drill hole located close to previous drill holes.

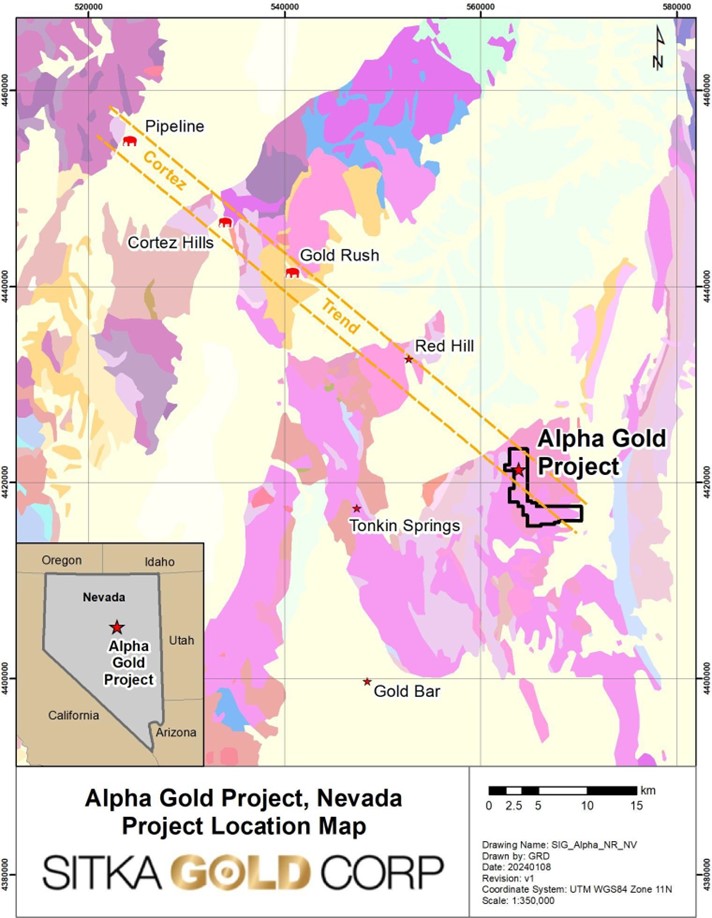

Figure 2: Regional map of the Alpha Gold Project

Conclusion: The two Sitka projects Alpha in Nevada and RC Gold in the Yukon are at different stages of development and they are also geologically very different. What both projects have in common, however, is that they are based on geological concepts that enable the existence of multi-million ounce deposits. In the Yukon, Sitka is pursuing an intrusion-related source of gold and is adding to its existing resource with virtually every drill hole. On the Alpha project, Sitka is not there yet. In Nevada, the company's recent drilling is looking for the presence and traces of reaction of mineralised fluids at the contact zone of certain sedimentary rocks. Since the key Carlin-type mineralisation event can be constrained to the period of 36-42 million years, the names of these structures are well known: it is the Horse Canyon/Devil's Gate contact. The advantage of the Carlin concept is that such contact zones can extend over kilometres. Sitka has now tested a 2 kilometres long corridor for the first time and has already encountered thick intervals of the right mineralisation there at a comparatively shallow depth. It is understandable that the Sitka team is now eagerly awaiting the drill results. Alpha has big neighbours. The Alpha gold property is only about 40 kilometres south-east of the Nevada Gold Mines complex in Nevada, which includes the Pipeline, Cortez Hills and Gold Rush mines. Alpha could therefore provide a huge surprise.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.