No better reason for a drill program

The summer season has finally begun in the Yukon – with 20 hours of daylight. And Sitka Gold (TSXV:SIG) (OTCQB:SITKF; FRA: 1RF) announces that it has commenced its approximately 14,000 meter summer drill program on the Clear Creek property within the RC Gold Project in the Yukon.

Earlier, in winter, the Company completed two strategic drill holes totaling approximately 1,000 meters to confirm the continuity of high-grade gold mineralization south of the Blackjack gold deposit. Visible gold was observed in both holes and assay results returned 191.0 meters grading 1.16 g/t gold, including 11.0 meters of 5.80 g/t gold within 89.0 meters of 2.03 g/t gold in hole 57 and 154.0 meters of 1.47 g/t gold, including 37.0 meters of 3.07 g/t gold and 8.0 meters of 4.61 g/t gold in hole 58.

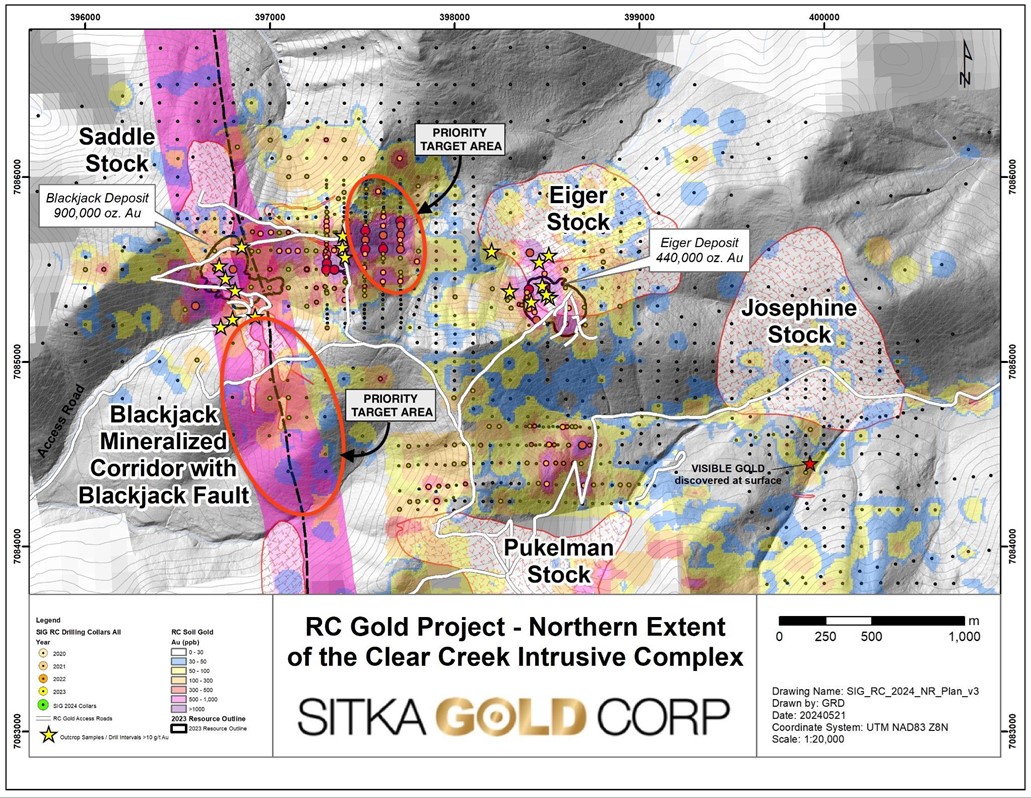

In addition to expanding the Blackjack gold mineralization to the southeast, targets for the 2024 exploration season include further drilling at the Saddle East zone (84m of 1.21 g/t gold drilled in 2023), further drilling at the Eiger deposit (inferred resource of 440. 000 ounces of gold published in 2023), further drilling at the Josephine Stock (visible gold at surface discovered in 2023) and additional investigation of the nine known intrusions with associated gold mineralization discovered to date on the Company’s 386 km² RC project. (see Figure 1)

Cor Coe, Director and CEO of Sitka Gold Corp: “Drilling currently underway is focused on expanding the Blackjack deposit following the discovery of high-grade gold mineralization outside the current resource during the winter diamond drill program. Our updated geologic model suggests that the high-grade gold zone continues to the south. We are also looking to test a number of other high priority targets.”

Figure 1: Overview map of the northern extent of the Clear Creek Intrusive Complex. The projection of the Blackjack Fault and mineralized Blackjack Corridor are highlighted along with priority targets in the area for 2024. Yellow stars indicate where rock samples or drill hole intercepts have returned >10 g/t gold.

Figure 2: Plan map shows diamond drilling currently planned for 2024 in the mineralized Blackjack Corridor. The Blackjack Fault appears to be an important structural control on intrusion-related gold mineralization.

Figure 3: The new target zone south of the Blackjack resource is several times larger than the known Blackjack resource area itself. The updated geological model indicates an area approximately 1km long along strike to the south of the resource as a high priority target.

Summary: Sitka’s successful winter drilling has demonstrated the importance of the structural fault along the Blackjack Corridor. It forms the key structure along which Sitka can systematically expand the existing Blackjack resource. Drilling is planned accordingly – initially in a south-easterly direction. In addition, there are several other targets that also have the potential to host intrusion-related gold deposits of considerable size. Sitka is talking about an area measuring around 3 km x 5 km that still needs to be drilled. This includes the Saddle Zone priority target area between the Blackjack and Eiger gold deposits, where the largest and strongest gold in soil anomaly has been measured on the property. There is no better justification for a drill program.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content is intended solely for the information of readers and does not constitute any kind of call to action; neither explicitly nor implicitly are they to be understood as a guarantee of any price developments. Furthermore, it is in no way a substitute for individual expert investment advice and does not constitute an offer to sell the share(s) in question or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising/journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offers, as our information relates only to the company and not to the reader’s investment decision.

The acquisition of securities involves high risks that can lead to the total loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, but any liability for financial losses or the guarantee that the content of the articles offered here is up-to-date, correct, appropriate and complete is expressly excluded. Please also note our terms of use.

According to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, clients or employees of GOLDINVEST Consulting GmbH hold shares in Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. In addition, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.