{kanada_flagge}With 10,000m of summer drilling well underway at Sitka Gold Corp’s (CSE: SIG; FRA: 1RF; OTCQB: SITKF) RC Gold Project, the company has now released assays from the third and final diamond drill hole from the past 2023 winter season. With 422.7 m averaging 0.74 g/t gold from surface throughout (including 111.7 m at 1.24 g/t gold), hole DDRCCC-23-043 adds to the existing deposit model at a critical location from which too little data was previously available. The result, like the two previous step-out drill holes of the winter, should immediately lead to an increase in size and quality of the previously published resource estimate. As recently as January of this year, Sitka had released its Maiden Resource of 1,340,000 ounces of gold at a grade of 0.68 g/t.

The Eagle Mine has a Measured & Indicated resource of 4.304 million ounces of gold in the form of 233 million tonnes of ore at an average grade of 0.57 g/t gold, according to the latest figures from February this year. Despite these, at first glance, low gold grades, Victoria Gold has calculated an All-in Sustaining Cost (“AISC”) of US$1,114 per ounce, which provides strong margins at today’s gold prices. These values, along with Victoria’s industrial approach, are a good benchmark to rank Sitka’s success. This is because Sitka’s gold grades to date have averaged 30% higher than Victoria’s – although the drill density is not yet sufficient to determine a resource in the M&I category. With the 10,000-meter drill program now underway, Sitka has an excellent chance of quickly adding substantial resources to its 1.3 million ounces of gold. Doubling the resource is not an impossibility, considering that the published resource has historically required only about 13,000 meters of drilling. One thing to keep in mind is that back then Sitka did not know the structure of the deposit as well as it does today, so the current drilling should be more accurate.

{kanada_flagge}With 10,000m of summer drilling well underway at Sitka Gold Corp’s (CSE: SIG; FRA: 1RF; OTCQB: SITKF) RC Gold Project, the company has now released assays from the third and final diamond drill hole from the past 2023 winter season. With 422.7 m averaging 0.74 g/t gold from surface throughout (including 111.7 m at 1.24 g/t gold), hole DDRCCC-23-043 adds to the existing deposit model at a critical location from which too little data was previously available. The result, like the two previous step-out drill holes of the winter, should immediately lead to an increase in size and quality of the previously published resource estimate. As recently as January of this year, Sitka had released its Maiden Resource of 1,340,000 ounces of gold at a grade of 0.68 g/t.

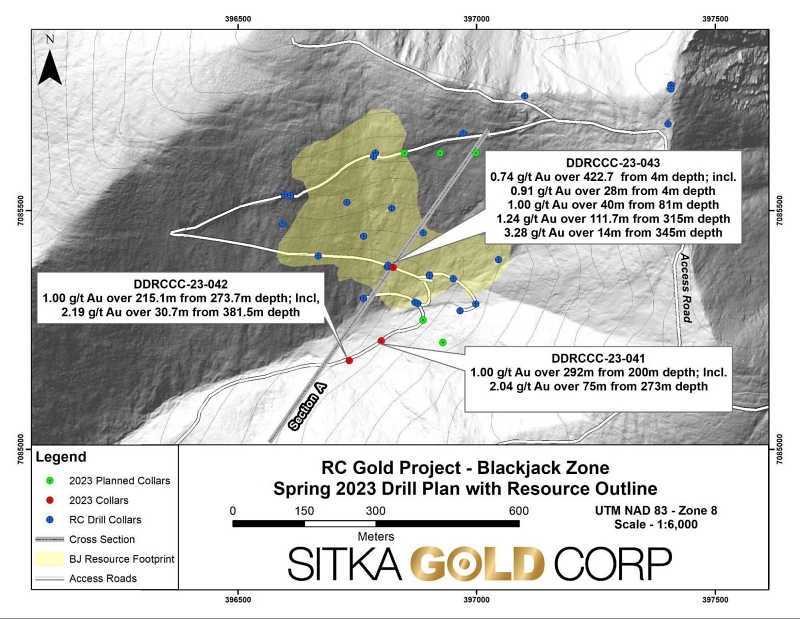

Figure 1: All three winter drill holes are shown in red.

Cor Coe, CEO and Director of Sitka Gold commented, “The results from hole 43 are very notable and demonstrate how consistent and abundant the gold mineralization is at our Blackjack deposit. Gold mineralization was encountered at surface and continued over the entire 422.7 meter length of this hole, which averaged 0.74 g/t gold and had multiple occurrences of visible gold. Hole 43 was designed to add to an area of our deposit model where drill core data was not available and to test mineralization at depth.”

For safety reasons, winter drill hole DDRCCC-23-043 had been stopped after 422.7 m approximately 43 m short of target depth, although mineralization visibly continued. Sitka is now in the process of deepening the hole. Additional step-out drilling to expand the Blackjack and Eiger gold deposits, both of which remain wide open, will be the main focus of RC Gold’s 2023 summer field season, along with additional exploration drilling to test the continuity of the mineralized corridor.

Summary: The RC Gold Project is strategically located midway between Victoria Gold’s Eagle Gold Mine – Yukon’s newest gold mine, which did not reach commercial production until the summer of 2020 – and Sabre Gold Mine’s Brewery Creek Gold Mine. The Eagle Mine has a Measured & Indicated resource of 4.304 million ounces of gold in the form of 233 million tonnes of ore at an average grade of 0.57 g/t gold, according to the latest figures from February this year. Despite these, at first glance, low gold grades, Victoria Gold has calculated an All-in Sustaining Cost (“AISC”) of US$1,114 per ounce, which provides strong margins at today’s gold prices. These values, along with Victoria’s industrial approach, are a good benchmark to rank Sitka’s success. This is because Sitka’s gold grades to date have averaged 30% higher than Victoria’s – although the drill density is not yet sufficient to determine a resource in the M&I category. With the 10,000-meter drill program now underway, Sitka has an excellent chance of quickly adding substantial resources to its 1.3 million ounces of gold. Doubling the resource is not an impossibility, considering that the published resource has historically required only about 13,000 meters of drilling. One thing to keep in mind is that back then Sitka did not know the structure of the deposit as well as it does today, so the current drilling should be more accurate.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. This content exclusively serves the information of the readers and do not represent any kind of call to action;, neither explicitly nor implicitly are they to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, however, any liability for financial loss or the content guarantee for timeliness, accuracy, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

Pursuant to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time which could affect the share price. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.