{kanada_flagge}Every drilling is an experiment. Geologists develop models and use drilling as the ultimate experimental setup to test their hypotheses. So far, so good. But, at what point can one actually speak of a discovery? Already when the geological model is confirmed? Or only when, for example, the gold grades are available from the laboratory? Nothing is more exciting in exploration than this time between the first confirmation and the wait for certainty, which can easily bring disappointment.

This is exactly the transitional phase that Sitka Gold Corp. (CSE: SIG, FRA: 1RF). Perhaps the company has just made a breakthrough discovery? We don’t know. But we (along with management) eagerly await the release of drill results – likely toward the end of this month. The countdown is on. In what follows, we will try to back up the speculation with facts and trace the basic thinking of the exploration geologists. This should help to better assess the significance of the potential discovery in the event of actual drilling success.

Sitka Gold poaches in the mining giants’ front yard

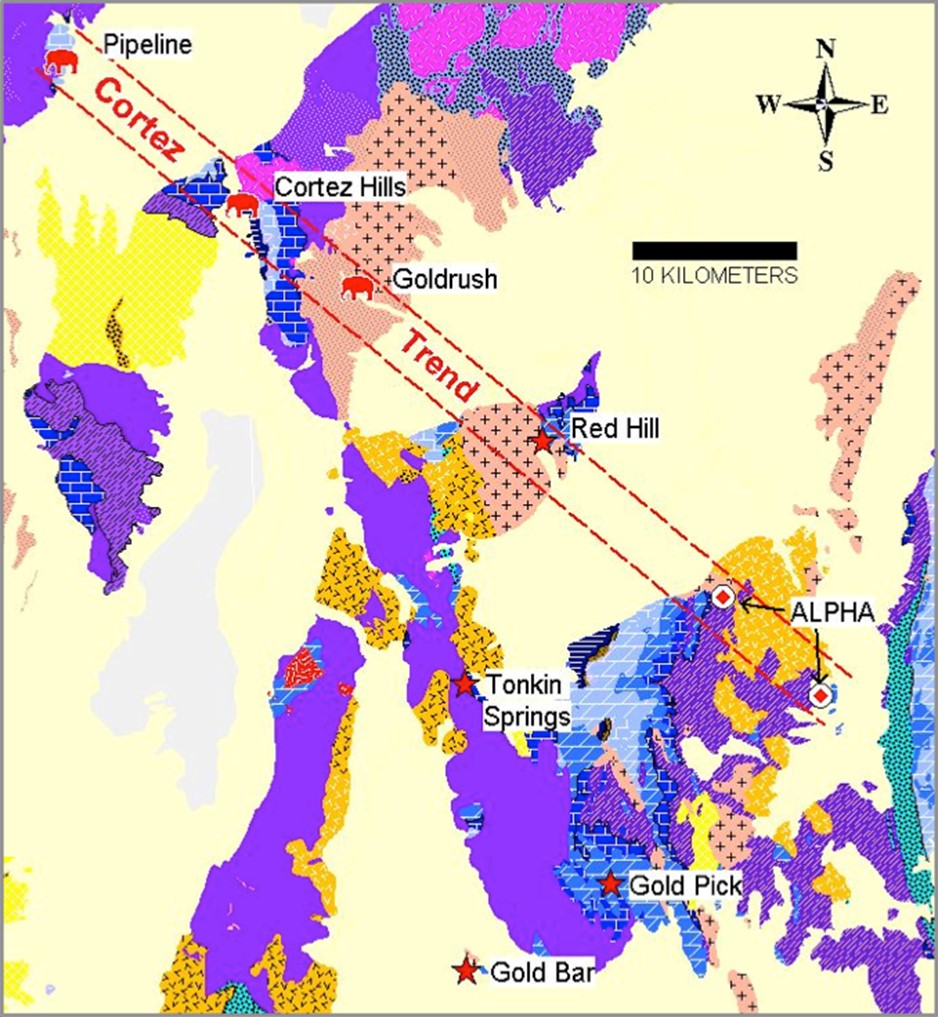

From the beginning Sitka Gold has been pursuing the idea of discovering a new Carlin Gold-style deposit on the southeast spur of the well-known Cortez Trend in Nevada for about three years. This sedimentary deposit type in Nevada attracts the major mining companies because they can mine gold here on an industrial scale. Mineable resources in the Cortez camp now exceed 50 million ounces, spread across a handful of large open pit projects. What does a small explorer like Sitka, with a current market capitalization of only about CAD 20 million, want to do about it? At least there is equality of arms when it comes to geological understanding. Sitka knows exactly what to look for! Sitka geologists are convinced that the key to success in interpretation lies in the stratigraphy of the Cortez Trend. Those who understand how sedimentary layers have subsided, tilted, or shifted possess a powerful tool in the search for deposits.

This is because all of the major open pit projects in the Cortez Trend have one thing in common: they produce gold from a very specific limestone horizon that was impregnated with gold like a sponge during the formation of the Cortez Fault in geologic time. This is why the finely disseminated gold from the Carlin style is sometimes called invisible gold, because it is just not contained in veins. At different points of the Cortez Trend, geologists have named this horizon differently because at the time of discovery they did not recognize the very large context that can be seen thanks to today’s methods.

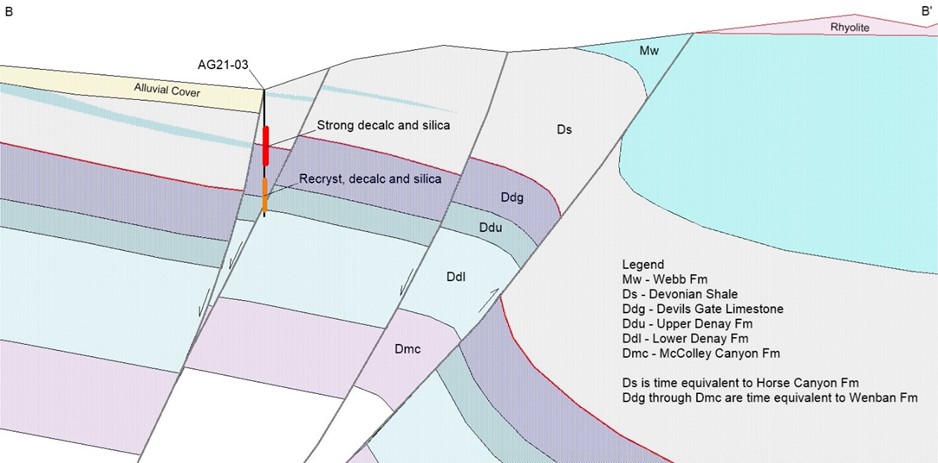

The contact zone between a limestone sediment from a particular Earth-age epoch and the overlying shale layers, which are from a later deposition, has proven to be particularly important. Similar to oil deposits, the shale, which is difficult to penetrate, has created ideal conditions for the enrichment of gold deposits below. The limestone was cooked and deacidified by the hot fluids from the depths. Accordingly, Sitka’s model contains the following elements: first, a specific gold-rich limestone-sediment layer, the so-called Webb/Devil’s Gate horizon, is sought; second, the overlying shale cap should be intact; third, the limestone should come as close to the surface as possible.

Success on Sitka’s Alpha project after only the 3rd well drilled

In total, Sitka has completed just three wells on the southeast spur of the Cortez Trend. From the first well drilled on the Alpha project last year, it was concluded that Sitka should secure additional claims 8 kilometers to the north. No sooner said than done. Two wells were then drilled on these new claims this year. The first drill hole intersected the target zone, but the drill rig was then moved another 750 meters to the south because the apex of the system was assumed to be there. Bingo! Drill hole AG21-03 delivered exactly the predicted picture: the Webb/Devils Gate contact was hit at a depth of only 73 meters. The underlying limestone shows almost picture-perfect deformation.

The Sitka claims are located about 40 kilometers southeast of the Cortez Hills gold mine jointly operated by Barrick and Newmont. Even closer are the Goldrush and Red Hill projects, which provided the geological blueprint for the Sitka search. Recent geological models show Goldrush to be related to Red Hill, which is why the entire system has since been renamed the Goldrush Complex. The details of the Red Hill discovery are particularly interesting (compared to Sitka’s Alpha project). Initial drill evaluations led to the discovery of the Red Hill system in late 2004 with an intercept of 61m @ 8.2 g/t gold at 375m depth. Subsequent drilling in 2006-08 confirmed continuity and expanded mineralization in the Red Hill area. In late 2009, a new discovery hole located approximately 1.7km south of the original Red Hill area intersected 20.5m @ 30.6 g/t (388m depth). Today, the Red Hill project is 4.2 kilometers long and 800 meters wide. https://mrdata.usgs.gov/sedau/show-sedau.php?recno=103 The Red Hill discovery was already the result of major advances in geological interpretation in the Cortez District in the early 2000s. The 2013 year-end resource for the Goldrush Complex is 75.5 mt @ 4.52 g/t measured and indicated resource for 10 Moz of gold, with an additional 39.5 mt @ 4.82 g/t for 5.6 Moz inferred resource. The system remains open in multiple directions and exploration continues. „

“What if” is now the question for Sitka Gold. Could Alpha be a second Red Hill? For now, Sitka has only confirmed its geological model and hit the Webb/Devils Gate contact at 73 meters depth. That wouldn’t be a great depth for a Carlin-type gold deposit in Nevada, at least.

Figure 1: Sitka’s Alpha Project is located on the southwest spur of the Cortez Trend. The more northerly of the two claims has just been tested. There, geologists had expected to encounter the Webb/Devil’s Gate target horizon at shallow depth. Exactly this hypothesis was confirmed. In the 3rd drill hole, the target horizon was already encountered at a depth of 240 feet, i.e. 73 meters.

For the time being, Cor Coe, CEO of Sitka, should have the last word. Commenting on the recent exploration success, he said, “We have encountered the target horizon at a depth that would be very attractive and easily minable if gold mineralization were to occur. The results confirm our model and reinforce our belief that Alpha Gold may have the geological prerequisites for a large Carlin-type gold deposit. The limestone encountered in the target horizon was highly altered. It is considered an excellent host rock for gold mineralization as has been observed analogously in existing gold deposits along the Cortez Trend. We eagerly await assay results from these drill holes.”

Figure 2: Cross section of drill hole AG21-03. The target zone of the Devil’s Gate limestone is highlighted in purple.

Conclusion:

If it turns out that the limestone horizon encountered in AG21-03 does indeed contain gold, Sitka could be at the beginning of a major new discovery because the host horizon is open in all directions. And if the gold grades are anything remotely like those at neighboring Red Hill, all hell would (rightly) break loose. A discovery at Sitka is sure to interest all of its major neighbors, especially Kinross, whose project is directly adjacent to Sitka’s. That’s why Sitka absolutely belongs on the watch list.

{letter}

Risikohinweis: Die GOLDINVEST Consulting GmbH veröffentlicht auf https://goldinvest.de Kommentare, Analysen und Nachrichten. Diese Inhalte dienen ausschließlich der Information der Leser und stellen keine wie immer geartete Handlungsaufforderung dar, weder explizit noch implizit sind sie als Zusicherung etwaiger Kursentwicklungen zu verstehen. Des Weiteren ersetzten sie in keinster Weise eine individuelle fachkundige Anlageberatung und stellen weder ein Verkaufsangebot für die behandelte(n) Aktie(n) noch eine Aufforderung zum Kauf oder Verkauf von Wertpapieren dar. Es handelt sich hier ausdrücklich nicht um eine Finanzanalyse, sondern um werbliche / journalistische Texte. Leser, die aufgrund der hier angebotenen Informationen Anlageentscheidungen treffen bzw. Transaktionen durchführen, handeln vollständig auf eigene Gefahr. Es kommt keine vertragliche Beziehung zwischen der der GOLDINVEST Consulting GmbH und ihren Lesern oder den Nutzern ihrer Angebote zustande, da unsere Informationen sich nur auf das Unternehmen beziehen, nicht aber auf die Anlageentscheidung des Lesers.

Der Erwerb von Wertpapieren birgt hohe Risiken, die bis zum Totalverlust des eingesetzten Kapitals führen können. Die von der GOLDINVEST Consulting GmbH und ihre Autoren veröffentlichten Informationen beruhen auf sorgfältiger Recherche, dennoch wird jedwede Haftung für Vermögensschäden oder die inhaltliche Garantie für Aktualität, Richtigkeit, Angemessenheit und Vollständigkeit der hier angebotenen Artikel ausdrücklich ausgeschlossen. Bitte beachten Sie auch unsere Nutzungshinweise.

Gemäß §34b WpHG und § 48f Abs. 5 BörseG (Österreich) möchten wir darauf hinweisen, dass die GOLDINVEST Consulting GmbH und/oder Partner, Auftraggeber oder Mitarbeiter der GOLDINVEST Consulting GmbH Aktien der Sitka Gold halten und somit ein Interessenskonflikt besteht. Die GOLDINVEST Consulting GmbH behält sich zudem vor, jederzeit Aktien des Unternehmens zu kaufen oder verkaufen. Darüber hinaus wird die GOLDINVEST Consulting GmbH von Sitka Gold für die Berichterstattung zum Unternehmen entgeltlich entlohnt. Dies ist ein weiterer, eindeutiger Interessenkonflikt.