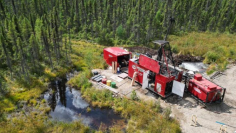

{kanada_flagge}Sitka Gold Corp. (CSE:SIG; FRA:1RF) is reporting numerous instances of visible gold in core drilled in close proximity to last year’s discovery at the very beginning of the ongoing winter drill program to follow up the Blackjack discovery at its RC Project in the Yukon!

Visible gold had also previously been encountered in pronounced form in discovery hole DDRCCC-21-021 (Hole 21). That hole had returned 1.17 g/t gold over 220.1 metres, including 50.5 metres of 2.08 g/t gold. Laboratory results from the three holes now completed from the winter drilling are pending. The fourth hole in the program (DDRCCC-21-025) is currently being drilled. To date, over 1,100 metres of drilling have been completed.

The four holes are part of a total 10,000 metre drilling campaign. The focus of the drilling is to further define the mineralized intrusion at the Blackjack Zone. All holes drilled to date have intersected significant intervals of the mineralized intrusive granitic unit as previously seen in hole 21. A second drill rig is expected to be transported to the project site in the next few weeks.

Cor Coe, CEO of Sitka stated, “We are learning a tremendous amount about the Blackjack Zone with this winter drill program. Our biggest takeaway from this drilling is that our mineralized intrusion is a dike and sill complex like those found in deposits such as Donlin Creek. Therefore, there is the possibility that the strike length, extent, and size of this deposit may increase dramatically. In addition, more ounces of gold should be located closer to surface in such a system, which we believe will positively impact future economic considerations, such as pit design. With multiple instances of visible gold observed during logging of these recent drill holes, the potential of the Blackjack Zone continues to grow and we look forward to seeing what assay results reveal.”

About the RC Gold Project

The RC Gold Project consists of a 376 square kilometer consolidated land package located in the newly developed Clear Creek, Big Creek and Sprague Creek districts in the heart of Yukon’s Tintina Gold Belt and Tombstone Gold Belt. It is the largest consolidated land package strategically located midway between Victoria Gold’s Eagle Gold Mine – Yukon’s newest gold mine reaching commercial production in the summer of 2020 – and Golden Predator’s Brewery Creek Gold Mine. The RC Gold Project land package consists of five properties, namely the RC, Bee Bop, Mahtin, Clear Creek and Barney Ridge properties. The Company recently identified a large 500m by 2000m intrusion-related gold system on the property in the Saddle Eiger zone and has drilled 19 diamond drill holes into this system to date. This was the primary focus of the Company’s 2020 and 2021 drill programs at RC Gold, which returned several significant gold intercepts.

The final hole of the 2021 drill program, hole 21 (DDRCCC-21-021) at the Saddle West Zone intersected 220.1 metres of 1.17 g/t gold from surface, was drilled below an anomaly with more than 500 ppb gold in soil previously identified at surface and part of the larger 2 kilometer by 500 metre gold anomaly in soil extending from the Saddle West Zone to the Eiger Zone. This hole was drilled 200 metres south of all previously drilled holes and intersected a newly recognized control structure for mineralization known as the Blackjack Fault. The RC Gold Project shares a boundary with Victoria Gold’s Clear Creek property to the west and Florin Resources’ Florin Gold property to the north.

Conclusion: The comparison with the Donlin Creek mega project from the mouth of Sikta CEO Cor Coe does show there is no false modesty, here. Coe is aiming high, because the Donlin gold deposit in the Yukon is one of the largest and also highest-grade open-pit gold projects in the world. Donlin Creek is now owned 50/50 by Nova Gold and Barrick Gold. Nova Gold cites a global resource of 551 million tonnes in both Measured & Indicated categories with average gold grades of 2.24 g/t gold. Total reserves are currently estimated at 39 million ounces of gold. These are truly high aspirations! Even a fraction of that would be enough to completely revaluate Sitka’s stock.

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Sitka Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Sitka Gold for reporting on the company. This is another clear conflict of interest.