Shares of gold explorer Ready Set Gold Corp. (CSE: RDY; FRA: 0MZ) have been in an almost continuous decline since its initial public offering at $0.60 CAD last December. Just a few days ago, the stock could be picked up for less than CAD 0.20. Accordingly, the market valued the 1.2 million historical ounce resource at the Northshore Project at less than CAD 10 million! The tide may now be turning following the release of the second half of a total of 13 drill holes at Northshore.

Results from the remaining seven holes confirm a new exploration model and provide an excellent basis for a much more comprehensive re-examination of the property formerly owned by well-known companies Balmoral and GTA Gold. Ready Set is the first company to systematically survey the entire property using the tools of modern exploration.

Seven out of seven drill holes hit gold mineralization

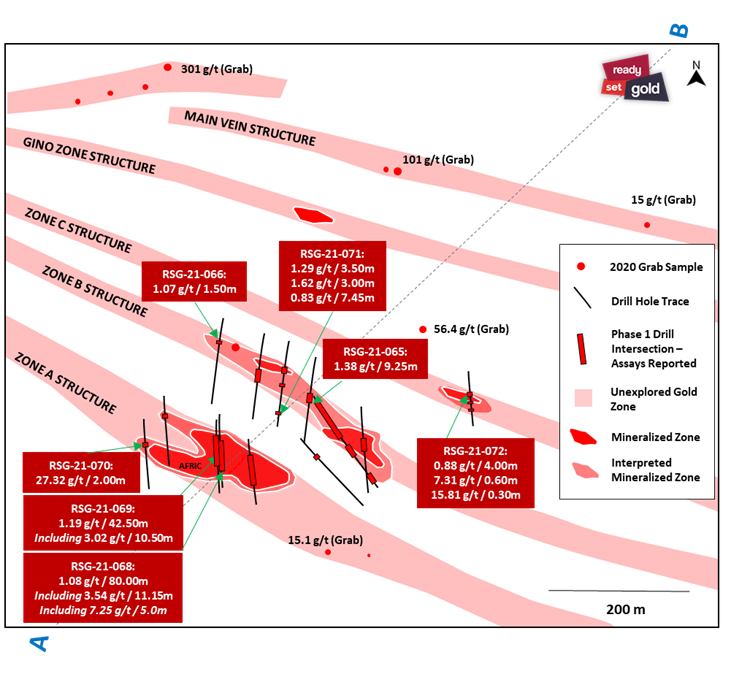

The good news is that all seven holes have intersected gold mineralization within the A, B and C zones in areas of limited historical drilling. Hole RSG-21-068 – intersected 80.00 meters (m) of 1.08 grams per tonne (g/t) gold (Au) – including 11.15m @ 3.50 g/t Au hosting a higher grade intercept of 5.00m @ 7.25 g/t Au. Hole RSG-21-069 – intersected 86.50m @ 0.89 g/t Au – including 10.5m @ 3.02 g/t Au. Hole RSG-21-070 – intersected 2.00m @ 27.32 g/t Au.

Figure 1: Exploration plan of Northshore showing recent results. Clearly visible are three parallel veins that were not distinguished from each other in previous surveys. The increased accuracy and better delineation of the gold occurrences should facilitate future exploration at Northshore. The orientation of the historical drilling tended to be parallel to the veins and therefore had not provided an accurate location.

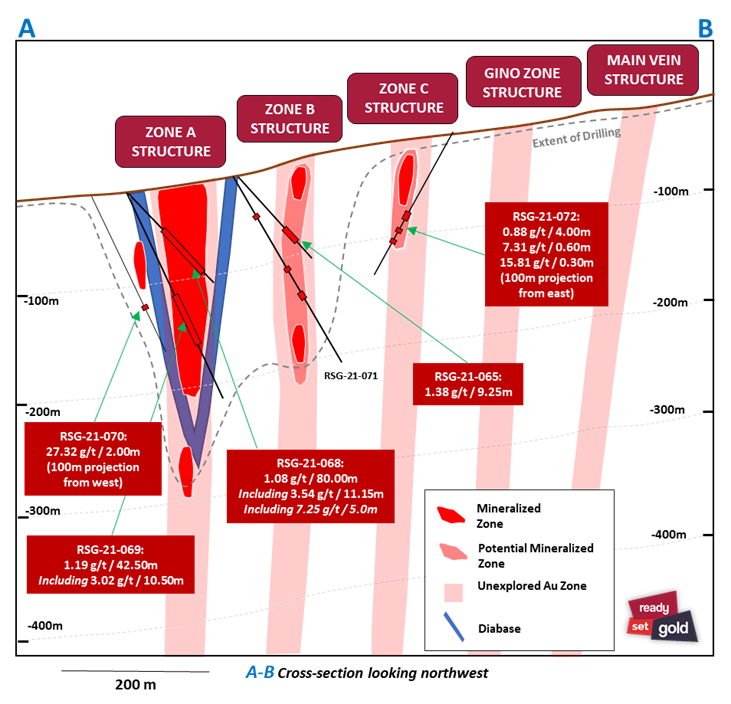

Figure 2: Cross-section once again shows the parallel alignments. The structures are open to the side and to depth. One of the big questions for future exploration will be how the ore grades develop to depth. This is because Ready Set geologists recognize possible parallels on Northshore to the Hemlo Mine, which lies about 70 kilometers away on the same fault system. At Helmlo, parallel ore veins with low grades had initially been found before it was recognized that they converge at depth and have higher grades.

Brad Lazich, VP of Exploration, commented on the current results as further confirmation of Ready Set Gold’s new geological model for the Northshore project. Lazich said, “These drill results increase our confidence in the results of historical drilling and in our new geological model.”

Christian Scovenna, CEO & Director, commented, “Our new model indicates that mineralization may be open along strike and at depth. By considering a different model than previous operators of the project, we may have unlocked the door to a regionally significant deposit.”

The Northshore project remains underexplored, with only about 5% of the area systematically evaluated. In addition, the depth potential of the gold mineralized zones remains untested.

Conclusion: This is how exploration works! First, historical results must be re-evaluated and, in the best-case scenario, a new model emerges – as is now the case with Ready Set – that predecessors did not have. The new model will give a new direction to future exploration. In particular, the potential parallel to the +20 million ounces produced at the Hemlo project could spark interest. However, this would probably require Ready Set to have the courage to drill deeper at some point. We are curious about the further development, for which Ready Set will need fresh money in the not too distant future. We will see how the company deals with the financing issue.

Disclaimer: GOLDINVEST Consulting GmbH offers editors, agencies and companies the opportunity to publish commentaries, analyses and news on http://www.goldinvest.de. This content serves exclusively to inform the readers and does not represent any kind of call to action, neither explicitly nor implicitly, and is not to be understood as an assurance of any price development. Furthermore, it does not in any way replace individual expert investment advice and does not constitute an offer to sell the share(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between GOLDINVEST Consulting GmbH and its readers or the users of its offerings, as our information only relates to the company and not to the reader’s investment decision.

The purchase of securities involves high risks which can lead to the complete loss of the capital invested. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the guarantee of the topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded.

In accordance with §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares in Ready Set Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares in the company at any time. Furthermore, a contractual relationship exists between Ready Set Gold and GOLDINVEST Consulting GmbH which involves GOLDINVEST Consulting GmbH reporting on Ready Set Gold. This is another clear conflict of interest.