{kanada_flagge}Rare earths are not really rare, but they are not easy to extract either – and at the same time they are in high demand. It is estimated that the market for neodymium, praseodymium & co. will multiply from around USD 3 billion in 2020 to USD 32 billion by 2030. A huge opportunity indeed, but also a huge challenge, as currently China – a “partner” from which the West is desperate to become less dependent – controls about 80% of global resources and produces 90% of the world’s rare earth components. Helping to reduce dependency on China and securing a large piece of the market for itself in the process is the goal of Ucore Rare Metals (WKN A2QJQ4 / TSXV UCU) – and in 2023, Ucore could potentially make a breakthrough.

{kanada_flagge}Rare earths are not really rare, but they are not easy to extract either – and at the same time they are in high demand. It is estimated that the market for neodymium, praseodymium & co. will multiply from around USD 3 billion in 2020 to USD 32 billion by 2030. A huge opportunity indeed, but also a huge challenge, as currently China – a “partner” from which the West is desperate to become less dependent – controls about 80% of global resources and produces 90% of the world’s rare earth components. Helping to reduce dependency on China and securing a large piece of the market for itself in the process is the goal of Ucore Rare Metals (WKN A2QJQ4 / TSXV UCU) – and in 2023, Ucore could potentially make a breakthrough.

Reducing or breaking the West’s dependence on China in the area of rare earths is also so important because these elements are used, among other things, in two absolute growth markets – firstly in the area of electromobility (electric motors) and secondly in the area of renewable energies (wind turbines). It is therefore fair to say that rare earths are of crucial importance for the global energy transition.

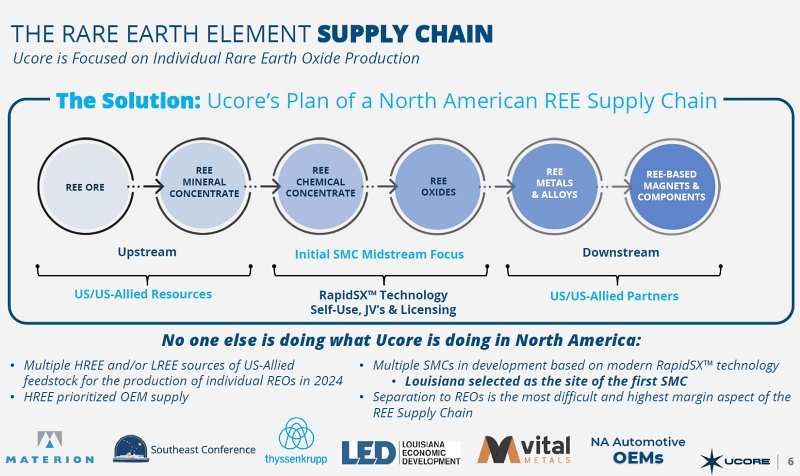

As regular Goldinvest.de readers probably already know, Ucore is relying on a technology called RapidSX™, an evolution of an established solvent extraction process, in an attempt to help break China’s dominance. Ucore’s RapidSX™ technology was independently verified last year, confirming that the process is capable of separating both light and heavy rare earths to produce high-quality rare earth elements. In addition, with RapidSX™, the efficiency of the process is expected to be at least three times higher compared to conventional extraction, potentially resulting in 50% – or more – lower capital expenditure (CAPEX) than for a conventional plant of the same size. And operational costs (OPEX) should also be significantly lower, about 20%, in a RapidSX™ (SMC, Strategic Metals Complex) plant than with conventional solution extraction, primarily due to the higher potential throughput.

Source: Ucore Rare Metals

With RapidSX™, Ucore places itself in the middle of the supply chain, where particularly high margins can be achieved. This is because with RapidSX™ the company produces so-called rare earth oxides from rare earth concentrates, which are then later used by Ucore’s customers to make rare earth metals and alloys and ultimately for rare earth-based magnets and components. Ucore intends to source the necessary feedstock from the U.S. or U.S. allies and then also supply the finished product to U.S. customers or customers in countries allied with the U.S., thus becoming part of a rare earth supply chain independent of China. Which, by the way, a report from the Baker Institute for Public Policy at Rice University in Houston, just recently strongly recommended!

Ucore has now decided to build the first SMC in the US state of Louisiana after Louisiana Economic Development promised nearly CAD 16 million in subsidies. The plan is to start production at the plant by the end of 2024, initially at 2,000 tons per year, and then expand to 5,000 tons per year. Meanwhile, potential sites in Louisiana have been whittled down to three and a choice is expected to be made early this year.

Demonstration plant is being commissioned this month.

First, however, is the commissioning of the company’s demonstration plant in Kingston, Ontario. This is expected to process several dozen tons per year of mixed rare earth concentrates derived from multiple feedstock sources, including heavy and light rare earth elements planned for the Louisiana SMC. It will also perform all RapidSX™ splits required to produce praseodymium, neodymium, terbium and dysprosium.

In early December 2022, the Company was able to report that it had received the feedstock required for the initial commissioning tests, including approximately two tonnes of a high purity heavy REE (“HREE”) feedstock, the most desirable and difficult to separate rare earth raw material. The first two test runs involve processing a light REE (“LREE”) material, followed by processing the HREE material. Both will be processed in the same 51-stage RapidSX™ demo plant – an unprecedented achievement in North America!

Ucore will spend the next several months engaged in these initial test runs, which are designed to demonstrate the significant advantages of the RapidSX™ technology platform in separating light and heavy rare earth elements into high-purity, single elements/compounds. At the same time, the company further explained, it will begin transferring technological and commercial data to the SMC in Louisiana, which is then expected to be under development. Once the commissioning tests are complete, Ucore intends to conduct two additional ten-ton processing campaigns for the commercial demonstration and product qualification program. This is to demonstrate that they can manufacture products to the specifications of potential customers. According to CEO Pat Ryan, the company is also already in discussions with various OEMs (original equipment manufacturers) primarily in the automotive sector, as Mr. Ryan has worked there for a long time.

Conclusion: It has taken a long time and Ucore has adjusted its plans considerably in the meantime – the first SMC was originally planned in Alaska, for example – but it seems that they are now really starting real headway. The commissioning of the demonstration plant – commissioning was to start in December – is a crucial step in our view, as it should provide confirmation that the RapidSX™ technology will work on a quasi-commercial scale, while also allowing discussions with potential customers to move forward. In 2023, we therefore expect news on the progress of work on the demonstration plant, possibly on discussions or even agreements with future customers, and on developments in Louisiana. In our view, 2023 could therefore be the year that Ucore Rare Metals makes a significant breakthrough, hopefully followed by the milestone of starting commercial production by the end of 2024 as planned, at which point we will see whether Ucore succeeds in meeting the ambitious targets set by CEO Pat Ryan, who hopes to secure a total of around 20% share of the rare earths market outside China forecast for 2030. According to him, that would be a volume of about $3.2 billion! In any case, we are very curious to see what 2023 will bring for Ucore, but also point out that this is a risky speculation.

Subscribe to the Goldinvest newsletter now

Follow Goldinvest on Twitter

Risk notice: GOLDINVEST Consulting GmbH offers editors, agencies and companies the possibility to publish comments, analyses and news on http://www.goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research, however, any liability for financial loss or the content guarantee for timeliness, accuracy, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

Pursuant to §34b WpHG and §48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Ucore Rare Metals and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time, which could have an impact on the Ucore Rare Metals share price. Furthermore, a contractual relationship exists between Ucore Rare Metals and GOLDINVEST Consulting GmbH, which implies that GOLDINVEST Consulting GmbH reports on Ucore Rare Metals. This is a wide rer, clear conflict of interest.